Like most other healthcare sectors, the Physician Medical Group market was hit hard when the coronavirus pandemic arrived in March 2020. Deal activity across the board came to a sudden halt in mid-March, except for deals that were far along in the sales process. Everyone from buyers to bankers sat back to assess what was going on as whole regions of the country went into social and economic lockdown until May.

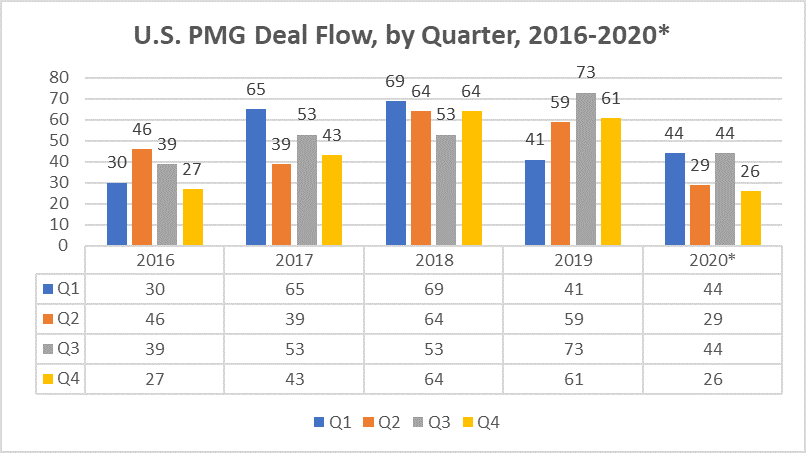

Months later, things don’t look as bad as they could have. Deal flow across all healthcare sectors through the end of November 2020 was down 18% compared with the same period in 2019 (1,374 deals vs. 1,667, respectively). The second and third quarters bore the brunt of the panic, with total healthcare transactions down 30% and 21% year over year, respectively. With one month (December) left to go in 2020, the fourth quarter may still post a decline versus 2019. Comparing deal volume from October and November in each year, 2020’s unfinished fourth quarter lags 2019’s by 17%.

If the entire healthcare market has sustained such a blow from Covid-19, what’s happened to the Physician Medical Group sector? Many specialty physicians are still on the front lines fighting the disease that infected more than 13 million people and killed more than 266,000 in the United States as of November 30.

The prognosis for the sector is looking very strong, according to deal makers in the space. The numbers may not look healthy yet (see chart above), but the election is over, even if the year is not. Democrat Joseph Biden Jr.’s presidency carries the threat of increasing, if not doubling, the capital gains tax in 2021. That had a lot of potential sellers ready to take a chance and hit the market before the end of the year.

Even with the Biden victory, control of the Senate won’t be determined until two run-off elections are held in Georgia on January 5, 2021. Investors are more optimistic that the administration won’t be as proactive on tax increases if the Senate stays under Republican control.

“We’re surprisingly busy,” said Andrew Colbert, Senior Managing Director at Ziegler, adding, “There was a lot of anxiety around a capital gains tax change. A divided Congress takes the impetus off doing deals toward the end of the year.”

Angela Humphreys, Chair, Healthcare Practice Group at Bass, Berry & Sims, said her firm has been busy with physician practice deals since May. “Private equity investors are continuing to make deals, and not just add-ons. We’re seeing new platforms” being created.

“It’s busier than usual. In the last 30 days, we had three physician deals close and four to five deals in the next 30 days,” said Eric Major, director at Provident Healthcare Partners. The activity is due partly to some relief from the threat of tax increases, but also reflects the pent-up demand, especially among private equity firms, to put money to work. Through the end of November, 15 private equity firms announced 17 deals for U.S. physician practices and 44 portfolio companies in the Physician Medical Group sector announced 74 deals.

What’s Hot, What’s Not

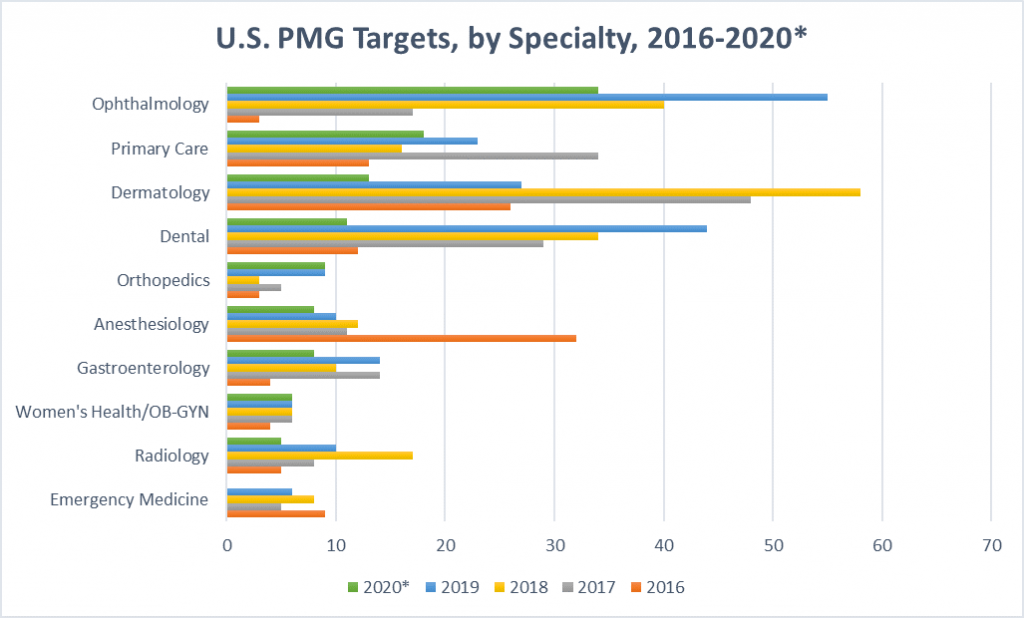

Over the last several years, three specialties have been highly sought after: dental, dermatology and ophthalmology. The pandemic has changed some dynamics, at least temporarily. (See chart above). First, there were lockdowns across several states, then personal protective equipment (PPE) became mandatory for practices that couldn’t rely on telehealth services to continue seeing patients.

Dermatology is one specialty that remains hard hit, and dental practices are still struggling, our sources told us. Dermatology practices that are more focused on cosmetic procedures are faring worse than those treating skin cancer and other serious conditions.

Dental practices are struggling with PPE expenses and far lower patient loads than they were used to, pre-Covid. Ophthalmology practices have rebounded, thanks to the continuing demand for cataract surgery. Multiples are mostly back to pre-Covid levels although deal terms have changed in some instances. Our sources report less cash is going into the closings and more equity is being rolled into the deal. Earn-outs are back, as well.

Want to hear more about the outlook for the Physician Medical Group sector in 2021? Bring your questions for our panelists and join us for an interactive discussion on December 10, 1 pm ET. To register, visit LevinAssociates.com. See you there.