As we researched data across 13 sectors for our upcoming publication, The Healthcare M&A Report, First Quarter 2019, an interesting trend in the “Other Services” sector popped up. This sector includes areas ancillary healthcare services such as ambulatory surgery centers, urgent care clinics, contract research organizations (CROs), healthcare staffing companies, specialty pharmacies, among others. Since it aggregates so many healthcare services, the deal count can be high.

There were 182 deals in 2018, only surpassed by numbers in the tech sectors and Long-Term Care. Last year’s totals were driven heavily by contract research organizations (CROs) and outpatient care transactions. Combined, they made up 47% of the deals in the sector. Outpatient care, in particular, nearly doubled in transaction count from 2017 to 2018, going from 24 deals to 43.

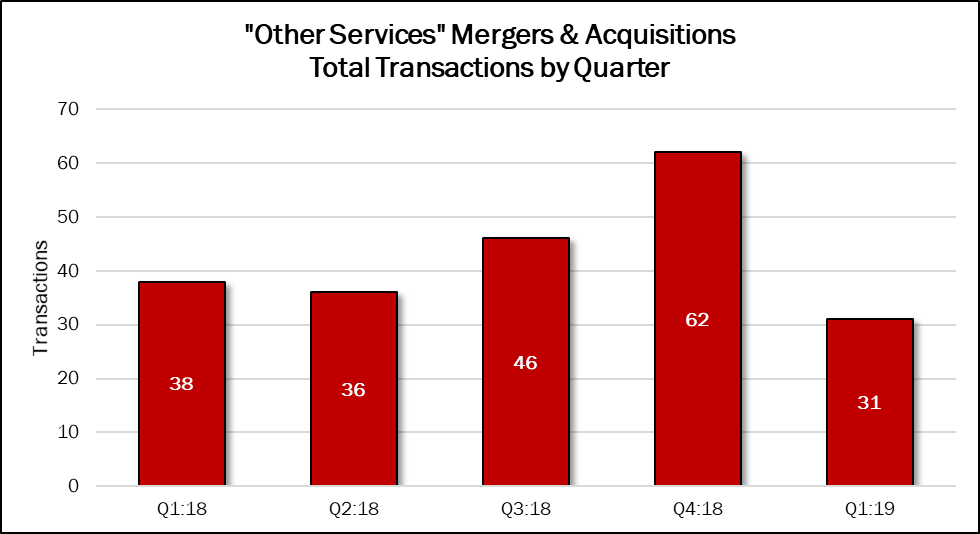

However, breaking the quarter-to-quarter rise, Q1:19 saw a 50% drop in deal volume from Q4:18, which resulted from a decrease in activity in certain sub-sectors such as CROs, staffing companies and outpatient care. We saw only one staffing transaction, seven CROs, and one outpatient care deal. Those are sharp declines from usually busy sub-sectors.

At the same time, spending grew by 142%, quarter over quarter.

That spike in dollar volume can be attributed to Thermo Fisher Scientific Inc.’s (NYSE: TMO) acquisition of Brammer Bio, a contract development and manufacturing organization (CDMO). It bought the target company from Ampersand Capital Partners, a private equity firm, for $1.7 billion, an amount that surpassed all of Q4:18’s total. The deal is actually the fourth largest deal in the Q1:18-Q1:19 period, covered in the upcoming First Quarter 2019 report.

The largest is a mammoth compared to the rest of the deals in the sector, or any sector for that matter. In Q1:18, you might recall the acquisition of Express Scripts Holding Company by Cigna Corporation for $67 billion.

These deals and more will be discussed in detail in the soon to be published Healthcare M&A Report, First Quarter 2019.