Now that we made it to 2021, the last thing our readers might want to do is look back at 2020. We totally get it, it was a very long year, but activity in the fourth quarter surprised all of us, and it’s worth sticking around as we break down the numbers in the healthcare M&A market.

Activity in October and November maintained the status quo for 2020, with dealmaking seemingly stifled by rising Covid-19 cases across the country. There were 130 deals announced in October, with a slight uptick in November, when 142 transactions were announced. For context, the average monthly deal volume for 2020 was 135.

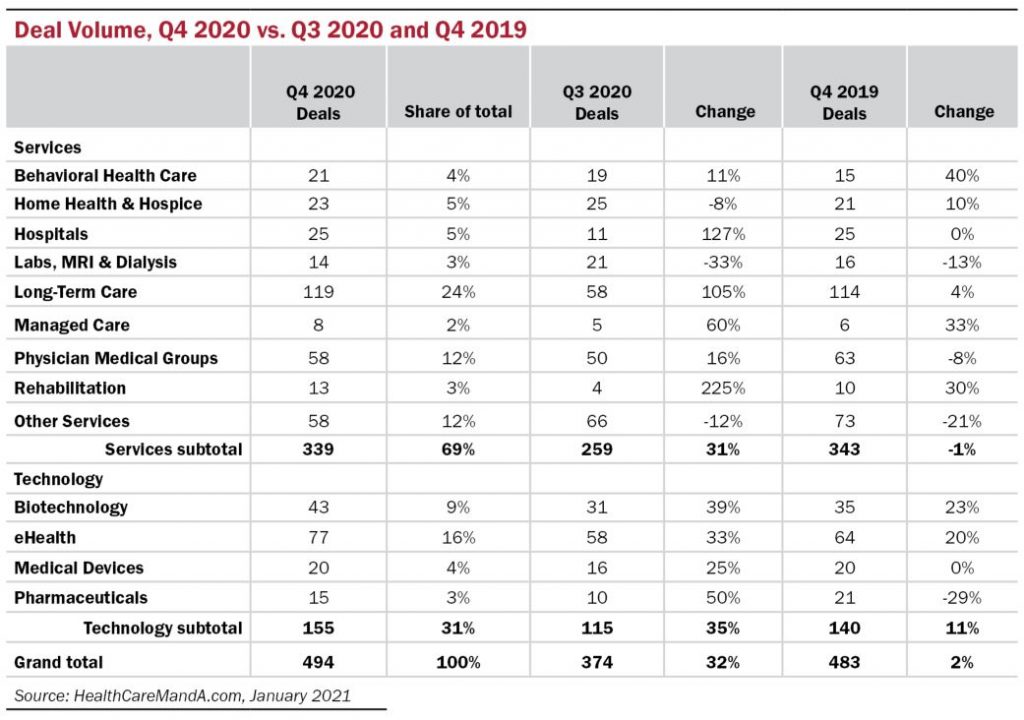

However, December healthcare M&A activity felt like an avalanche, with 222 deals on the books, according to search results in our Healthcare Deals Database. And as earnings reports come out, more transactions will be disclosed, driving that number even higher. We were struggling to remember a month when deal volume broke the 200 mark, let alone had a chance to reach the 250 mark. The only other month to come moderately close in recent memory was back in October 2018, when 198 deals were announced (an historically busy year overall). December’s deal volume brought Q4:20’s total to 494 deals, or 32% higher than Q3:20 and a slight 2% more than Q4:19

Based on just raw numbers, the Long-Term Care sector experienced the largest increase in deal volume in Q4:20, jumping to 119 deals, or 105% quarter over quarter and 4% year over year. The Long-Term Care sector accounted for 24% of all transactions in Q4:20.

Hospital activity saw a similar trajectory, albeit with smaller numbers, with 25 deals on the books for Q4:20, or a 127% increase over totals in Q3:20. A significant portion of hospital transactions were for a single facility, specifically an acute care facility, and only two deals targeted a system that filed for bankruptcy. With the Covid-19 pandemic putting a huge strain on health systems and hospitals in the United States, we were worried the market would buckle, but the Q4:20 numbers showed resilience in the sector.

Most sectors saw double- or triple-digit gains, and we were hoping to write a paragraph about deal volume without having to use the words “decline” or “decrease,” but the Home Health & Hospice sector saw a slight decline in deal activity compared with Q3:20, dropping by 8%, or just two deals. Either way, 23 deals indicates interest in the sector remains active and healthy.

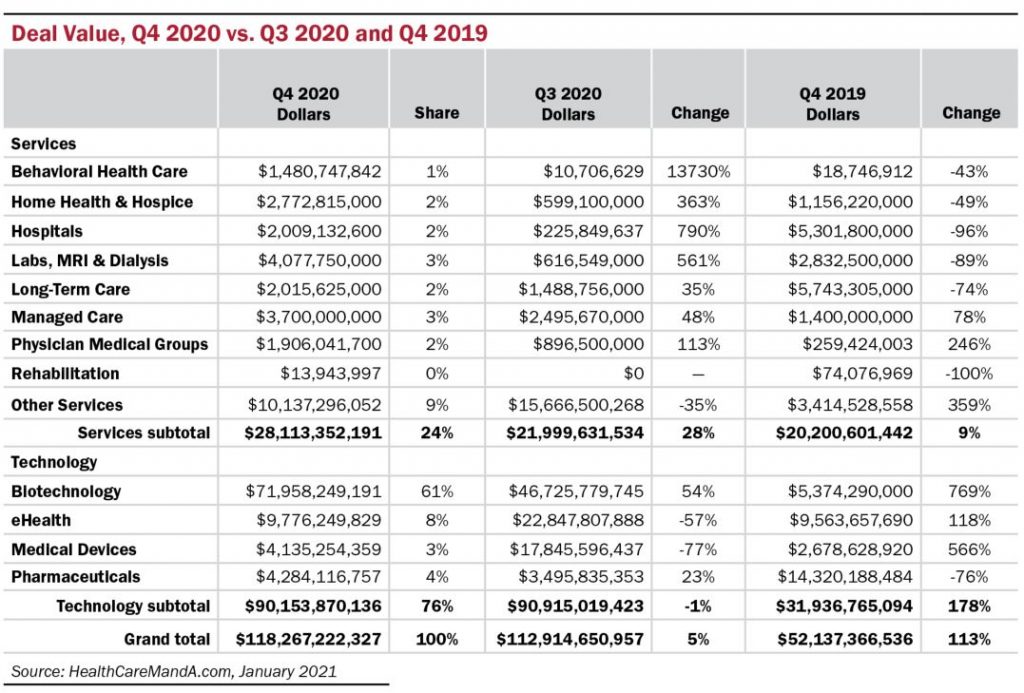

In Q3:20, there was a staggering $112.9 billion in announced spending, and we thought that would have been the peak for 2020. But spending in Q4:20 topped that value by roughly $5.3 billion, hitting $118.2 billion in total spending.

By all accounts, it was a strong end to the healthcare M&A market for 2020, a relief from a very tough year. We knew there would be a last minute rush to close some deals, as there is every year, but the magnitude caught us by surprise. Hopefully, we’ll see if that momentum spills into 2021, which would be a welcome start for the new year.