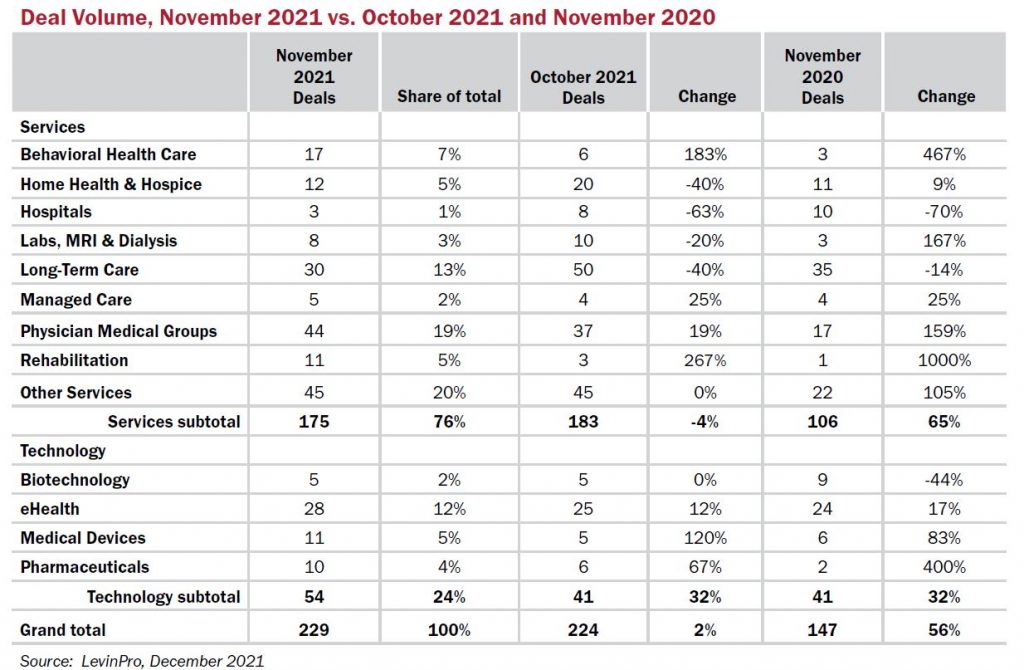

The penultimate month of 2021 did not disappoint. There were 229 deals announced in November. It’s a mere five deals more than what dealmakers announced or closed in October, but the fourth quarter is shaping up to be a historic era of activity. Most of the deal activity remains focused on the lower market, highlighting the fragmentation of the market, meaning there are plenty of targets left for equity buyers and strategic investors.

Aside just from a natural cooling off of the market, the only major headwind on the way is the Omicron variant, which has already hit the United States. Its been rattling public markets; Moderna and Pfizer are quickly pivoting to develop Omicron-specific vaccines, and the White House is already limiting international travel from countries where the variant has been detected. The market thrived this year despite the Delta variant, but it seems the Omicron variant is more of an unknown at the moment.

Back to the good news. The Physician Medical Group sector continues to be one of the major sectors driving activity this year, with 44 deals on the books in November, beating the 37 announcements from the previous month. Private equity buyers and their sponsored companies remain the primary drivers in the market, reporting add-on acquisitions almost on a daily basis. Dental and eyecare especially remain attractive targets for private equity because those services are still primarily private pay, as opposed to Medicaid or Medicare, meaning higher payment rates.

Plus, after a rough year in the pandemic, plenty of small physician practices are looking for a way to manage an increasingly complicated healthcare industry, and private equity-backed management services organizations (MSO) have been there to meet that demand. Nearly all physician deals take the form of a partnership with an MSO, and that trend looks like it will continue for some time. It’s a perfect storm, really.

And a note on the Other Services sector, which reported 45 deals last month, the most of any sector. It’s a diverse pile of targets and industries, but most of the deal activity belongs to healthcare real estate transactions, such as medical office buildings or ambulatory surgery centers.

In one deal, Tenet Healthcare Corporation (NYSE: THC), along with its subsidiary United Surgical Partners International, acquired SurgCenter Development (SCD) for $1.2 billion. SCD partners with local surgeons to create physician-owned and physician-operated ambulatory surgical centers.

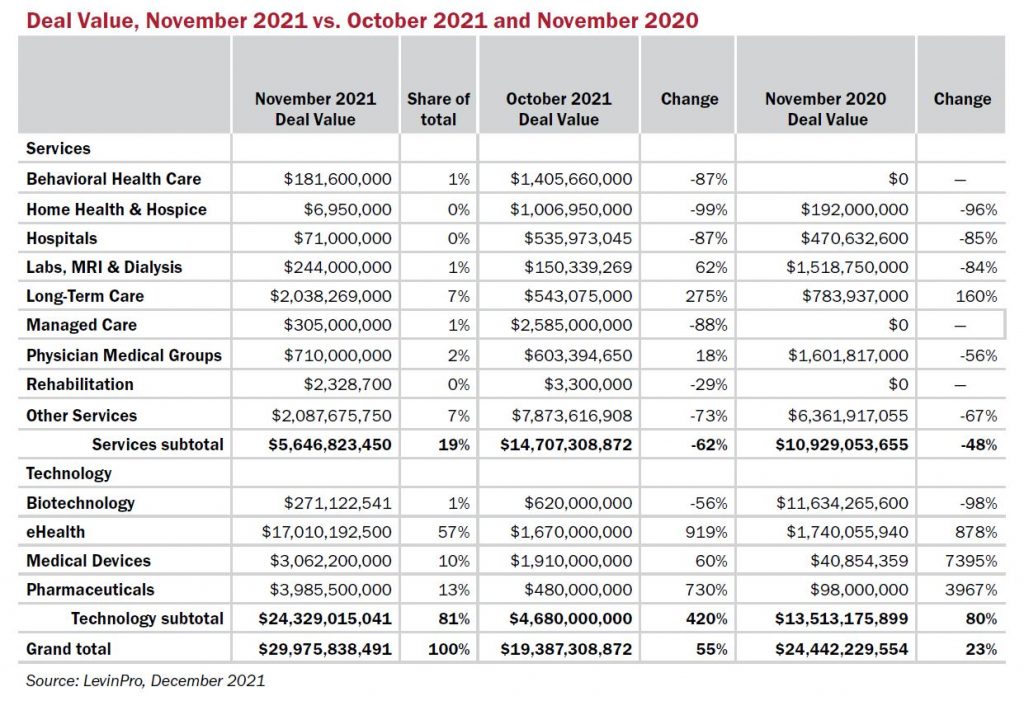

Announced deal spending, however, has been on the lighter side lately, hitting just short of $30 billion in November. It is a 55% increase over announced spending in October, but spending felt healthier across the sectors. November felt top-heavy; the acquisition of anthenahealth, Inc. by affiliates of Hellman & Friedman and Bain Capital for $17 billion made up a significant chunk of the spending. Some large portfolio deals in Long-Term Care also boosted spending totals.

December, historically, is usually an incredibly busy month for dealmaking as brokers and advisors look to close deals before the end of the year. But even if December had zero deal announcements, 2021 will still be the busiest year on record for healthcare M&A. We expect more than zero deals, obviously, but either way, it’s safe to say 2021 has been a successful year for the industry.