Spending in the first quarter roared to nearly $150 billion, up 240% compared with the fourth quarter ($43.9 billion) and up 32% compared with the first quarter in 2018 ($113.4 billion).

This quarter’s total would be halved if it weren’t for a single deal with a $74 billion price tag, Bristol-Myers Squibb’s (NYSE: BMY) acquisition of Celgene Corporation (NASDAQ: CELG). Two other deals added to the outsized total, Danaher Corporation’s (NYSE: DHR) $21.4 billion acquisition of GE Healthcare’s (NYSE: GE) Biopharma business and Centene Corporation’s (NYSE: CNC) $17.4 billion buyout of smaller health insurance rival WellCare Health Plans (NYSE: WCG).

Those three deals made up 76% of the quarter’s spending. Without them, the combined total would be far lower, just $35.4 billion, and more in line with the performances turned in in the last two quarters of 2018 ($31.1 billion and $43.9 billion, respectively).

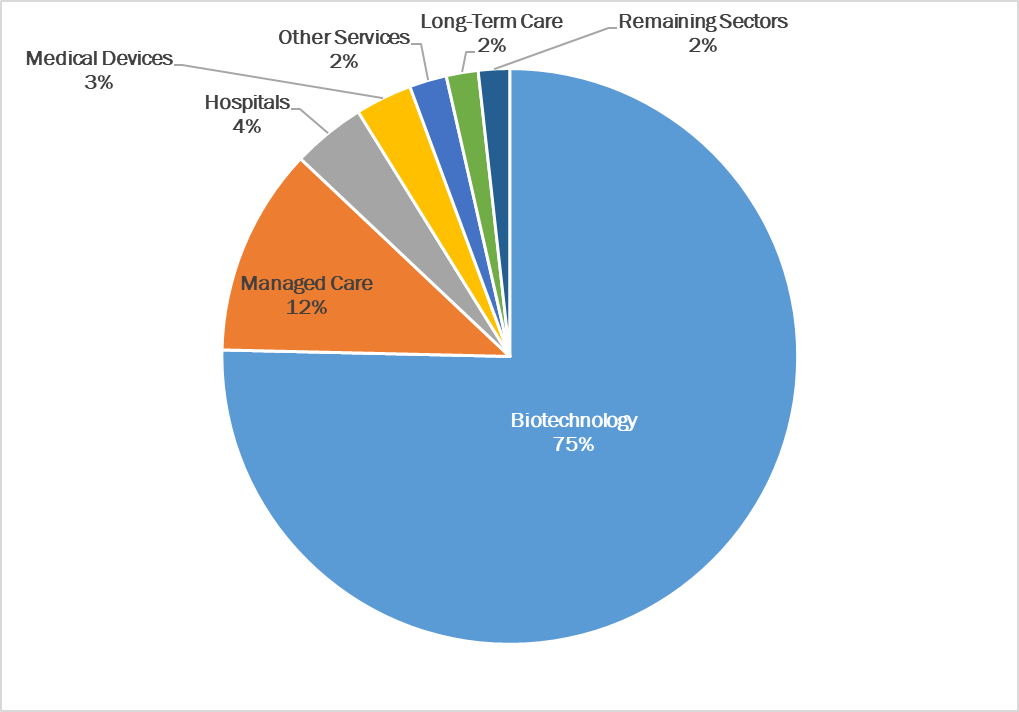

A total of $149.2 billion was spent to fund the 374 transactions reported in Q1:19, based on disclosed prices. The Biotechnology sector dominated the dollar side of deal making, accounting for 75% ($112.4 billion) of the total. Five of the top 10 transactions in this quarter came from the Biotechnology sector and had a combined total of 109 billion.

The Managed Care sector led the rest of the services side with 12% ($17.4 billion) of spending in the first quarter. The Long-Term Care sector, which sometimes dominates quarterly spending, saw myriad smaller deals. The largest price disclosed in the sector was $898 million.

Dollar Volume by Share in Q1:19

Source: HealthCareMandA.com, April 2019

Source: HealthCareMandA.com, April 2019