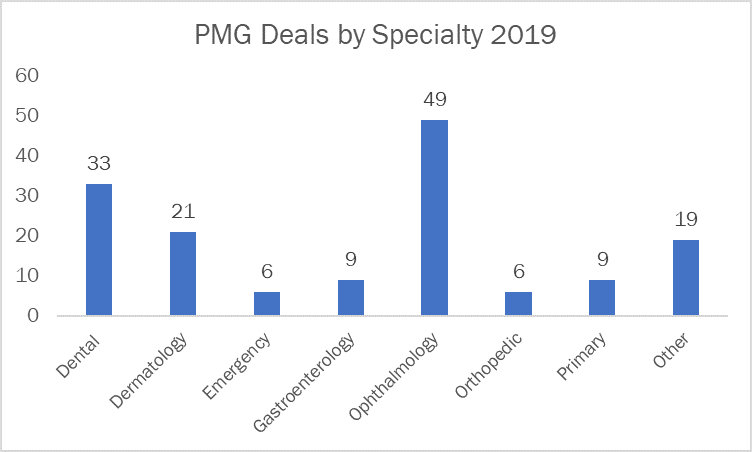

Even with just our preliminary data, private equity dominated dealmaking in the Physician Medical Groups (PMG) sector in 2019. According to our Deal Search Online database, PE firms and their portfolio companies (PE Buyers) accounted for roughly 71% of M&A activity in the sector, or 152 deals. And although we found dealmaking in nearly every specialty, from OB/GYN to radiology, it was heavily concentrated in three particular fields: dermatology, dental, and ophthalmology.

There were 49 deals focused on ophthalmology practices in 2019, a significant jump over every other specialty, and it was a select group of buyers driving the deal volume. Acuity Eyecare Group, a portfolio company of Riata Capital Group, reported nine transactions in Arizona, Iowa, Ohio Pennsylvania, and Texas, adding 43 locations to its network. SightMD, a portfolio company of Chicago Pacific Founders, reported four acquisitions. EyeSouth Partners, a portfolio company of Shore Capital Partners, and EyeCare Partners, a portfolio company of FFL Partners, both announced five transactions. Speaking of EyeCare Partners, but this past week, FFL Partners sold its portfolio company to Partners Group for $2.2 billion. Under FFL, EyeCare acquired and operated 450 locations across 13 states.

In fact, the largest deals in the sector focused on ophthalmology. Goldman Sachs‘ private equity arm, West Street Capital Partners VII, purchased Capital Vision Services LP for $2.6 billion, which manages independently owned optometry practices, operating under the trade name MyEyeDr. The company employs approximately 560 optometrists and ophthalmologists. The sellers in this deal, Altas Partners LP and CDPQ, had bought Capital Vision for $775 million in 2015.

Dental groups also attracted a great deal of attention from PE Buyers, recording 33 deals in 2019 so far. Cordental Group, a dental support organization (DSO) and a portfolio company of NMS Capital, was particularly busy, reporting five transactions alone this year. Although no prices were disclosed, there’s a good chance Cordental’s largest deal was the acquisition of AppleWhite, a dental services organization with locations in Iowa, Illinois, Minnesota and Wisconsin. Through a network of 35 offices, it supports over 100 dentists and hygienists and provides dental care to nearly 185,000 patients annually.

Dermatology was the only other specialty to record double digits, but it is also one of those specialties that draw consistent attention year after year. However, this year, PE Buyers branched out this year, building a more diverse portfolio. Primary care, orthopedics, and gastroenterology were the focus of multiple deals this year. Perhaps PE Buyers are laying the foundation for new platforms for new specialties, and we’ll see a shift in dealmaking in 2020.