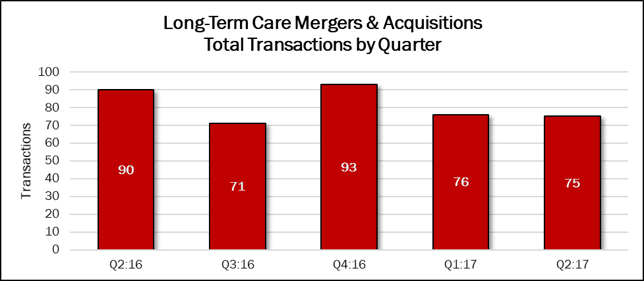

Merger and acquisition activity stayed virtually even in the second quarter, down 1% from the previous quarter, to 75 transactions. The quarter’s deal volume makes up 24% of the 315 deals announced within the past 12 months. Q2:17’s deal volume is 17% lower than the same period a year earlier.

Source: HealthCareMandA.com, July 2017

Source: HealthCareMandA.com, July 2017

Based on revealed prices, approximately $9.7 billion was committed to finance second quarter deals, an increase of 574% compared with the previous quarter and 299% higher than the same period in 2016. The second quarter accounted for 47% of the $20.6 billion spent in the last 12 months. Forty-four of the 75 deals disclosed prices, and two were more than $1 billion.

Dollars Spent on Long-Term Care Mergers & Acquisitions, by Quarter

| Q2:16 | Q3:16 | Q4:16 | Q1:17 | Q2:17 |

| $2,438,278,000 | $2,968,025,000 | $6,470,061,655 | $1,444,300,000 | $9,734,850,500 |

Two publicly traded REITs got together, and accounted for the largest transaction of the quarter. Sabra Health Care REIT agreed to pay nearly $4.0 billion for Care Capital Properties, a healthcare REIT that was spun out from Ventas in 2015. It focuses on owning, acquiring and leasing skilled nursing facilities and other healthcare and senior living properties.

The second big deal, at $2.6 billion, was announced by Columbia Pacific Advisors, LLC, an investment firm that currently manages $1.45 billion in funds that have developed or acquired ownership interests in more than 300 senior living communities. The target was Hawthorne Retirement Group, a developer, owner and operator of senior living communities, with 55 properties across 20 states and two Canadian provinces currently in its portfolio. It is also developing 24 new communities.

The third largest transaction was announced by Kayne Anderson Real Estate Advisors, which paid $825 million for Sentio, a public, non-traded REIT backed by investment firm KKR. Sentio has a portfolio of 34 seniors housing and medical office properties in 16 states. Most of Sentio’s acquisitions were completed between 2009 and 2015, with little activity in 2016.