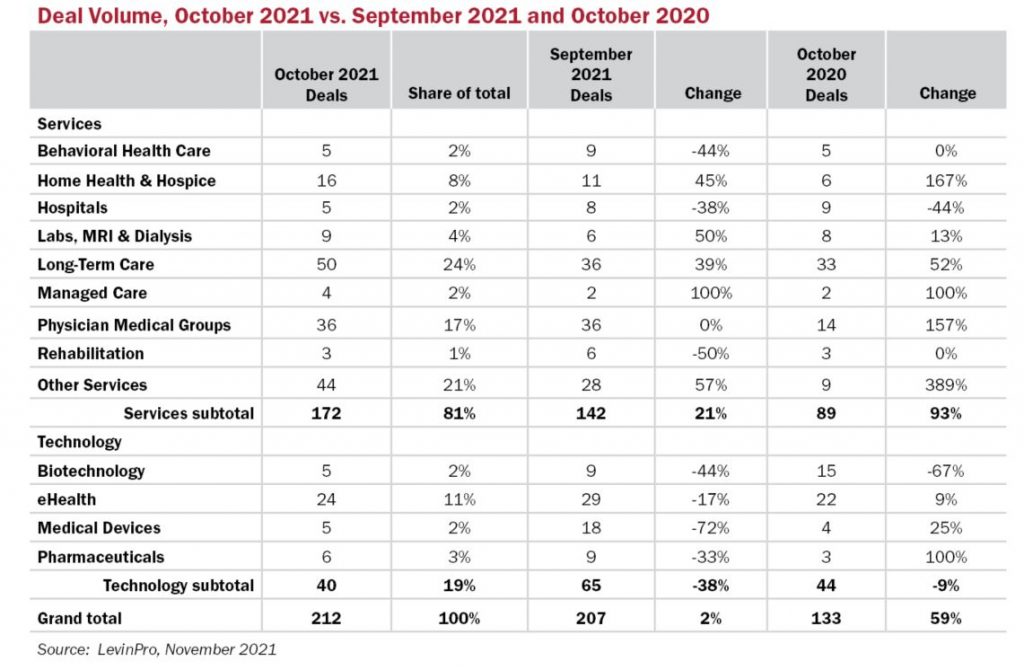

Here we are again. Activity in October hit 212 deals, a slight uptick compared with 207 deals announced in September, but more than 50% higher compared with October 2020. It’s an all-time record for a single month, at least for now. Some activity last month can be attributed to the typical fourth quarter surge, but fear of a capital gains tax increase and plenty of tailwinds across sectors are really pushing dealmakers to close.

The chart below shows the bulk of the deal activity is concentrated in a few sectors: Physician Medical Groups, eHealth, Long-Term Care and Other Services. It has been this way for most of the year, and we don’t expect it to change in the fourth quarter.

The Physician Medical Group sector is experiencing a boom for a variety of reasons (as explored in our lead story this month), but we will offer a key factor driving deal activity. After a rough year in the pandemic, plenty of small physician practices are looking for a way to manage an increasingly complicated healthcare industry, and private equity-backed management services organizations (MSO) have been there to meet that demand. Nearly all physician deals take the form of a partnership with an MSO, and that trend looks like it will continue for some time.

eHealth activity seems to have leveled out after a big surge earlier in the year. Instead of telehealth, most deal activity seems focused on healthcare analytics. The Carlyle Group (NASDAQ: CG) acquired Saama Technologies, Inc., an AI-driven intelligent clinical cloud company, for $430 million. Healthcare-focused analytic solutions support industry initiatives such as affordable care and population health management, which will be an emerging demand as more and more areas of health care move to value-based care management

And a note on the Other Services sector. It’s a diverse pile of targets and industries, but most of the deal activity belongs to healthcare real estate transactions, such as medical office buildings or ambulatory surgery centers. These deals accounted for 50% of the transactions in the sector and nearly $1 billion in transaction value. The largest of those deals was announced by Physicians Realty Trust (NYSE: DOC), a self-managed healthcare real estate company, which purchased a portfolio of 15 Class-A medical office buildings located in eight states, comprising approximately 1,460,000 square feet, for $764 million.

Spending in October, however, was much lower compared with September, 60% lower to be exact at $17.7 billion. It was even 44% lower than the total transaction value announced in October 2020. The difference in transaction value can be attributed to a lack of high-value deal announcements in October, rather than anything worth raising a red flag over. The largest deal in September, for instance, was Baxter International Inc.’s $12.4 billion acquisition of Hill-Rom Holdings, Inc. The largest deal in October was Walgreens Boots Alliance, Inc.’s $5.2 billion investment into VillageMD. There’s a $7 billion difference right there.

But with two months left in the quarter, we think the activity is only going to accelerate. This acceleration happened last year as we made the turn out of the pandemic, and it’s only natural that dealmakers end 2021 in an even bigger fashion.