Bain & Company‘s recent Global Private Equity Report 2020 highlighted some slowdowns in investments across the board, writing that global buyouts from private equity (PE) firms dropped to 13% of M&A deal value in 2019, compared with 15% in the previous two years.

A survey cited in the report stated that 57% of PE fund general partners interviewed think the economy has reached a cyclical peak, while 14% think it has already entered a recession. However, in the healthcare services industry, PE firms and their portfolio companies are more bullish, confident against signs of a recession and chatter about “Medicare for All” in the Democratic presidential primaries.

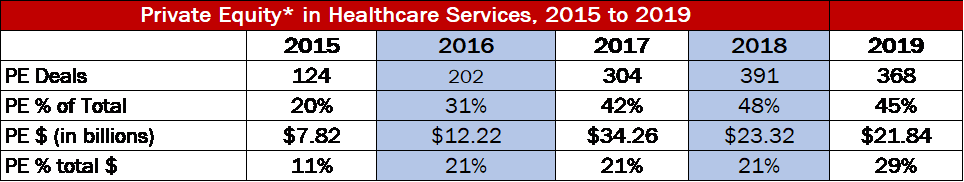

Source: HealthCareMandA.com, February 2020

According to data from our Deal Search Online database, PE firms and their portfolio companies accounted for 45% of healthcare services deals, a slight decrease from 2018’s total of 48%. Spending was up. PE firms accounted for 29% of disclosed spending, with an average revenue multiple of 3.0x and EBITDA of 12.0x. Considering 2018 was a record year across the board, the consistency in activity into 2019 is impressive.

It also varied by sector. PE activity made up only 7% in the Hospitals sector but dominated other sectors such as Behavioral Health Care. Roughly 68% of the deals in Behavioral Health sector had a PE buyer, with a major focus on substance abuse treatment providers and autism treatment providers.

However, PE firms swarmed the Physician Medical Group sector, accounting for 75% of all transactions, with a particular interest in ophthalmology, dental, and dermatology practices. West Street Capital Partners VII, Goldman Sachs‘ private equity arm, reported the largest transaction in this sector among PE buyers, spending $2.7 billion for Capital Vision Services LP, including debt. We wrote about the deal when it was announced back in June 2019, and it shows the incredible attention ophthalmology groups are drawing.

More information on other sectors and PE activity, including exclusive trend analysis on M&A in hospitals, behavioral health care companies, home health & hospice agencies, physician medical groups, rehabilitation, labs/MRI/dialysis centers and more, can be found in the upcoming 2020 Health Care Services Acquisition Report.

Trackbacks/Pingbacks