The only way to go is up, right? April was the first full month after the World Health Organization declared the COVID-19 virus a pandemic on March 11, and you can see the impact in the healthcare M&A numbers. Even after adding deals that surfaced in later weeks, April 2020 deal count just barely crossed the 100 mark, according to our Deal Search Online database.

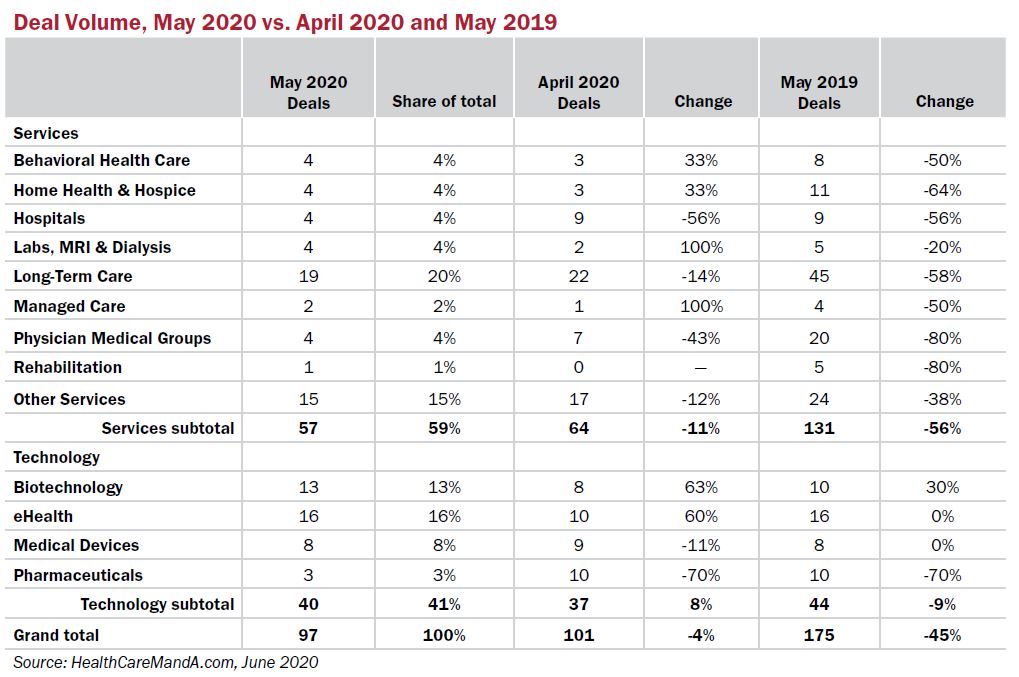

With 97 deals on the books for May, it seems we have bottomed out. It might take more than a year to hit the numbers that were posted in May 2019 (175 deals), but with restrictions loosening around the country, June might show increased activity.

For instance, the last week of May didn’t have a single Long-Term Care deal announcement, but on June 1, Welltower (NYSE: WELL) disclosed two large seniors housing portfolio sales and 29 medical office buildings for roughly $1.3 billion. That might be just enough fuel to start the engine again for the Long-Term Care sector.

Private equity kept sectors like Behavioral Health Care and Home Health & Hospice afloat, accounting for more than half of the transactions in those sectors in May.

It’s worth highlighting the distribution of deal volume between the services and tech sectors. Typically, services sectors make up roughly 65% to 75% of deal volume, with technology making up the rest. M&A activity in the services sectors still made up a majority of the deal flow in May, but the scale wasn’t quite as one-sided. Technology deals made up 41%. In April 2020, the transaction total represented only 36%, and in May 2019 it was even lower at 25%. Activity in the Biotechnology and eHealth sectors beat or matched totals in April 2020 and May 2019, which shows that it’s not just a decrease in services deals tipping the scale, but a resilient market for digital health and biotech.

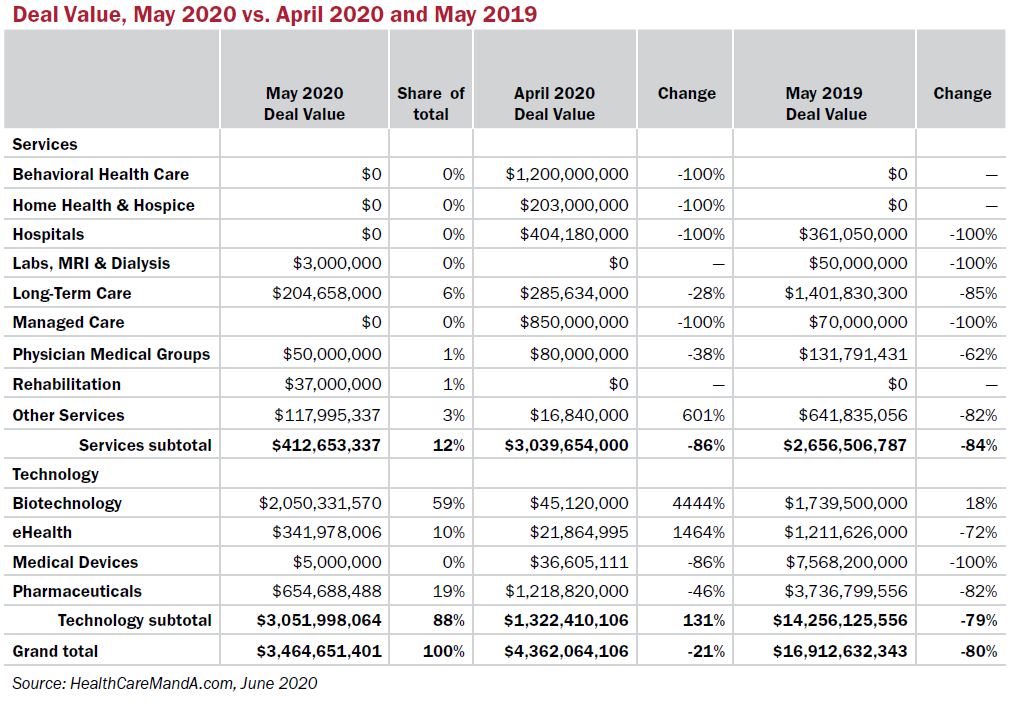

Healthcare M&A spending, however, took an even more dramatic nosedive, dropping 21% compared with April 2020 and 80% compared with May 2019. The largest deal of May 2020 in terms of price came from the acquisition of Portola Pharmaceuticals, Inc. by Alexion Pharmaceuticals, Inc. for a little more than $1.404 billion

It was a pleasant surprise to see some activity in the Rehabilitation sector, even if it was a single deal (we’ll take what we can get). Omada Health, a care company that offers digital health programs to help manage chronic pain, acquired Physera, Inc. for $37 million. Physera is a musculoskeletal care company that delivers physical therapy and interventions digitally and via telehealth visits. With most of healthcare moving to telehealth for the foreseeable future, the purchase seems like a no-brainer.

Last month likely was just a “wait and see” period for dealmaking. Senate Majority Leader Mitch McConnell (R-KY) announced that Senate Republicans have begun to consider proposals for a fourth and final COVID-19 response bill at the end of June, so any positive details for the healthcare industry could provide some relief.

However, a second wave of COVID-19 infections could emerge in the fall, which might keep deal makers hesitant to change course. Dr. Anthony Fauci, the director of the National Institute of Allergy and Infectious Diseases, has said that if we play it smart, a second wave isn’t “inevitable.” Fingers crossed.