Market Overview

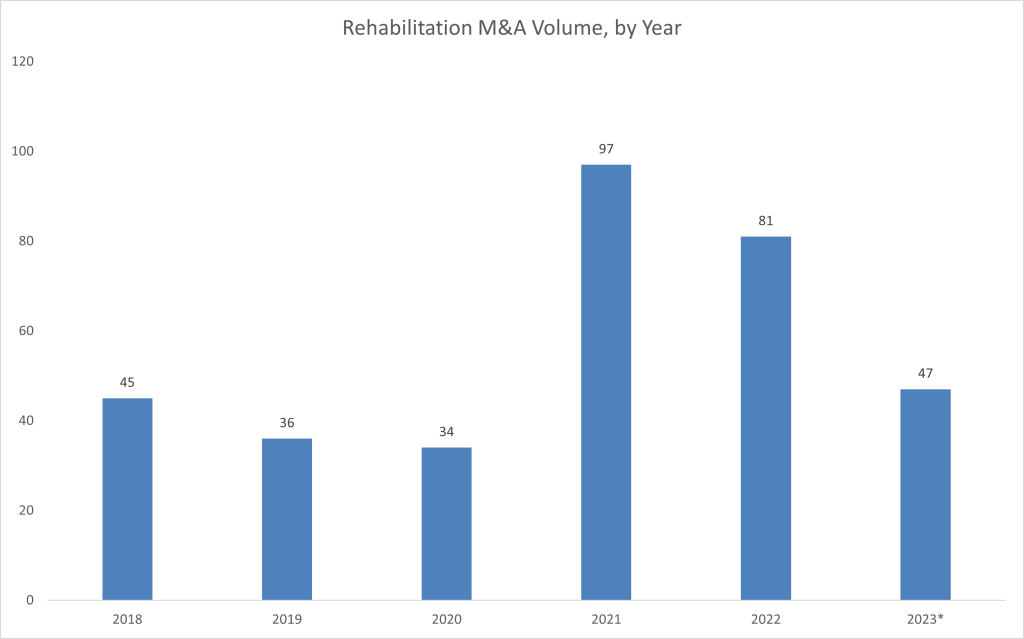

The Rehabilitation sector has never been the most popular market for investors. From 2018 to 2020, the market failed to break 50 deals annually, and then activity skyrocketed in 2021 and 2022, hitting a record high of 97 in 2021. However, investment activity in 2023 has slowed again, and we’re expecting to reach only 50 deals by the end of the year. That’s a significant decline of nearly 40% year over year.

*Data as of December 15, 2023

For context, other sectors are swarmed with strategic investors and private equity capital. According to our recent dive into the Physician Medical Group M&A market, deal volume for that market hit 478 deals by November 30, and that’s down from a record high of 579 in 2022.

“Currently, the market boasts 28 verified acquirers, inclusive of three publicly traded entities and numerous private equity-backed firms,” stated Paul Martin, CEO of Martin Healthcare Advisors. “While the physician sector initially led investment activity, the physical therapy domain is swiftly catching up.”

Martin Healthcare Advisors, a sell-side advisory firm, specializes in the outpatient rehabilitation sector. Since 2000, the firm has successfully executed over 100 transactions, encompassing upwards of 350 clinics, with owner payouts surpassing $450 million.

Not only is deal volume low in 2023, but there have been no major deals or mergers worth highlighting either. U.S. Physical Therapy, Inc., one of the more active acquirers in the space, has announced four deals so far in 2023, mostly for undisclosed therapy clinics across the country, offering valuations ranging from 0.8x to 1.9x for the practices. The largest deal, valued at $13.9 million, was for two physical therapy practices located in Colorado and Alaska. The practices have a combined annual revenue of $7.2 million.

Compare this to activity in 2022 when Patient Square Capital purchased Hanger, Inc. for $1.25 billion, or 1.1x Hanger’s 2021 revenue. Headquartered in Austin, Texas, Hanger provides orthotic and prosthetic services through its patient care segment, with approximately 875 locations nationwide.

Activity in 2023 has been quiet, to say the least, but we can blame some of the emerging market conditions for the slowdown.

Notable Headwinds

There’s also no doubt that there are significant headwinds facing the Rehabilitation sector (as with every healthcare vertical). According to The National Association of Rehab Providers & Agencies, 22,032 physical therapists left the workforce in 2021, primarily due to therapist burnout exacerbated by the COVID-19 pandemic. And the market is not immune to high inflation and interest rates either.

“The industry faces significant challenges, including downward pressure from payers, rising professional salaries, and a critical shortage in the professional workforce,” said Martin.

Martin is referring to the cuts in the 2024 Medicare Part B Physician Fee Schedule, which includes a 3.4% decrease in the conversion factor, one of the elements used in calculating final payment amounts for various codes.

“The impact of the cut is far-reaching, affecting more than 27 specialties including physical therapy,” said The American Physical Therapy Association in a press release.

No market is without risk, and it’s important to address some of the macro challenges of the physical therapy industry.

Huge Tailwinds

Despite these headwinds, the tailwinds are extremely strong, and investors should take notice for the future. Aging demographics and other health problems, such as rising obesity, are going to keep driving demand for outpatient physical therapy services.

“Demographic shifts present vast opportunities for our industry,” noted Martin. “An increasingly active baby boomer population, who are living longer and staying extremely active, substantially boosts demand for our services.”

According to U.S. Physical Therapy, Inc.’s November 2023 investor presentation, each year, approximately 50% of Americans over the age of 18 develop a musculoskeletal injury that lasts more than three months, and only 10% use outpatient physical therapy services. There is an enormous amount of growth potential left in the Rehabilitation sector that investors can capitalize on in the future.

And we would be remiss not to mention the benefit of the healthcare industry’s shift toward value-based care. As the market moves from inpatient offerings to lower-cost, outpatient services, the Rehabilitation sector stands to benefit since it’s one of the key verticals in the post-acute care market.

“The low cost and strong clinical outcomes of physical therapy services in the outpatient setting is an ideal fit for the current healthcare landscape where payors and provider networks are seeking high quality, cost-effective care for its patient population,” Provident Healthcare Partners wrote in a perspective on the market.

However, perhaps the biggest tailwind is the fragmentation of the market.

“The rehabilitation sector remains highly fragmented,” Martin explained. “For perspective, Select Medical, the largest industry player, controls under 5% of national clinics, with the top five entities combined holding less than a 10% share.”

The data backs up Martin’s comments. The U.S. outpatient rehabilitation market has more than 37,000 independent clinics. Some significant players include Select Medical (1,900 clinics), ATI Physical Therapy (900 clinics) and U.S. Physical Therapy, Inc. (675 clinics). Additionally, rehabilitation services are split across many sources: hospitals, therapy clinics, physician-owned clinics, chiropractors and more.

A heavily fragmented market is ripe for consolidation and M&A, and 2024 is looking to be a strong year for the Rehabilitation sector.

“Anticipating a deal flow in 2024 comparable to the robust years of 2021 and 2022,” Martin remarked, attributing this to stabilized interest rates and considerable private equity capital. “The interplay of seller expectations and acquirer innovation will shape the final deal count, yet all economic indicators and acquirer enthusiasm suggest a favorable trend.”

Looking beyond 2024, Martin’s outlook is even more optimistic.

“Addressing the professional supply issue and demonstrating the intrinsic value of physical therapy to patients could revolutionize the potential for value-based care,” he asserted. “I am firmly convinced that this industry will not only grow but also consolidate significantly in the coming 5-10 years.”