For the past two years, the healthcare M&A market has seen a surge of deals involving SPACs, or special purpose acquisition companies created solely as a vehicle for emerging companies to go public. These deals, called a de-SPAC transaction, seem to be surfacing once a week in the healthcare market, a trend not unique to this industry either. Here’s how they start: a sponsor company or investor, sometimes a private equity firm or investment firm, creates a public shell company and then raises funds and capital, called a private investment in public equity, or PIPE, under the idea that it will use those funds to find a target private company. Investors can buy into the PIPE at a low share price, usually $10 (give or take) as we’ve seen in healthcare de-SPAC deals, and then get the right to purchase future shares at the same initial price (called a warrant).

Since early 2019, there have been 45 de-SPAC transactions announced in healthcare, with a total value of $102.3 billion. As you might expect, most of these deals target a company in Biotechnology (15 deals) or eHealth (10), since those companies can be scaled up quickly without the regulatory hurdles a healthcare services provider might have, whether at the state or federal level. That’s not to say SPACs haven’t targeted those types of companies. Last quarter, The Oncology Institute of Hope and Innovation, a physician group, merged with DFP Healthcare Acquisitions Corp. (NASDAQ: DFPH), a special purpose acquisition company sponsored by an affiliate of Deerfield Management Company, L.P., in an $842 million de-SPAC deal, and ATI Physical Therapy did the same in February with Fortress Value Acquisition Corp. II (NYSE: FAII) in a $2.5 billion deal.

In fact, in mid-July, the largest de-SPAC transaction in healthcare was announced. MSP Recovery, LLC, a Medicare, Medicaid, commercial and secondary payer reimbursement recovery provider, merged with Lionheart Acquisition Corp. II (NASDAQ: LCAP). The transaction valued MSP at $32.6 billion, which will become a publicly traded company on the NASDAQ.

The rise in de-SPAC deals can be attributed to a few factors. First, in a volatile market, especially during 2020 when the COVID-19 outbreak pummeled the markets and public health, there are fewer unknown factors for founders who want to go public. “There’s more deal certainty, pricing is discovered sooner, and you have a long-term investment partner in the form of a SPAC sponsor,” said Jay Knight, Member and Head of Bass, Berry & Sims’ Capital Markets Subgroup. “You effectively do the roadshow before the transaction is announced.”

On its surface, de-SPAC transactions seem like a sweet deal. Private companies get to dodge the IPO process while getting an influx of cash from the PIPE and the balance sheet of the SPAC, which can be used for further M&A, product development, or other opportunities.

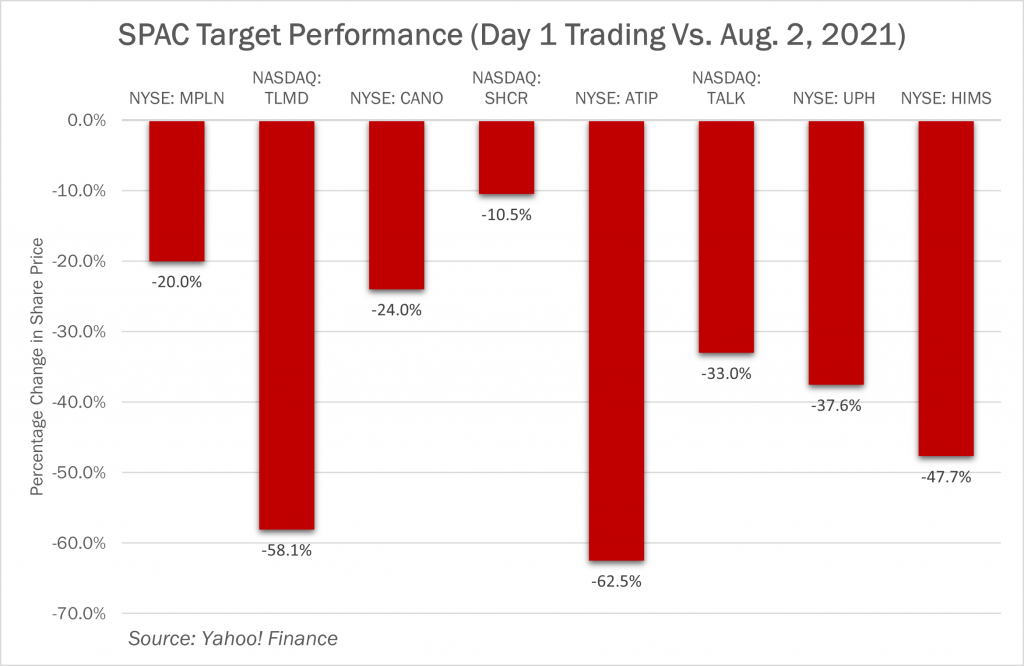

However, it seems that despite the high hopes of these companies once they hit the market in a de-SPAC transaction, share and financial performance is no guarantee. As you can see in the chart below, de-SPAC target companies in the eHealth, Other Services and Rehabilitation sectors have suffered severe losses in value. Multiplan, Inc. (NYSE: MPLN), which started trading on October 8, 2020 at $9.84 per share, hit $6.27 six months later, and as of August 2, sits currently at $7.87. Soc Telemed Inc (NASDAQ: TLMD) hit the market in late January at $10.50, and as of August 2, it has plummeted to $4.40. ATI Physical Therapy (NYSE: ATIP) began trading this past June at $10 a share. That stock price is now at $3.75 as of August 2. Many of these companies are also facing litigation from shareholders for security violations. Outside investors feel they were misled during the de-SPAC transaction, especially regarding the target company’s financial projections.

These drops in share prices highlight one of the real risks of a de-SPAC, especially those for the outside investor. Because it’s not a traditional IPO, SEC regulations aren’t as strict and have much more leverage about what they disclose in a deal announcement. For instance, SPAC announcements have the safeguards of forward-looking statements, whereas IPOs do not.

“Whenever investing in a SPAC, really look for what the SPAC discloses, any conflicts of interest in the target they’re looking to merge with. Inside investors and sponsors sometimes gain a lot more in these deals than outside investors, and that can cause real problems,” said Shayne R. Clinton, Member at Bass, Berry & Sims. “And when the SPAC and target announce their merger and include financial projections, they should be able to justify why they only shared certain forecasts and not lower (base) cases of any projections.”

Other headwinds may sour SPACs for some investors. For a target company, a downside of partnering with a SPAC is that the leadership might have to give up their position to the SPAC sponsor, which might have them turn toward a private equity buyer for an injection of capital or go down the traditional IPO route to retain more control.

Despite these risks, Mr. Clinton and Mr. Knight don’t expect the trend of de-SPAC transactions to slow down any time soon. “There’s a lot of liquidity in the market and investors want to do something with it,” Mr. Knight said. “The SPAC transaction isn’t going away anytime soon as there are still over 400 SPACs looking for a target. Moreover, the SPAC structure will likely continue to evolve over time as investors, sponsors and targets learn what works and what doesn’t work. While the froth may be coming off the SPAC market somewhat, that may ultimately be a good thing if the markets stabilize and what is left is another long-term viable path for companies to access the public markets.”

With high valuations, a speedy process, and a lucrative PIPE to scale up a company, it’s no wonder emerging companies are partnering with SPACs. The risks for outside investors might be hard to ignore on the other hand, and it could be worth waiting for the process to evolve and mature. If those share prices rise, that would help ease investors’ worries. But until then, proceed with caution.