Health Care Deals Slide in April 2017

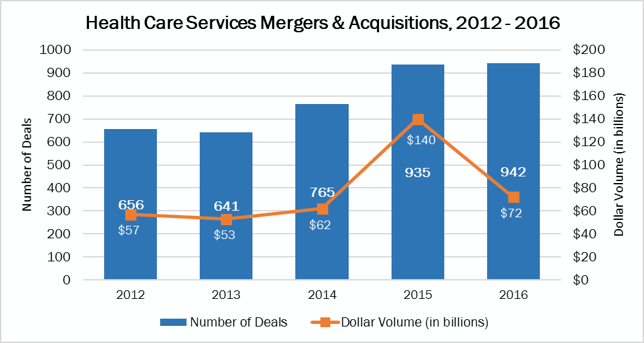

April usually doesn’t feel like February, at least, weather-wise. As far as healthcare mergers and acquisitions go, however, deal volume in April 2017 (103 deals) feels a lot like February’s deal volume (102). The chart below shows the clear winners and losers in April 2017. Deal volume was down 29% compared with the previous month (March, 145 deals), and slid 12% compared with the year before (April 2016, 141 deals). Healthcare services deal volume accounted for just 50% of April’s preliminary total. The services sectors typically account for higher percentages than the technology sectors (although that trend is reversed when it comes to dollar volume). The services side... Read More »

PE-backed Pivot Physical Therapy Grows (Again)

Acquisitions of rehabilitation companies and clinics has been on the rise in recent years. That trend is continuing in 2017, with nine deals announced in the first quarter. Five of those were announced in March alone. The second quarter is off to a good start, too. Pivot Physical Therapy, a portfolio company of CI Capital Partners, just inked its fourth deal of 2017. On April 5, 2017, Pivot acquired Tidewater Physical Therapy, an outpatient physical therapy practice with more than 30 locations across Virginia, including five aquatic therapy centers and three performance centers. This purchase comes on the heels of a two-year buying spree. Back in 2014, CI Capital Partners, alongside... Read More »

Rehabilitation Deals Gained Strength in 2016

Mergers and acquisitions in the Rehabilitation sector continued the climb that began in 2014, with a 21% increase in deal volume since 2015. Mergers and acquisitions in the Rehabilitation sector continued the climb that began in 2014. A total of 40 deals were announced in 2016, up 21% compared with the year before, and 90% higher than in 2014. This fragmented sector has benefited from the growing emphasis on post-acute care and cost efficiencies, similar to the Home Health sector. Like physician medical groups, targets in this sector tend to be small, privately held operations and their acquisitions aren’t always publicly announced. For that reason, the data may underrepresent the... Read More »