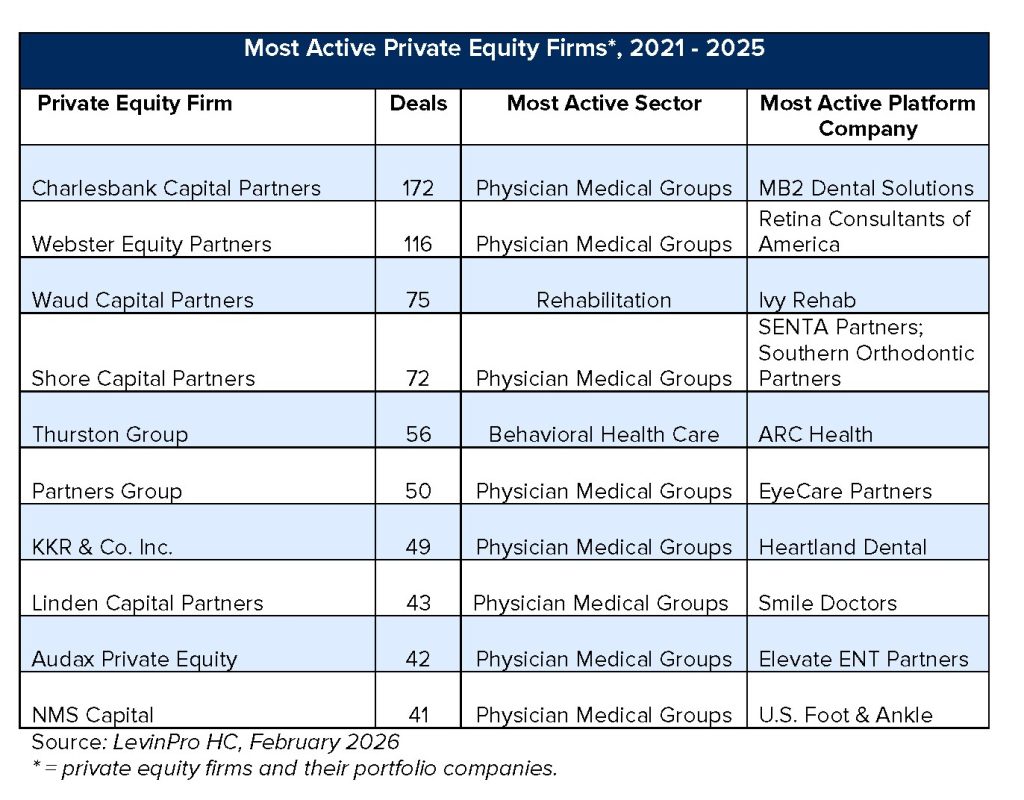

In the final preview of our 2026 Health Care Services Acquisition Report, we’re placing a spotlight on the most active private equity firms in the healthcare market. In the past five years, no private equity firm has been more involved in the healthcare M&A market than Charlesbank Capital Partners. The firm and its portfolio companies have announced 172 transactions over the past five years, according to transaction data captured in the LevinPro HC platform. It was founded in 1998 and currently has $22 billion in total assets, according to its website.

Of those 172 deals, Charlesbank’s portfolio company, MB2 Dental Solutions, is responsible for nearly all of them (165). Founded in 2007, MB2 offers general dentistry services, orthodontics, cosmetic dentistry and oral surgery, and partners with dentists across the country. MB2 and Charlesbank began working together in 2021, but in late 2024, MB2 Dental received a $525 million capital investment from Warburg Pincus, another PE firm. With this new injection of funding, the company announced 19 deals in 2025 alone.