by | May 3, 2017 8:26 pm | Behavioral Health Care, Biotechnology, eHealth, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Long-Term Care, Managed Care, Medical Devices, Other Services, Pharmaceuticals, Physician Medical Groups, Rehabilitation

April usually doesn’t feel like February, at least, weather-wise. As far as healthcare mergers and acquisitions go, however, deal volume in April 2017 (103 deals) feels a lot like February’s deal volume (102). The chart below shows the clear winners and losers in April 2017. Deal volume was down 29% compared with the previous month (March, 145 deals), and slid 12% compared with the year before (April 2016, 141 deals). Healthcare services deal volume accounted for just 50% of April’s preliminary total. The services sectors typically account for higher percentages than the technology sectors (although that trend is reversed when it comes to dollar volume). The services side... Read More »

by | May 3, 2017 5:53 pm | CRO, Laboratories, MRI & Dialysis, Private Equity

Private equity firms are taking big stakes in contract research organizations (CROs) in 2017. Through May 3, 12 CRO deals have been announced this year, up 140% from the same period last year, when only five deals were announced (these numbers do not include contract manufacturing organization deals). In late April, The Carlyle Group was rumored to be weighing the acquisition of Albany Molecular Research Inc. (NASDAQ: AMRI), a New York-based CRO. A week later, the private equity firm announced the sale of its majority stake in Pharmaceutical Product Development, LLC (PPD), a global contract research organization that provides comprehensive, integrated drug development, laboratory... Read More »

by | Apr 21, 2017 6:32 pm | Medical Devices, Other Services

Cardinal Health, Inc. (NYSE: CAH) announced its $6.1 billion acquisition of three Medtronic businesses (NYSE:MDT) on the same day it disappointed shareholders with its 2017 guidance update. It’s been a tough April for Cardinal Health, the healthcare services and products company that operates through its Pharmaceutical and Medical segments. On April 18th, 2017, the company released a disappointing guidance update stating that its fiscal 2017 non-GAAP EPS from continuing operations will be at the bottom of its previous guidance range of $5.35 to $5.50. The company pointed to generic drug deflation as one of the leading factors. That same day, the company announced its largest deal to date,... Read More »

by | Mar 28, 2017 7:55 pm | CRO, eHealth, Other Services, Private Equity

It may not be news to digital health sector watchers that Bracket, a privately held clinical trial technology provider, was sold again. On March 28, 2017, San Francisco private equity firm Genstar Capital purchased the company for an undisclosed price. Bracket, a Pennsylvania-based clinical trial technology, has changed hands several times over the years. Bracket serves biotechnology and pharmaceutical companies, as well as clinial research organizations. It leverages Bracket eCOA™, a platform for electronic clinical outcomes assessments that collects information from patients (ePRO), clinicians (eClinRO) and other observers (eObsRO). The company started off as a division of United... Read More »

by | Mar 17, 2017 4:44 pm | Hospitals, Other Services, Private Equity

Air Methods Corporation (NASDAQ: AIRM), a global air medical transportation company, has been on the acquisition trail since the late 1990s, announcing 12 deals targeting smaller air ambulance operators. Now it’s a takeover target itself, thanks to activist shareholder Voce Capital Management LLC. Voce Capital, and its managing director J. Daniel Plants, had been calling for Air Methods management to put the company on the block as far back as 2015. In February 2017, the investment firm launched a fight for four board seats and publicly criticized AIRM’s financial returns and “a multi-year syndrome of operational, strategic and governance failures.” Air Methods... Read More »

by | Mar 2, 2017 3:56 pm | Behavioral Health Care, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Long-Term Care, Managed Care, Other Services, Physician Medical Groups, Private Equity, Rehabilitation

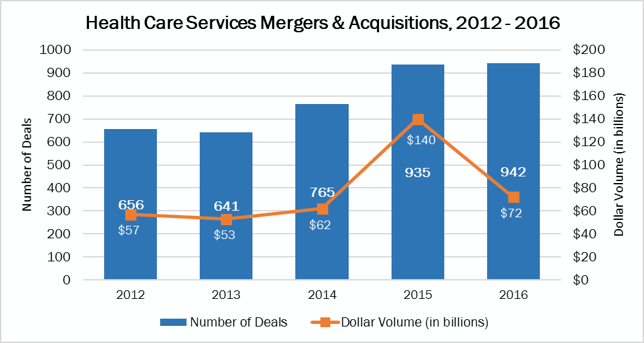

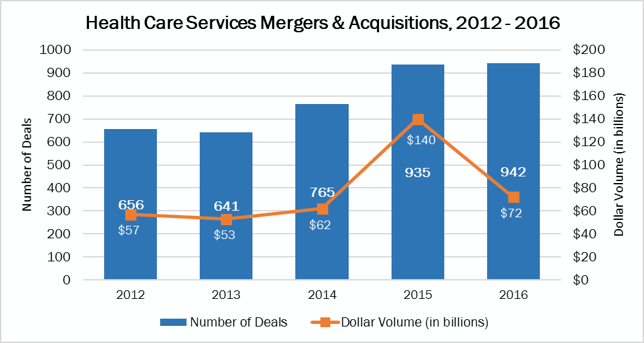

Every spring, we publish myraid statistics on the healthcare services deals announced the year before, in the form of The Health Care Services Acquisition Report. This year’s 23rd edition, which will available in late March, has this examination of what financial buyers targeted in 2016. Strategic buyers continued to dominate the health care services M&A market in 2016, as they have in the past. Their 683 deals made up 73% of the year’s deal volume. The $45.7 billion spent accounted for 63% of the combined total of $72 billion. A total of 259 deals, or 27% of the services deal volume in 2016, were carried out by financial buyers, such as private equity firms and real estate... Read More »