TowerBrook & Ascension Acquire Hospice Compassus in $1 Billion Deal

TowerBrook Capital Partners and Ascension have joined forces in a hospice deal worth $1 billion, or 11.8x revenue. The joint venture is buying Hospice Compassus, which provides hospice, palliative and home health care and services to patients in more than 25 states, from Formation Capital and Audax Private Equity. Towerbrook and Ascension will own equal stakes in Hospice Compassus after buying the hospice firm an auction that started in early 2019. Formation and Audax backed Hospice Compassus for roughly five years, recapitalizing the company in 2014 for roughly $300 million, according to the same report. Although it’s no surprise that PE firms are big players in the Home Health and... Read More »

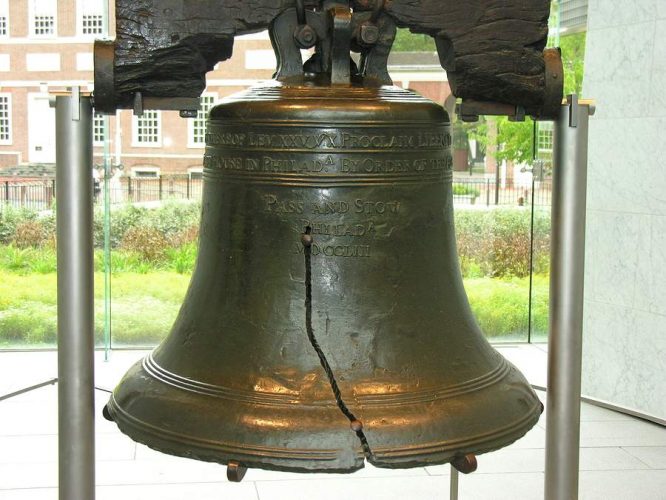

St. Christopher’s Hospital Goes to Auction in Philly

Yet another hospital bankruptcy has led to an auction and a sale. This time it was St. Christopher’s Hospital for Children in Philadelphia, Pennsylvania. The 188-bed hospital is a healthcare outpost in north Philly and one of only two children’s hospitals in the city. In 2018 it and Hahnemann University Hospital were sold by Tenet Healthcare (NYSE: THC) to California investment banker Joel Freedman, represented as American Academic Health Systems LLC (AAHS), for $170 million. Hahnemann’s financial troubles prompted American Academic to file for Chapter 11 bankruptcy protection on June 30 and led to that hospital’s closure in July 2019. St. Christopher’s... Read More »

TPG Capital Re-enters the Southeast Asia Hospital Market

TPG Capital and its sponsored companies have been on a tear in 2019. Through its recently launched U.S. autism platform, Kadiant, the global private equity firm announced six deals since February. Its U.S.-based digital health company WellSky announced two deals in the past 12 months and back in February, Kindred Healthcare, now co-owned by TPG and Welsh, Carson, Anderson & Stowe, acquired a hospital in Los Angeles out of the Promise Healthcare bankruptcy. In early September, TPG announced its acquisition of another digital health company, Convey Health Solutions, from New Mountain Capital for an undisclosed price. Two weeks later, the firm was back in the news with a $1.2 billion deal... Read More »

KentuckyOne Unloads Jewish Hospital and its Assets

After two years of negotiations, KentuckyOne, a subsidiary of CommonSpirit Health, is selling the finiancially ailing Jewish Hospital (462 beds) and its Louisville-area assets, which include three hospitals and four outpatient centers. The negotiations dragged on so long, Jewish Hospital was in danger of closing. The acquirers are the University of Louisville (UofL) and its University Medical Center (333 beds). UofL is recieving financial assistance in the deal with a state-funded $50 million, 20-year low-interest loan, half of which is forgivable if UofL meets certain employment criteria or extends services to currently underserved areas of the commonwealth. The terms of the deal are... Read More »