-

by Kate Humphrey | Feb 18, 2026 3:36 pm | eHealth

William Blair announced that it acted as an advisor to PrimeRx throughout its acquisition by RedSail Technologies. The seller was TA Associates, who initially invested in PrimeRx in 2021. Having closed on February 5, 2026, this transaction marked William Blair’s second signed or closed advisory deal in healthcare technology in 2026. Terms...

Read More »

-

by Kate Humphrey | Feb 18, 2026 3:34 pm | Physician Medical Groups

On February 17, Imagen Dental Partners announced its first acquisition of the year with the purchase of Campbell Dental. Terms of the deal were not disclosed. Based in Cedar Park, Texas, Campbell Dental offers the full scope of dental care. It is run by Dr. Jarrod Campbell, who is supported by a team of assistants. Imagen Dental is a...

Read More »

-

by Avery Swett | Feb 18, 2026 10:26 am | eHealth, Private Equity

NuvemRx announced that it has acquired the 340B referral capture business formerly known as par8o from R1 RCM. Founded in 2011, par8o is a healthcare technology company specializing in 340B referral capture with expansive integrations with major pharmacy partners. par8o advances access to care for safety-net healthcare organizations by turning...

Read More »

-

by Avery Swett | Feb 18, 2026 10:24 am | Hospitals, Other Services

Grand Blanc, Michigan-based McLaren Health Care has acquired Clarkston Medical Group (CMG). CMG is a network of primary and specialty care providers with 11 clinics in Oakland County. From pediatrics to adult and geriatric medicine, its providers focus on prevention, chronic disease management and same-day care. McLaren Health Care is a fully...

Read More »

-

by Kate Humphrey | Feb 17, 2026 3:53 pm | Physician Medical Groups, Private Equity

SALT Dental Partners announced that it expanded its presence in New York and Virginia with the acquisition of the practice of Dr. Julia Cerny and Hampton Oral & Facial Surgery. Hampton Oral & Facial Surgery operates out of one location in Hamptons, Virginia. According to its website, the practice offers a full scope of dental...

Read More »

by | Jul 14, 2017 4:01 pm | Behavioral Health Care, Biotechnology, eHealth, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Long-Term Care, Managed Care, Medical Devices, Other Services, Pharmaceuticals, Physician Medical Groups, Rehabilitation

Health care merger and acquisition activity slowed in the second quarter of 2017. Compared with the first quarter of 2017, deal volume decreased 15%, to 366 transactions. Deal volume was also lower compared with the same quarter the year before, down 14%. Combined spending in the second quarter reached $95.8 billion, an increase of 62% compared with the $59.1 billion spent in the previous quarter, according to HealthCareMandA.com. Second quarter deal value was up 8% compared with the $88.7 billion spent in Q2:16. Health care services transactions accounted for 52% of the second quarter’s dollar volume, much higher than the 14% share reported in the first quarter, and the 19% share recorded... Read More »

by | Jul 7, 2017 6:40 pm | Behavioral Health Care, Biotechnology, eHealth, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Long-Term Care, Managed Care, Medical Devices, Other Services, Pharmaceuticals, Physician Medical Groups, Rehabilitation

Preliminary data for the month of June shows that investors are still bullish—or at least comfortable—betting on health care. Some 123 transactions were announced last month, an 11% decrease compared with May’s 138 transactions. Year over year, however, this early data is just 5% below the 130 deals announced in June 2016. For a little perspective, April 2017’s deal volume was just 104 transactions, which made the May numbers look very strong by comparison. June’s deal volume looks reassuringly healthy, as it is close to the year-ago total, and could be adjusted upward in the future as more deals come to light. The same trends we’ve noted in previous months are still playing out, too. Deal... Read More »

by | Jul 7, 2017 4:42 pm | Hospitals, Long-Term Care, Private Equity

Kindred Healthcare (NYSE: KND) has made no secret that it is getting out of the skilled nursing business. It took until June 30 for the deal announcement to come, and when it did, it was a bit of a surprise that a single buyer was taking over the entire business. Private equity firm BlueMountain Capital Management, LLC, through a joint venture it is leading called BM Eagle Holdings, agreed to acquire Kindred’s 89 skilled nursing facilities. BlueMountain, you may recall, acquired the financially failing Daughters of Charity hospital system in California in July 2015, following the collapse of Prime Healthcare Services’ $849 million bid in March 2015. A week after this deal with Kindred... Read More »

by | Jun 9, 2017 7:28 pm | Behavioral Health Care, CRO, eHealth, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Long-Term Care, Managed Care, Medical Devices, Other Services, Pharmaceuticals, Physician Medical Groups, Rehabilitation

Preliminary data for the month of May shows an encouraging uptick in deal volume, with the services sectors making up 66% of the total. Some 134 transactions were announced last month, a 30% increase over April’s anemic 103 deal volume total. But monthly transaction totals in 2017 are not keeping pace with those in 2016. A year ago, 151 transactions were announced, 11% higher than in May 2017. There’s no question that the ongoing uncertainty surrounding the American Health Care Act hangs heavily on healthcare investors. The Senate Republicans have been at work behind closed doors to craft a different deal than the one sent to them by the House Republicans in mid-May. From the handful of... Read More »

by | May 3, 2017 8:26 pm | Behavioral Health Care, Biotechnology, eHealth, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Long-Term Care, Managed Care, Medical Devices, Other Services, Pharmaceuticals, Physician Medical Groups, Rehabilitation

April usually doesn’t feel like February, at least, weather-wise. As far as healthcare mergers and acquisitions go, however, deal volume in April 2017 (103 deals) feels a lot like February’s deal volume (102). The chart below shows the clear winners and losers in April 2017. Deal volume was down 29% compared with the previous month (March, 145 deals), and slid 12% compared with the year before (April 2016, 141 deals). Healthcare services deal volume accounted for just 50% of April’s preliminary total. The services sectors typically account for higher percentages than the technology sectors (although that trend is reversed when it comes to dollar volume). The services side... Read More »

by | Mar 2, 2017 3:56 pm | Behavioral Health Care, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Long-Term Care, Managed Care, Other Services, Physician Medical Groups, Private Equity, Rehabilitation

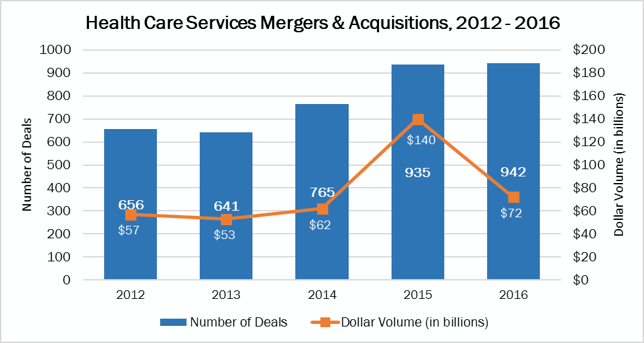

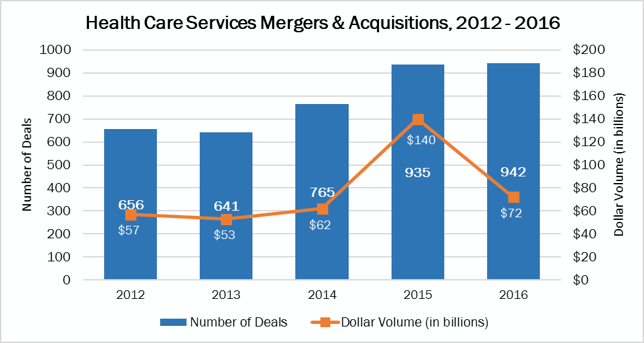

Every spring, we publish myraid statistics on the healthcare services deals announced the year before, in the form of The Health Care Services Acquisition Report. This year’s 23rd edition, which will available in late March, has this examination of what financial buyers targeted in 2016. Strategic buyers continued to dominate the health care services M&A market in 2016, as they have in the past. Their 683 deals made up 73% of the year’s deal volume. The $45.7 billion spent accounted for 63% of the combined total of $72 billion. A total of 259 deals, or 27% of the services deal volume in 2016, were carried out by financial buyers, such as private equity firms and real estate... Read More »