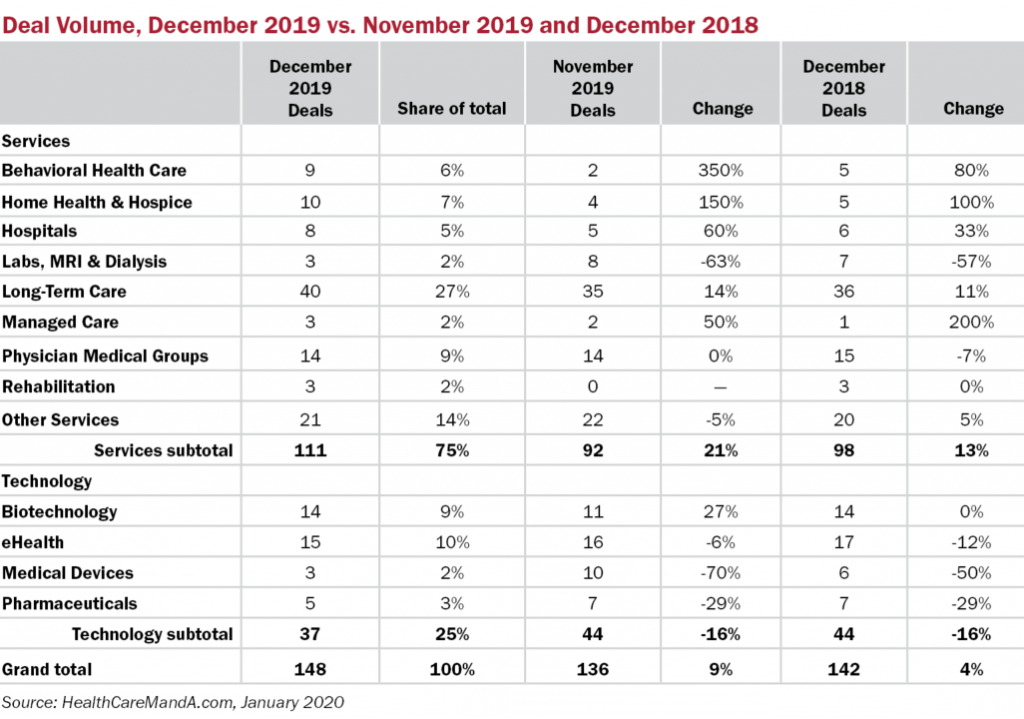

December’s deal volume proved to be a fitting end to a busy year. With 148 deals already reported, the last month of the year easily topped November’s total of 136 (+9%) and even December 2018’s 142 deals (+4%). Deal makers were in a rush to close transactions by the end of the year, obviously.

The services sectors benefited the most from this holiday rush, accounting for an unusually high 75% of December’s volume. By contrast, the services side contributed 68% of November’s deal volume and 69% of December 2018’s total. The average share is around 63% over the course of a year

A few of the services sectors posted strong gains, year over year. Home Health & Hospice gained 100%, albeit on an increase of five deals. Even with all the noise surrounding the Patient-Driven Groupings Model start on January 1, half of the deals announced in this sector in December targeted exclusively home health care providers and only two were exclusively hospice providers, the latter being a safer bet in some investors’ minds because hospice reimbursement is not under CMS’ scrutiny. For the moment.

The Behavioral Health Care sector posted an 80% gain, year over year, as autism services and addiction programs took center stage. And yes, the Managed Care sector was up 200% in the same timeframe, but a rise to three deals from a single one in 2018 isn’t cause for tremendous celebration. The same holds true for the decline in deal volume in the Labs, MRI & Dialysis sector, which dropped 57% compared with a year ago.

One small decrease is worth mentioning, however. The Physician Medical Group sector was down by just one deal compared with a year earlier, resulting in a 7% slip. This may be the start of something bigger, at least for some physician specialties such as emergency medicine, hospitalists, anesthesiologists and others whose revenues could be adversely affected by the passage of the “surprise medical bill” legislation that is currently stalled in the Senate (along with hundreds of other bills). Jim Jenkins, Jr., a member of Bass, Berry & Sims, told us late last year that the legislation could lead to a dramatic shift in the balance of power between payors and providers, such that keeping physicians in-network could guarantee more reimbursement revenue. Of course, the dental, dermatology and ophthalmology platforms will continue to grow, unhindered.

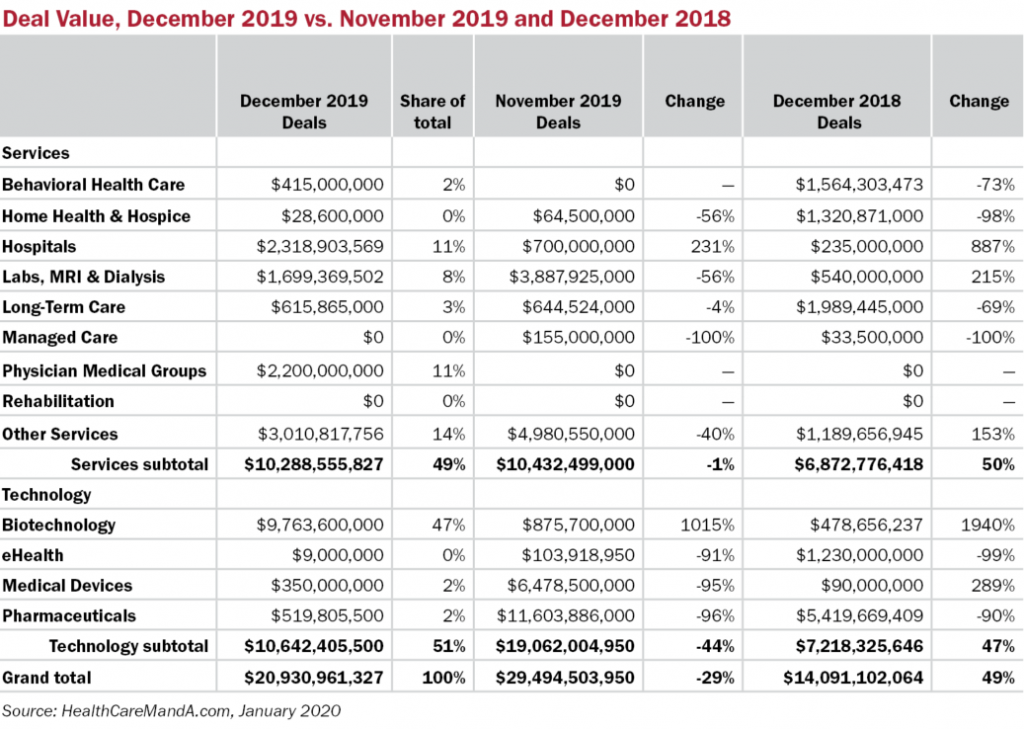

Monthly spending didn’t disappoint, landing at $20.9 billion. Even though deal volume was down across all the technology sectors, year over year, four of the 10 largest deals by disclosed price came from the Biotechnology sector. The biggest deal in December came in at $3.0 billion, as Japanese drug maker Astellas Pharma (TSE: 4503) acquired Audentes Therapeutics (NASDAQ: BOLD), a genetic medicines company focused on rare neuromuscular diseases.

As the new year begins, the same factors are affecting the healthcare market. Interest rates are still low and probably not rising soon, capital is still cheap and available, and health care is still very fragmented. It’s tempting fate to ask, “What could go wrong?”, right?