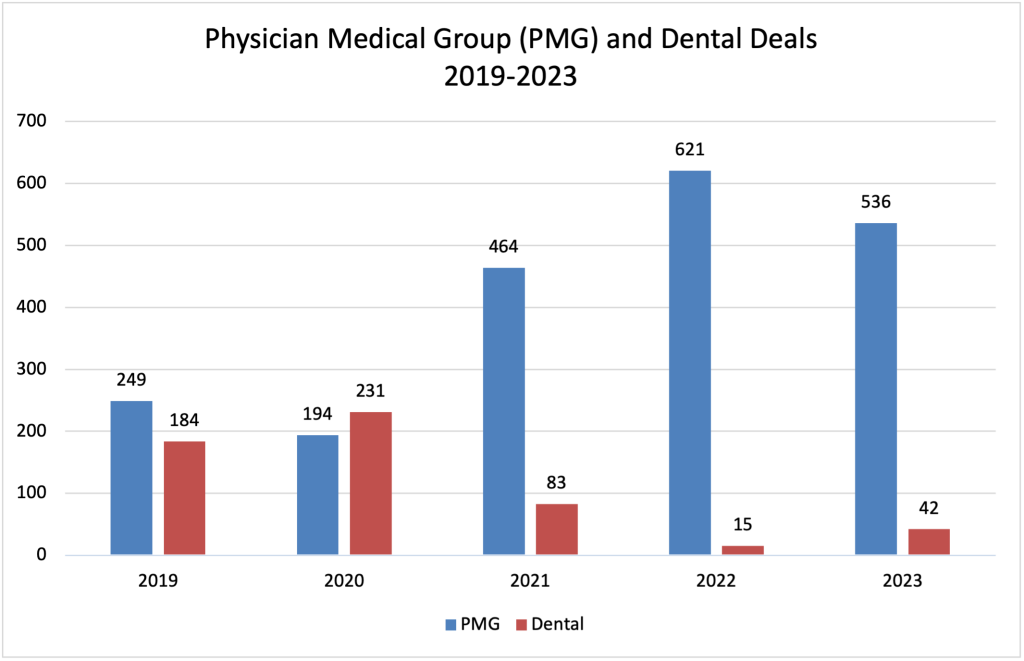

Dental groups are among the most popular investments in the healthcare M&A and Physician Medical Group (PMG) space. In January 2024, there were 50 PMG acquisitions, according to data from the LevinPro HC database. Of those 50, 23 of them were in the dental specialty. This high deal volume continued from 2023, when 184 (34% of the PMG deals) dental transactions were reported, and 231 (37% of the PMG deals) were reported in 2022. In 2019, there were 42 dental transactions, which just shows how much the industry has grown over the past five years.

With such high deal activity, the question of ‘why are investors so interested in this market?’ is often raised. While there are myriad reasons to invest in the dental space, we want to highlight three that are particularly important: the highly fragmented status of the industry, the increase of digital dentistry and technology, and the profound impact of the “Zoom effect.”

Consolidation

The dental industry is highly fragmented, with most dentists and orthodontists working independently. According to the American Dental Association, as of 2023, more than 200,300 dentists were actively registered in the United States. IBISWorld reported that, as of 2023, almost 16,000 orthodontists were practicing in the United States, with approximately 61% working independently. Additionally, practice ownership amongst dentists fell from 85% in 2005 to 73% in 2021. So, with more than half of dentists and orthodontists still working independently, there are plenty of opportunities for consolidation.

The low average size of acquired practices underscores the fragmented nature of the dental market. Data from the LevinPro HC database indicates that investors, over the last year, targeted dental practices with less than five dentists.

Within the first month of 2024, 23 dental transactions were reported. These transactions averaged five physicians per practice, but that is slanted slightly to the higher side as three of those practices had more than 10 physicians, which is not the norm in the dental space. In 2023, the 184 dental transactions averaged three providers per practice. In 2022, the 231 deals averaged five physicians per practice (also skewed higher as two transactions had more than 100 providers on staff, and five had more than 20 physicians).

Many of the transactions were completed by dental service organizations (DSO) that aim to improve the quality of care by relieving physicians of administrative pressures, facility maintenance and expanding care reach to increase profit.

As many dentists and orthodontists turn to the benefits of partnering with a DSO, there are many acquisition opportunities for investors.

Digital Dentistry

Secondly, investors should pay close attention to the dental market because of the rise in digital dentistry. While the implementation of tools and technology into any healthcare is a broad subject, there have been several updates specific to dentistry that will ensure demand.

Current trends in the digital dentistry space include the integration of artificial intelligence, 3D printing, digital smile design, CAD/CAM technology and tele-dentistry. Artificial intelligence and machine learning allow dentists to analyze patient data for personalized treatment recommendations; 3D printing and CAD/CAM technology allow the creation of specialized dental work, which helps reduce treatment time; digital smile design permits the use of digital imaging to enhance cosmetic dentistry planning; and tele-dentistry provides remote dental care, particularly in underserved areas.

These technologies could revolutionize dental care with more precise restorations, faster treatment times, and expansion of access and reach of care. As digital technologies become more prevalent, there will be an increasing demand for specialists in dental technology, digital dentistry and tele-dentistry.

National Dentex Labs’ (NDX) activity highlights the increased activity in the digital dentistry space. A provider of dental prosthetics and restorative dentistry products, NDX has completed four transactions since 2020, when it was purchased by Cerberus Capital Management, expanding its digital dentistry capabilities. This activity reinforces how digital dentistry and dental technology have become increasingly important in the M&A landscape.

“Zoom Effect“

Lastly, the “Zoom effect,” which is the overanalyzing of facial features from being on camera all the time, was fueled during the COVID-19 pandemic and has left a lasting impact on the cosmetic and aesthetic dentistry industry. While many companies have shifted away from primarily remote work and are back to in-person, camera usage is still higher than it was previously, causing people to focus on ‘imperfections’ in their smile. It should be noted that the cosmetic dental industry is heavily reliant on technological advances in the field (such as digital dentistry) and the two work closely together to increase a practice’s profitability.

Veneers and teeth whitening, for example, have become increasingly common. Veneers have become more ubiquitous as less expensive materials such as resin veneers become more readily available. According to a report by Grand View Research, the global dental veneers market size was valued at $2.1 billion in 2021 and is expected to expand at a CAGR of 8.3% between 2022 and 2030. The same report noted that the teeth whitening market was estimated to be worth $6.9 billion in 2021 and is expected to grow at a CAGR of 5%. With both markets set to grow, that indicates the demand for the treatments.

Additionally, procedures like veneers and teeth whitening are often not covered by insurance, as they are typically not seen as medically necessary. With cosmetic dentistry not being covered by insurance, there are high profit rates for practice owners as the procedures are primarily private and out-of-pocket pay.

When it comes to braces, the ‘adult braces’ market is experiencing a boom that coincides with the “Zoom effect.” Specifically, Invisalign has come to hold a large presence as they are more comfortable and are much less noticeable than traditional braces. Approximately 32% of patients receiving orthodontic treatments in the United States and Canada are adults, according to data from the Marketplace by the American Association of Orthodontists. That percentage of patients has increased by more than 40% within the last decade. In May 2021, the British Orthodontic Society noted that even as early as September 2020 there was an increase of adults seeking alignment care.

With a rising focus on aesthetics and cosmetic dentistry, the dental space is prime for investments as there is an unlimited potential for profit. For example, in 2023, Dental Care Alliance, a DSO backed by Harvest Partners, acquired three dental practices specializing in cosmetic dentistry. In 2022, six acquisitions targeted cosmetic practices.

Dental is a great market to invest in because of its strong demand. Having healthy (and perfect-looking) teeth won’t be going out of fashion any time soon, ensuring a lot of attention on the industry.