What Physician Specialties Are Private Equity Firms After?

Editor’s Commentary:

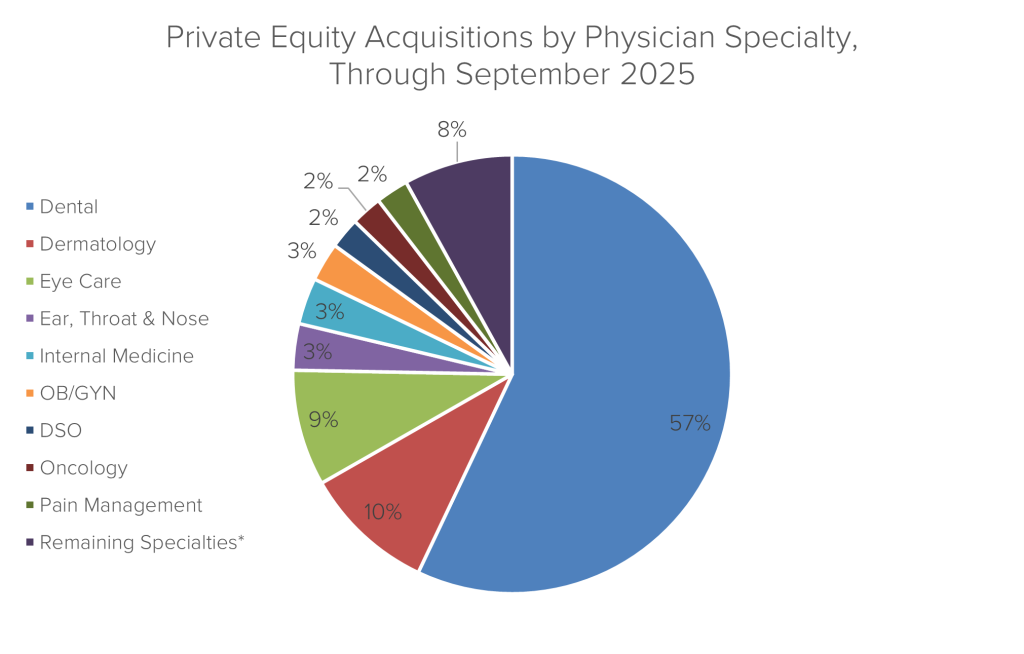

Throughout 2025, dental practices have been the clear favorite for roll-up acquisitions by private equity firms and their sponsored platforms. This year’s trend mirrors activity we captured in 2024 and 2023 on our LevinPro HC platform, with dental drawing most of the attention in private equity investments and funding for years now. The volume of activity makes sense when you examine the tailwinds: a fragmented market, stable cash flows and the promise of a DSO’s ability to generate higher margins at scale. It’s a no-brainer for these firms to work quickly to build out a national platform.

Our 2024 numbers differ slightly in other areas, however. Dermatology and eye care are popular year over year, but there are fewer deals for plastic surgery practices and cardiologists and more for pain management doctors and OB/GYN groups. Pain management providers are benefting from demographic tailwinds of an aging population, the shift to outpatient care and patients looking for non-pharmacological alternatives to opiods.

Private equity-backed platforms like Clearway Pain Solutions (NexPhase Capital) have been eager to expand their network of pain management clinics, and Together Women’s Health (Shore Capital Partners), is a new MSO dedicated to women’s health and OB/GYN clinics.