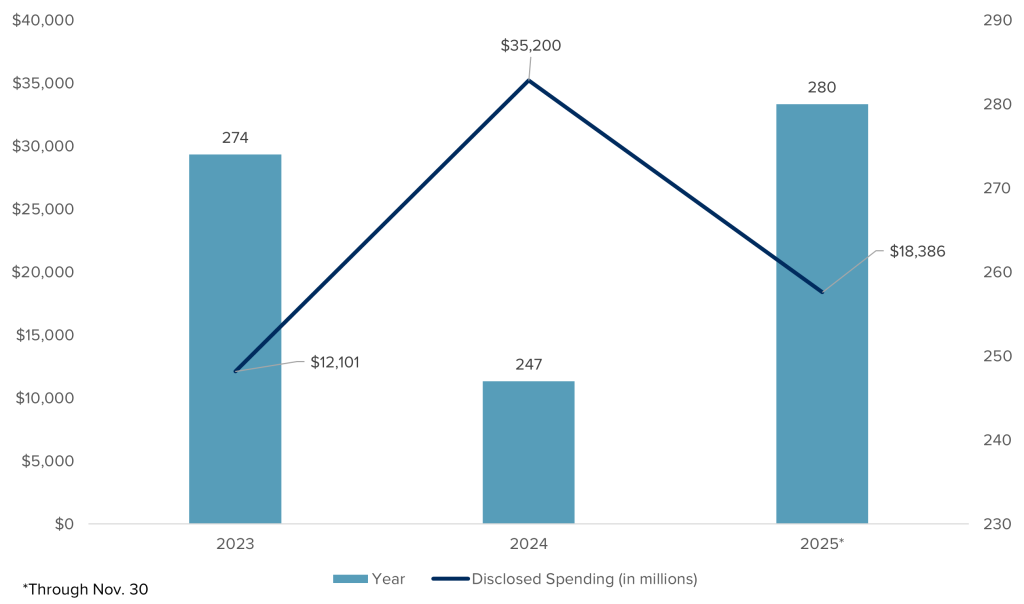

eHealth Activity Hits 3-Year High (Already)

With still a month left in 2025, eHealth M&A activity has hit a 3-year high, with 280 deal announcements, a 13% increase over last year’s volume. Although AI has been a hot topic in healthcare (and just about everywhere), our LevinPro HC data shows that investors have been targeting revenue cycle management firms (50 deals), telehealth (48 deals) and patient engagement (48 deals) more than any other vertical. With all the reimbursement upheaval and changes this year, it’s no surprise that revenue cycle management services are in high demand, exemplified by Waystar’s $1.25 billion purchase of Iodine Software.

Although year-over-year spending has declined, it remained healthy throughout 2025, with $18.4 billion in disclosed transaction value so far. The largest deals were mostly from private equity firms, such as Clearlake Capital Group’s $5.3 billion acquisition of ModMed and Patient Square Capital’s $2.6 billion takeover of publicly traded Premier, Inc.