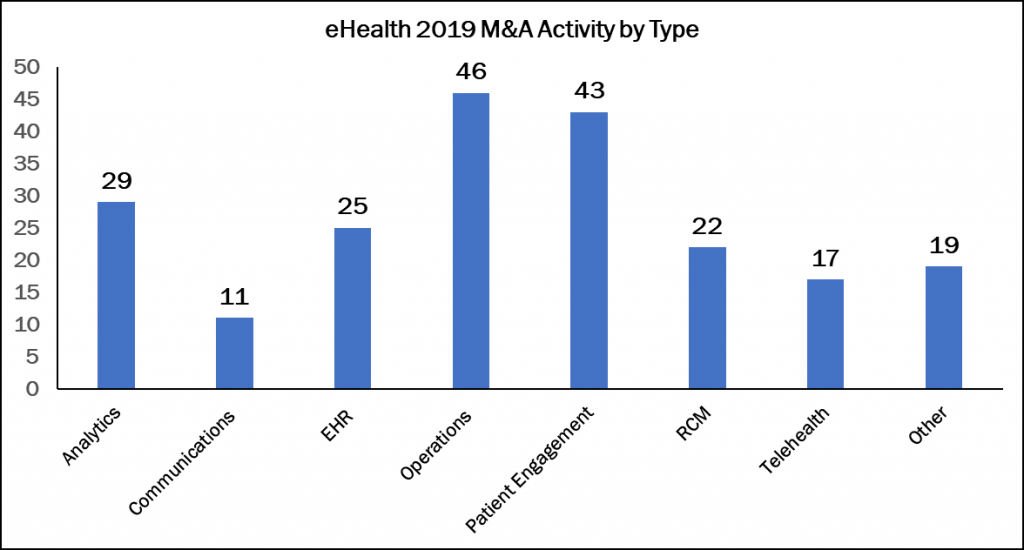

It almost goes without saying that technology has permeated every aspect of healthcare, but dealmaking in 2019 underscores that point even further. Based on preliminary numbers, eHealth deals hit a record 212 this year, a slight uptick from 2018’s deal count of 204, according to our Deal Search Online database.

The graph above breaks out the number of deals by target type. Companies focused on providing management software solutions to support back-office operations led the sector this year, with 46 deals. These are usually small firms offering software-as-a-service (SaaS) platforms that could be implemented to aid any type of healthcare organization. One example is the acquisition of OmniComm Systems, Inc. in mid-July by Anju Software, a portfolio company of Providence Equity Partners, for $64.9 million. OmniComm’s software facilitates workflow management, data collection, communications management and decision-making processes for biotechnology, pharmaceuticals and medical device companies and other clinical trial sponsors.

The most notable trend this year, however, was the demand for patient engagement platforms. Providers need more meaningful ways to communicate with their patients beyond basic transactions, and patient engagement solutions help them achieve the gold standard of every healthcare organization: reducing cost, improving health, and improving the patient experience.

And there were big companies seeking out these services. In August, Experian Health, the healthcare arm of Experian (LSE: EXPN), bought MyDirectHealth, which develops digital care coordination solutions to help patients find the appropriate care provider. Back in March, Tabula Rasa HealthCare, Inc. (NASDAQ: TRHC) acquired PrescribeWellness for $150 million, roughly 5x revenue. The target company facilitates collaboration between more than 10,000 pharmacies with patients, payers, providers and pharmaceutical companies. It provides patient services such as medication home-delivery, appointment scheduling, Medicare plan reviews and more.

Demand for the usual services, such as revenue cycle management (RCM) firms and electronic health record (EHR) companies, remained steady thanks to private equity firms. EQT, a leading European investment firm, and Canada Pension Plan Investment Board, a professional investment management organization, partnered together to acquire Waystar from Bain Capital for $2.7 billion. Waystar was formed through a September 2017 merger of Navicure and ZirMed, two leading RCM companies.

The biggest deal of the year by announced price was for a digital health company focused on analytics and managing big data. Dassault Systemes (Paris: DSY) bought Medidata Solutions, Inc. (NASDAQ: MDSO) for $5.8 billion. Medidata Solutions’ platform assists life science companies in performing clinical trials with managing vast amounts of data. Medidata’s cloud-based solutions are used by 1,300 customers globally, including pharmaceutical companies and biotechs, contract research organizations, and medical centers and sites.

Communication companies, which help facilitate systems between payers and providers, saw 11 deals this year, with telehealth slowly climbing in popularity. We expect telehealth to grow in 2020, as virtual and remote care could aid hospital systems and physician groups (and patients) cut down on costly checkups and visitations. In the “Other” category, there were companies that offer artificial intelligence systems, remote patient monitoring systems, and point-of-care platforms, all categories that might find itself in the headlines come 2020. Only time will tell.