Fourth Quarter Results

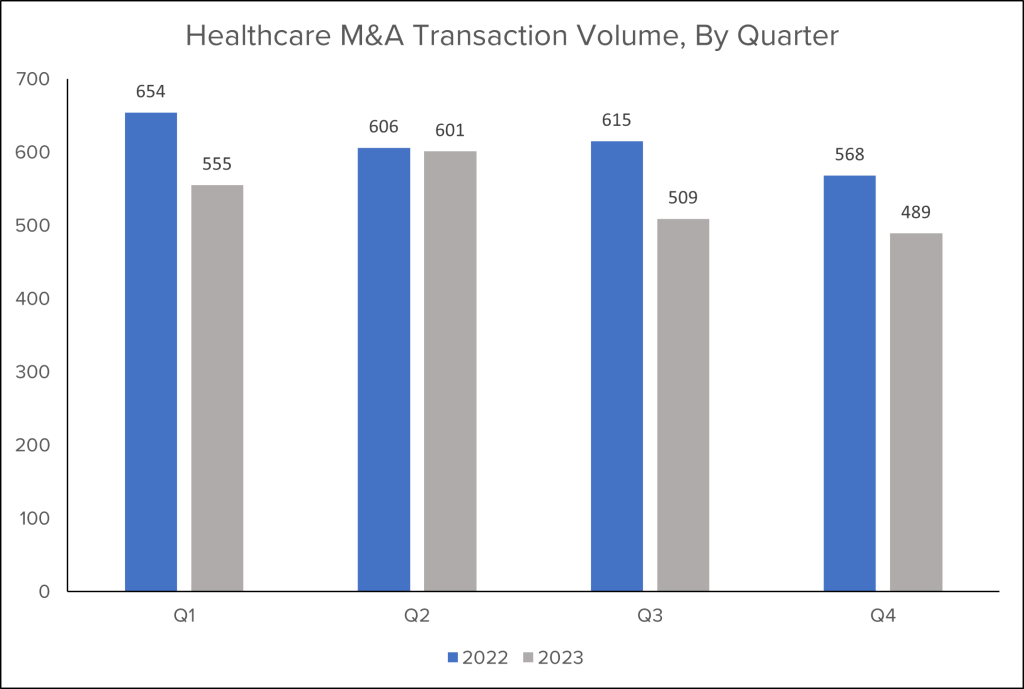

If we had to judge healthcare M&A activity in the fourth quarter of 2023, we’d say it was “fine.” Volume reached 489 deals, the slowest quarter of the past two years, but considering the macroeconomic headwinds the industry faced in 2023, activity could have been much slower. Deal activity in the fourth quarter of 2023 was 4% lower than volume in the third quarter and 14% down from Q4:22. In 2022, the quarterly M&A activity averaged 610 deals, but that fell to 538 in 2023, and with headwinds remaining essentially unchanged, we expect 2024 to keep that trend.

Dealmaking remained relatively stable in the fourth quarter due to another wave of private equity (PE)-funded transactions, which accounted for roughly 32% of all deals. PE continues to show high interest in the healthcare services sectors, such as Behavioral Health Care and Home Health & Hospice. Those industries benefit from favorable headwinds, such as increased demand for services and favorable demographics.

Announced transaction value in the fourth quarter hit $77.3 billion, nearly double the $40.4 billion spent in the third quarter. The surge in deal spending can be attributed to several large acquisitions in the Biopharma industry from a handful of buyers. For instance, Bristol Myers Squibb announced four deals totaling nearly $23 billion in value; AbbVie Inc. announced four at nearly $20 billion in total value. Many of these deals were complete takeovers of smaller companies with products ready to hit the market, especially in oncology and psychiatric medication, instead of smaller licensing deals.

There were some notable deals on the healthcare services side as well. Novant Health System, a not-for-profit integrated system based in North Carolina, purchased three hospitals in South Carolina from Tenet Healthcare Corporation for $2.4 billion; Healthpeak Properties, Inc., one of the largest healthcare REITs in the country, announced an all-stock merger valued at approximately $21 billion with Physicians Realty Trust.

Full-Year Results

The fourth quarter’s results reflect the overall performance for 2023. Preliminary numbers show 2023 hit 2,154 deals, a 12% decline from the 2,443 transactions announced in 2022, which was a record high. Although there’s likely a significant cache of deals to be discovered in upcoming annual and quarterly reports, we doubt there will be enough transactions to close the gap.

Some industry experts have suggested that headwinds such as the healthcare industry staffing shortages are a major factor in the decline of M&A volume. Staffing issues can have a negative impact on near-term financials across numerous sectors, affecting company valuations and potentially upending the deal negotiation process.

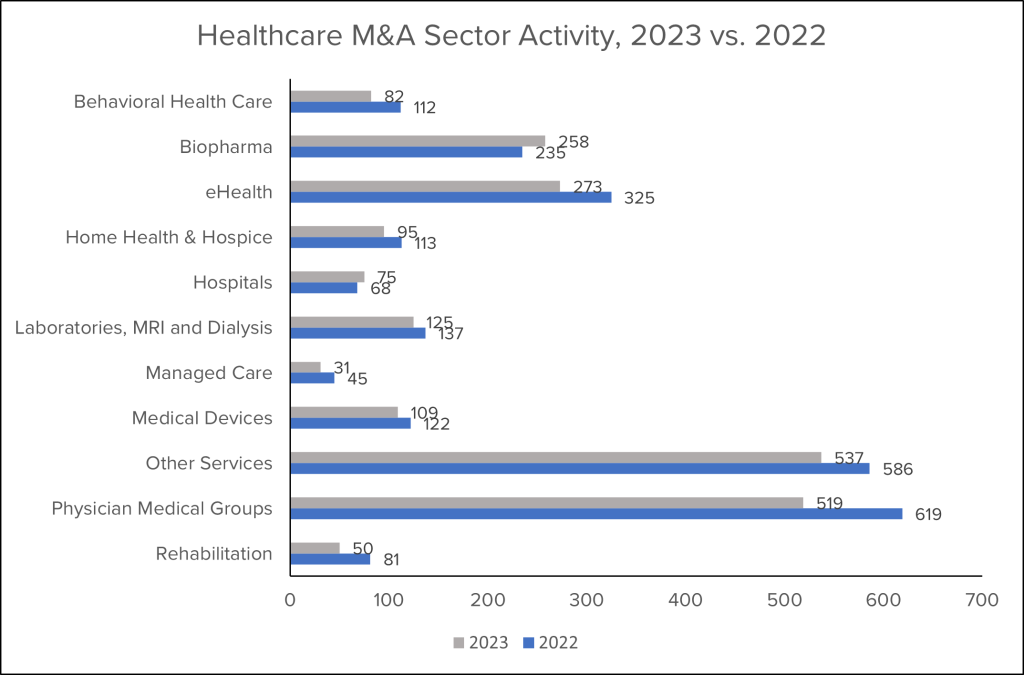

The Physician Medical Group sector had one of the largest drops in activity, down 100 deals from the volume seen in 2022. Several experts we’ve spoken with have noted that the increase in interest rates has made it difficult for some investors to take on more debt and keep expanding in the market, forcing a slowdown in dealmaking for physician practices.

However, that sector is now contending with increased regulatory pressures and shifting reimbursement models. Envision Healthcare, backed by private equity giant KKR, filed for Chapter 11 Bankruptcy in May, citing declining patient volumes due to the COVID-19 pandemic, exclusion from health insurance networks, rising inflation and clinician shortages and a financial strain from the implementation of the No Surprises Act.

The Department of Justice and the Biden Administration are also watching rollup transactions, which are very popular amongst PE and their sponsored platforms in the physician space. In September 2023, the Federal Trade Commission filed an antitrust lawsuit against U.S. Anesthesia Partners and Welsh, Carson, Anderson & Stowe, its private equity investor. Keep an eye on this space.

One of the few markets to see an increase in activity was the Hospital sector, which reached 75 deals. As competition in the outpatient care market heats up, many health systems decided to merge with rather than buy a smaller community hospital, suggesting that scale and diverse revenue streams could help stabilize an organization during harsh conditions. There were 17 mergers closed between health systems in 2023, with each deal carrying an average size of 500 beds and at least four hospitals, according to data captured in LevinPro HC. One of the largest mergers in 2023 was Kaiser Permanente’s acquisition of Geisinger Health, which comprises 10 hospitals and 133 primary care and specialty clinic sites. The deal closed back in March. The combined health system is expected to generate more than $100 billion in revenue.

Although the year had plenty of notable transactions, it’s hard to deny each healthcare vertical is facing tough headwinds. Industry experts believe 2024 will be more of the same, but the level of investment activity hinges on how the Federal Reserve handles interest rates. Dealmakers and investors can handle headwinds, but chaos makes negotiations difficult. Many are optimistic about the future, but it might be rough waters for the time being.