July’s deal volume beat the totals posted in July 2017, but didn’t quite match those posted the previous month. The healthcare merger & acquisition market is still going strong, in other words. Not too hot, no sign of getting cold.

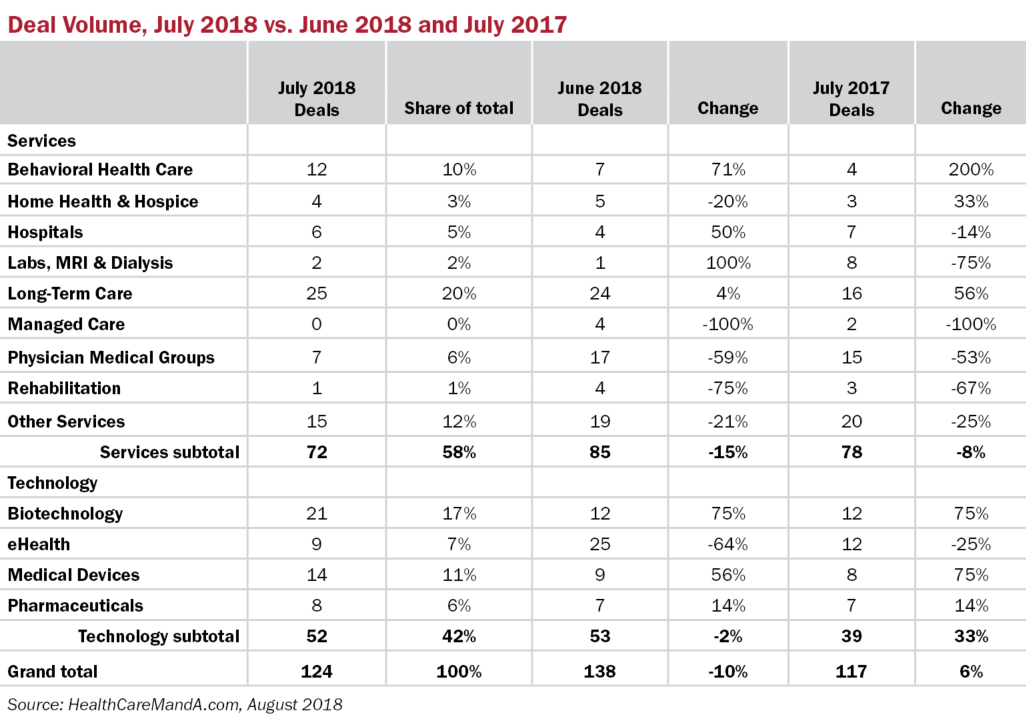

Preliminary deal volume in July reached 124 transactions, a 10% loss compared with June’s busy 138 transactions but 6% better than the same month in 2017. The services sectors accounted for 58% of the month’s total, but percentage was actually lower than in June, when services made up 62% of the total, and in July 2017, when services made up 67% of the month’s volume.

Some sectors that out-performed both the previous month and the year-over-year period were Behavioral Health Care, Long-Term Care, Biotechnology and Medical Devices.

Spending, which isn’t a good measure of anything to do with the healthcare market, was comfortably comparable with the year-ago period. With prices not reported in four of the 13 sectors, July 2018 still ended with $10.0 billion in combined spending. That’s 11% higher than in July 2017, when the total reached $9.0 billion.

June 2018 was an out-sized month for dollar volume, coming in at $27.0 billion. The services sectors alone totalled some $12.0 billion, higher than the totals in July 2018 and 2017.

Here’s looking at August, which has gotten off to a rather slow start, dollar-wise, but is sizzling with reported deals. Catch you on the flip side.