by Lisa Phillips | Apr 30, 2018 9:41 am | Home Health & Hospice, Long-Term Care

Toledo, Ohio is a hotbed of healthcare deal making, all of a sudden. Three companies based there joined together to carve up HCR ManorCare, the financially beleauered tenant of Toledo-based Quality Care Properties, Inc. (NYSE: QCP). Welltower Inc. (NYSE: WELL) and not-for-profit ProMedica Health System joined the fray, and it became one complicated deal. Quality Care Properties was spun out from HCP, Inc. in October 2016, taking with it HCP’s skilled nuring assets, most of which were operated by HCR ManorCare (HCRMC). As of December 31, 2017, QCP owned 259 skilled nursing facilities with 22,205 beds, 59 assisted living/memory care communities with 3,843 units, one 37-bed surgical... Read More »

by Lisa Phillips | Jan 29, 2018 10:09 am | Behavioral Health Care, Biotechnology, eHealth, Long-Term Care, Managed Care, Medical Devices, Other Services, Pharmaceuticals, Physician Medical Groups, Rehabilitation

2017 was another big year for billion-dollar healthcare transactions. Among the deals that disclosed prices, 44 topped the billion-dollar mark, for a total of approximately $263.1 billion. Although that number seems high, there were 50 billion-dollar deals announced in 2015, although those totaled a slightly lower $240.1 billion. 2016 posted lower totals for both the number of billion-dollar deals (39) and combined prices ($194.1 billion). Of course the biggest healthcare deal in 2017 was the $77 billion acquisition of Aetna Inc. (NYSE: AET) by CVS Health (NYSE: CVS). But there were many more sizable transactions across the sectors, as the chart below illustrates. See how many you remember... Read More »

by Lisa Phillips | Oct 6, 2017 6:08 pm | Healthcare Market Updates, Long-Term Care

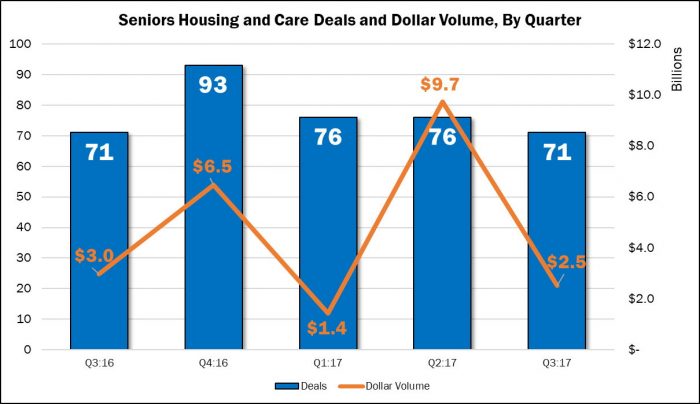

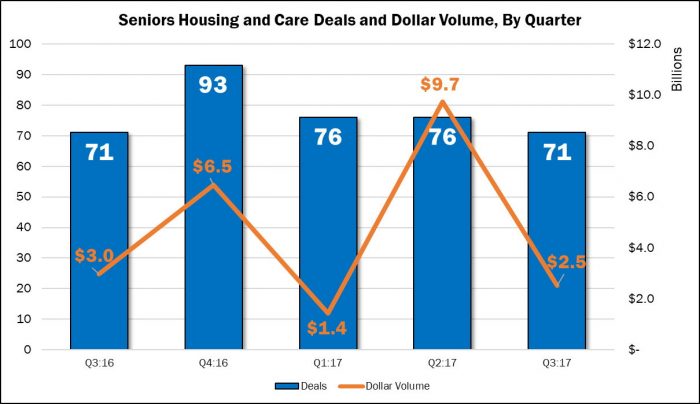

We will be addressing the quarterly seniors housing and healthcare M&A results in Health Care M&A Quarterly Report, which covers all 13 health care sectors. But, here is a preview: Although it remained above 70 deals for the quarter, seniors housing and care M&A activity fell to a year-low, tying with last year’s third quarter at 71 publicly announced transactions. Dollar volume also fell from its recent peak of $9.7 billion in the second quarter of 2017, recording $2.5 billion in transaction value based on disclosed prices. Increasingly, we have seen buyers prefer the one-off deals that come with one or two properties. Those deals are easier to complete and are most... Read More »

by Lisa Phillips | Jul 28, 2017 2:21 pm | Long-Term Care

Merger and acquisition activity stayed virtually even in the second quarter, down 1% from the previous quarter, to 75 transactions. The quarter’s deal volume makes up 24% of the 315 deals announced within the past 12 months. Q2:17’s deal volume is 17% lower than the same period a year earlier. Source: HealthCareMandA.com, July 2017 Based on revealed prices, approximately $9.7 billion was committed to finance second quarter deals, an increase of 574% compared with the previous quarter and 299% higher than the same period in 2016. The second quarter accounted for 47% of the $20.6 billion spent in the last 12 months. Forty-four of the 75 deals disclosed prices, and two were more than $1... Read More »

by Lisa Phillips | Jul 14, 2017 7:21 pm | Long-Term Care

The dollar volume of publicly announced seniors housing and care acquisitions in the second quarter of 2017 surged to $9.7 billion, a nearly 600% increase over the first quarter’s volume of $1.4 billion. The number of announced transactions in the second quarter (75) was basically even with the first quarter (76), according to new acquisition data from HealthCareMandA.com. The dollar volume is the highest since the second quarter of 2014. Driving the dollar volume were two billion-dollar acquisitions, including the acquisition of Care Capital Properties by Sabra Health Care REIT in a transaction valued close to $4.0 billion, as well as the acquisition of Hawthorn Retirement Group by... Read More »

by Lisa Phillips | Jul 14, 2017 4:01 pm | Behavioral Health Care, Biotechnology, eHealth, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Long-Term Care, Managed Care, Medical Devices, Other Services, Pharmaceuticals, Physician Medical Groups, Rehabilitation

Health care merger and acquisition activity slowed in the second quarter of 2017. Compared with the first quarter of 2017, deal volume decreased 15%, to 366 transactions. Deal volume was also lower compared with the same quarter the year before, down 14%. Combined spending in the second quarter reached $95.8 billion, an increase of 62% compared with the $59.1 billion spent in the previous quarter, according to HealthCareMandA.com. Second quarter deal value was up 8% compared with the $88.7 billion spent in Q2:16. Health care services transactions accounted for 52% of the second quarter’s dollar volume, much higher than the 14% share reported in the first quarter, and the 19% share recorded... Read More »