LevinPro HC Stat of the Week: Private Equity Activity in 2025

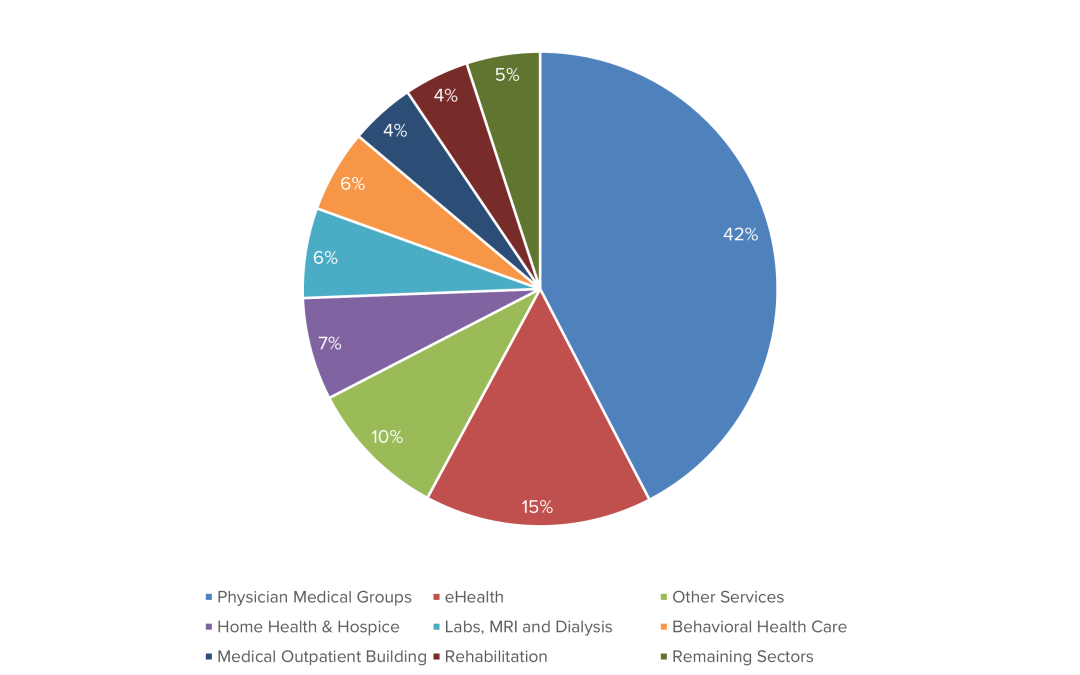

In our new LevinPro HC Stat of the Week, we’re previewing data from our upcoming Healthcare Services Acquisition Report. In our analysis of private equity (PE) transaction data for 2025, 42% of all PE deals targeted physician groups, the largest volume of any sector. Physicians have been popular targets for PE firms for years, especially through add-on acquisitions by platforms such as MB2 Dental and Epiphany Dermatology. eHealth companies also received a surge of attention in 2025, most notably revenue cycle management firms (30 deal announcements). With all the reimbursement upheaval and changes in 2025, it’s no surprise that revenue cycle management services are in high demand,... Read More »

Summit Spine & Joint Centers Acquires Savannah Pain Management and Savannah Pain Center

Summit Spine & Joint Centers, backed by private equity firm Wellspring Capital Management, announced on January 20 that it acquired Savannah Pain Management and Savannah Pain Center. Run by Dr. Keith A. Kirby, MD., Savannah Pain Management and Savannah Pain Center operate as one pain management center with one location in Savannah, Georgia. It also operates one outpatient surgery center. Summit Spine & Joint Centers is a management services organization that provides administrative and support services to its network of clinics and ambulatory surgery centers across the Southeast. It became a portfolio company of Wellspring Capital Management in 2025. This is... Read More »

PE Firm Main Post Partners Buys HomeWell Care Services

HomeWell Care Services announced on January 21 that it has been acquired by San Francisco, California-based Main Post Partners. HomeWell Care Services is a leading national franchise provider of personal care, companionship and homemaker services for seniors and homebound individuals. With locations in 22 states, HomeWell is franchised by HomeWell Franchising Inc. Main Post Partners is a private equity investment firm focused on investing in proven growth companies across the consumer value chain. Main Post Partners invests in both majority and minority positions primarily in first institutional capital situations where founders, entrepreneurs and management teams are looking for a partner... Read More »

KidsChoice Announces Majority Investment from Aquitaine Capital

KidsChoice announced in a January 21 press release that it has received a majority investment from Aquitaine Capital. KidsChoice is an Oklahoma-based provider of clinic-centered autism and pediatric therapy services, serving children and families through applied behavior analysis, speech therapy and occupational therapy. New York City-based Aquitaine Capital is a women-owned private equity firm that partners with founder- and family-owned businesses to support long-term growth. The firm brings capital, operational expertise and a deep network to help management teams scale responsibly while strengthening quality, consistency and performance. Looking ahead, KidsChoice will continue... Read More »