Things felt tough in the third quarter. According to the Centers for Disease Control, the United States passed 7 million cases of COVID-19, with over 200,000 confirmed deaths, or 20% of the deaths caused by the pandemic worldwide. The 2020 presidential election kicked into full swing, but no one seems thrilled by reports coming out of the race. The healthcare M&A market, however, showed promise.

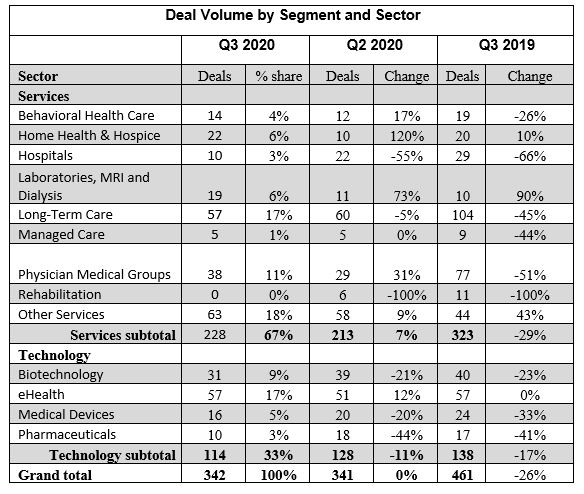

According to results in our HealthCareMandA.com Deal Database, deal volume in Q3:20 remained flat compared with Q2:20; stabilization is a welcome change after months of decline. In Q3:20, there were 342 transactions announced, compared with 341 deals in Q2:20 and 461 in Q3:19.

Healthcare M&A in the services sectors saw an uptick in activity, rising 7% to 228 deals compared with Q2:20. Deal activity in several sectors, such as Behavioral Health Care, Physician Medical Groups and Laboratories, MRI & Dialysis, all jumped by double digits compared with the previous quarter. Home Health & Hospice saw a triple-digit increase (22 deals). Hospital transactions declined, dropping 55% compared with Q2:20. No doubt the uptick in COVID-19 cases in the Southeast and Southwest of the U.S. played a huge role in that.

Activity in the technology sectors declined by 11% in Q3:20 compared with Q2:20. The only sector that saw an increase in deal activity was the eHealth sector, rising 12% to 57 deals. Activity in eHealth even matched that of Q3:19, highlighting the continued demand for digital health targets.

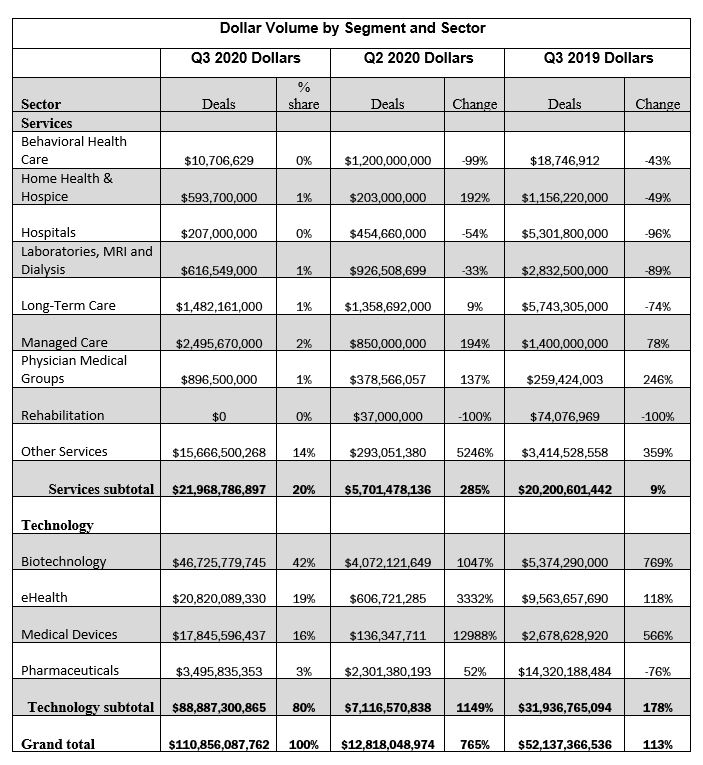

But spending skyrocketed this quarter, shooting up 765% compared with Q2:20 and 113% compared with Q2:19. The year’s largest deals, including Gilead Sciences, Inc.’s (NASDAQ: GILD) acquisition of Immunomedics (NASDAQ: IMMU) for $21 billion, and the $18.5 billion merger of Teladoc Health (NYSE: TDOC) and Livongo Health, Inc. (NASDAQ: LVGO), were all announced in the third quarter. Combined spending reached $110.8 billion in Q3:20, a high point for 2020.