The Physician Medical Groups (PMG) market is an industry that we frequently analyze, and for good reason. Coupled with its high deal volume, the sector is brimming with changing trends such as the growth in the cardiology space or how the size of the practices being purchased has changed over time.

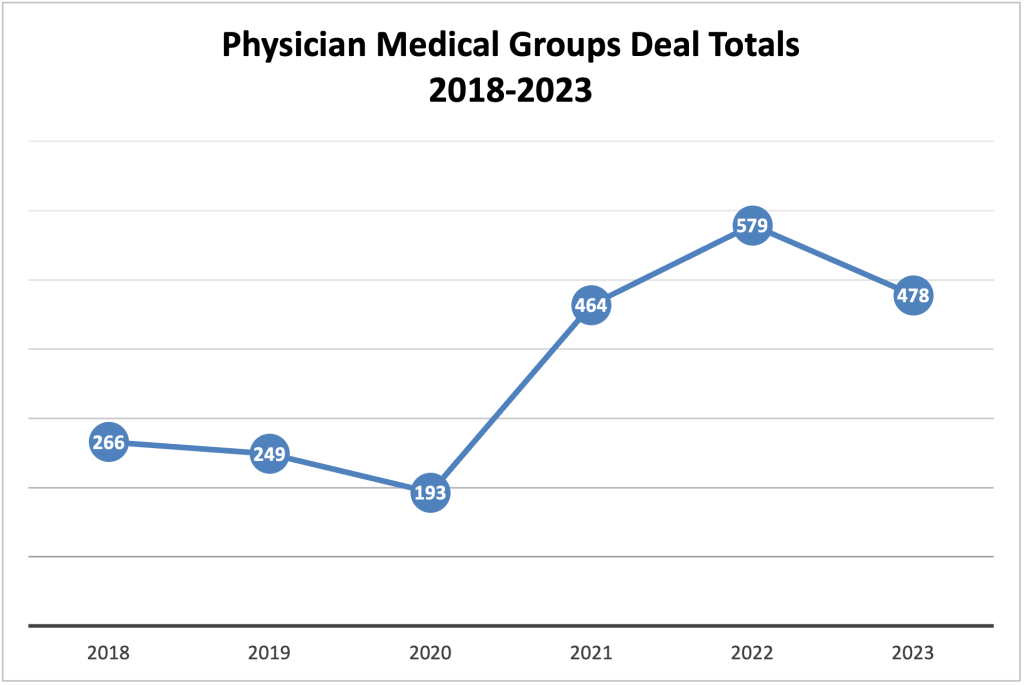

According to the LevinPro HC database, between January 1, 2023, and November 30, 2023, there were 2,001 healthcare transactions reported, 478 of them in the PMG sector, accounting for approximately 24% of deals. PMGs represent the second largest healthcare sector, with Other Services, a catch-all for ancillary services and companies at 502 transactions.

The deal volume in 2023 represents a slow in M&A activity from previous years; in 2022, 579 PMG deals (a record high) were announced; and in 2021, 464 acquisitions were reported. Yet, deal activity is still higher than it was in 2020 when COVID-19 hit the market the hardest, and only 193 PMG acquisitions were announced.

While there has been a plethora of trends and statistics that have changed, several have remained constant. MB2 Dental Partners, a portfolio company of Charlesbank Capital Partners, is still one of the most active acquirers with 44 deals in 2023 (up from 40 acquisitions in 2022); the OB/GYN market is climbing at a sizable rate; and private equity (PE) groups remain active investors, even if their activity has slowed.

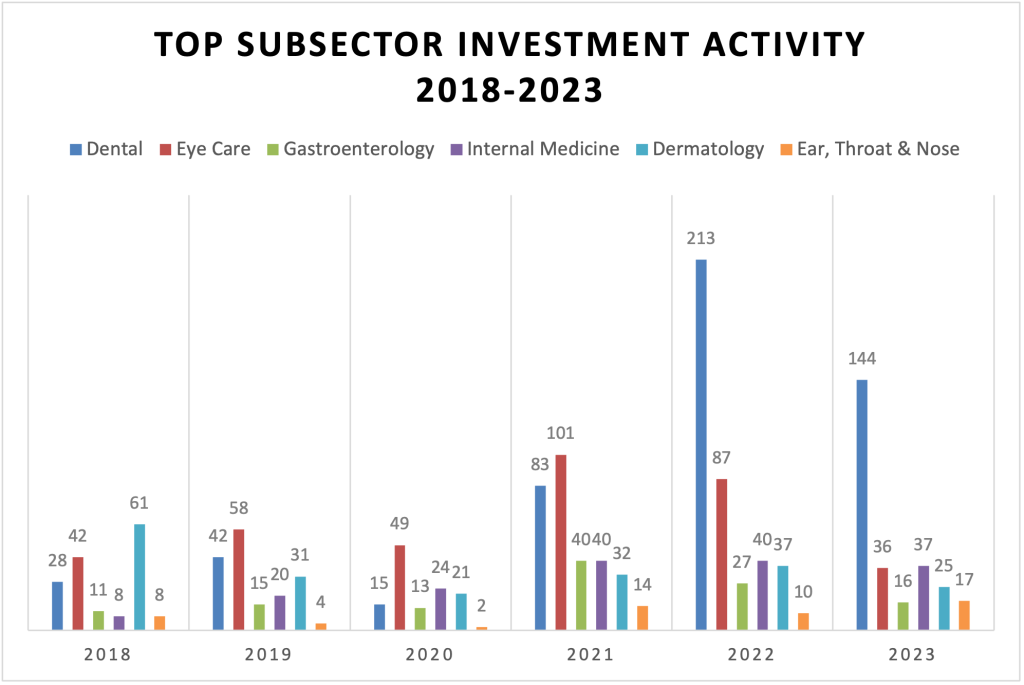

For the second year in a row, M&A activity in the dental specialty has accounted for the most deals in the PMG space. Between January 1, 2023, and November 30, 2023, 144 dental transactions were reported. This is a 32% increase from 2022 when 213 dental acquisitions were announced, but a 73% increase from the 83 announced in 2021. Dental Care Alliance, LLC, backed by PE group Harvest Partners, announced 11 deals, making it the second most active dental buyer.

According to analysts at Harris Williams, the strength of the dental market comes down to the fact that it is “large and growing, remains highly fragmented, and has proven to be recession-resilient, with significant opportunities to continue to consolidate and professionalize.”

Internal medicine represents the second most active specialty in 2023 with 37 reported acquisitions. Like in the dental space, the deal volume in 2023 is a decrease from 2022, and even 2021, for internal medicine where 40 deals were announced in both years. Yet, 2023 was busier than 2020, 2019, and 2018, all of which averaged 17 acquisitions each year. Buyers such as VillageMD, a subsidiary of Walgreens, and Palm Medical Centers, were among the most active in the space with three deals each.

Eye care experienced a rather large decrease in M&A volume throughout the first 11 months of 2023, totaling 36 transactions. This is a 59% decrease from the entirety of 2022 where 87 deals were announced, and a 64% drop from 2021 when 101 were reported. The activity seen in 2023 is even lower than in 2020 with 49 acquisitions, 2019 that had 58 and 2018 that saw 42. A driving factor for the eye care space’s high-deal activity is an aging American population’s need for eye care, so even though demand remains, it’s hard not to wonder if the high-deal volume is over.

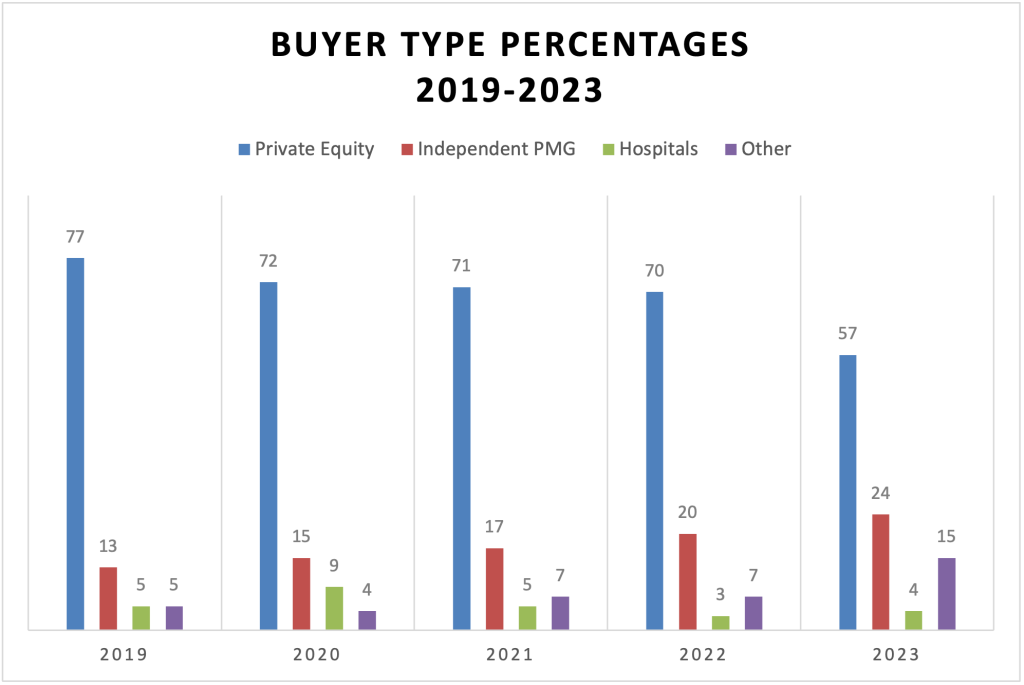

In 2023, 274 PMG acquisitions were completed by private equity groups and/or their portfolio companies, representing roughly 57% of PMG transactions. This is a 41% decrease from 2022 when 407 out of 579 deals were completed by PE groups, or 70%. In 2021, 329 out of 464 acquisitions were completed by PE firms, which accounts for 71% of the PMG deals of the year. This trend of private equity firms completing approximately 70% of the PMG deals continued from 2020, where 138 out of 193 transactions were PE-backed at 72%. Private equity groups such as Chicago Pacific Founders and Webster Equity Partners accounted for much of the activity,

The percentage of deals completed by independently owned PMG groups has steadily increased since 2019. This rise in independent groups purchasing other physician groups is possibly due to a waning PE interest and consolidation taking a toll on the market. In 2019, independently owned PMG groups accounted for 13% of activity; in 2020, it rose to 15%; in 2021, the percentage increased to 17%; and in 2022, it accounted for 20%. The biggest jump in percentage happened in the first 11 months of 2023 which saw 24% of acquisitions being completed by independent PMG groups.

In 2023, hospitals accounted for a small percentage of buyers, with 20 transactions completed by them, or 4%. This is a slight increase from 2022 when approximately 3% of PMG transactions were done by hospitals.

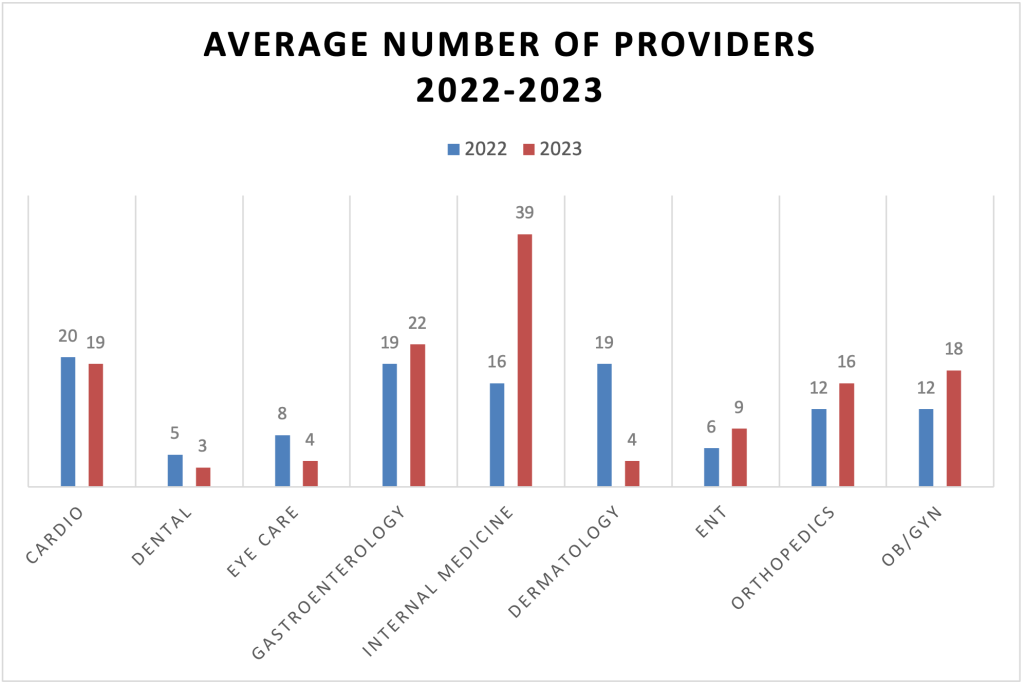

For a statistic that we don’t often examine, we looked at how the size of the acquired practices (the average number of physicians are on staff) has changed over time and how it differs between specialties. However, it should be noted that data going back past mid-2021 is limited, so the data may be skewed, and we were prevented from going back further.

Initially, we predicted that across the board the sizes of the practices would be dwindling down over the last year, but it doesn’t look like that is the case across the board.

Internal medicine, on average, had the most physicians on staff at each practice, averaging 79 in 2022 and 198 in 2023. Yet, this is a skewed statistic as there were two transactions with outliers in provider numbers. In 2023, Independent Physician Association of New York, which was purchased by Vytalize Health, has more than 3,000 providers and Seoul Medical Group, acquired by Ascend Capital Partners, has a network of more than 2,000 providers. In 2022, there were three transactions with more than 500 providers on staff, increasing the average. Without those transactions, internal medicine averages 39 physicians per practice in 2023 and 16 in 2022.

We found that in 2022 and 2023, dental practices that were acquired averaged five and three physicians, respectively. Dental is also the most likely to have smaller practices, with less than five providers. Out of the 144 dental transactions announced in 2023, only nine of them were practices with more than five physicians on staff. But that can be due, at least in part, because there were simply that many more dental transactions than other specialties. Interestingly, all those transactions were completed by private equity groups and averaged 17 providers.

Cardiology also had a higher range of average number of physicians. In 2022, the provider number averaged 16 physicians across 16 transactions. In 2023 the average was 19 across 26 deals, and out of those 26 deals, 18 of them were practices with more than five physicians. The cardiology sector seems to see more transactions with a higher provider number as nearly 70% of the deals in 2023 were done with practices with more than five physicians.

We spoke with Dana Jacoby, President and CEO of Vector Medical Group, about the market. On why many of the transactions were targeting practices of a smaller size, she had this to say:

“Over the past couple of years, we have seen a lot of smaller practices transacting. Many of these were bolt on additions to larger groups. Also, many of the larger groups (platforms) have either already transacted or have tried to maintain independence, despite ongoing changes to market conditions. Diligence takes longer in larger groups, so [the market is] seeing the effect of a longer sales cycle for the larger practices coupled with numerous bolt on medical practice opportunities.”

Continuing, she addressed why, when the chips are down, physicians at smaller practices are more willing to sell their business. “Smaller practices are more susceptible to reimbursement degradation, plus they don’t have the opportunity to build or rely on ancillary revenue streams such as ambulatory surgery centers. They also have less sub-specialization and less dominance than larger groups, so they are more vulnerable to the reimbursement and payor shifts in their respective markets.”

While we anticipated seeing only small practices being bought and sold, it was great to see larger practices are still in the M&A game. The PMG market has experienced notable shifts in trends in 2023, reflecting the dynamic landscape of the industry. Despite a slowdown in deal volume, the PMG market is still a major player in the healthcare space.