Yes, the B-word is being bandied about among deal makers these days. Talk of a bubble, particularly in healthcare services, is becoming more open. We heard it often at a recent breakfast meeting of healthcare investors, and again and again in conversations since.

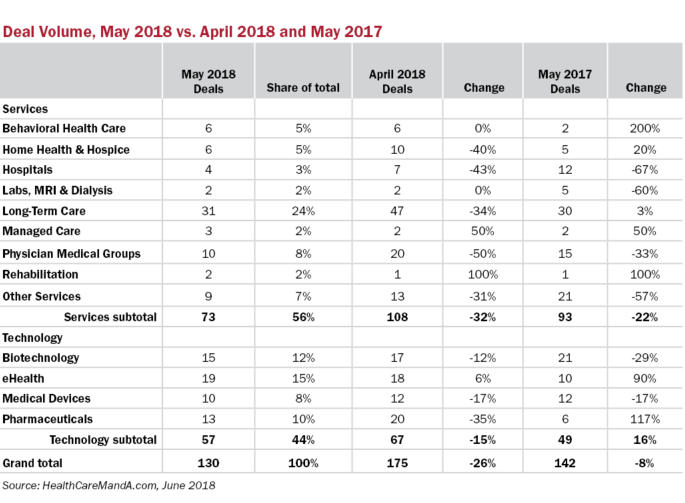

In May, some 130 transactions were made public, representing a 26% decline compared with April’s out-sized 175 transactions, and 8% below the 142 deals recorded in May 2017. Deals in the services sectors accounted for 56% of the month’s total, which is much lower than their share in April (62%) and the same month a year earlier (65%). It’s not just that the technology sectors are picking up some steam after a long drought, although they are. Deal volume in the services sectors last month was far lower than in April and last May.

Still, some sectors are doing better than others. Right now, Behavioral Health Care is seeing a surge in investor interest, thanks to the Affordable Care Act, parity laws and broader public awareness of opioid addiction, mental health issues and autism. Companies focused on autism and opioid treatment programs in particular are going for 17x, 18x, and even 19x trailing EBITDA more often now, according to one source.

Home Health & Hospice is seeing more interest, as the move to lower cost-of-care venues outside of skilled nursing facilities and rehabilitation centers draws more investors. Multiples there are not as frothy, with the higher range around 10x EBITDA and more often in the 7x to 8x range, we hear. For Medicaid-based home health businesses, which traded around 4x to 5x EBITDA about five years ago, buyers are paying closer to 8x to 9x. The lament that “I can’t make money paying 10x” may eventually weigh on deal making activity in this sector too.

That hasn’t stopped some large firms from getting in on the action, because they have a lot of capital to deploy. Over-bidding is necessary to get into these markets, and it’s the cost of doing business these days.

Looking at the level of deal value posted in May, the $88.6 billion total is the result of a single mega-deal. Takeda Pharmaceutical (OTCQB: TKPYY) announced it will acquire Shire plc (NASDAQ: SHPG) for $81.5 billion, including assumed debt of $19.54 billion. That deal alone makes up 92% of the month’s spending. It also takes the “biggest healthcare deal” record from Pfizer (NYSE: PFE), which bought Wyeth, Inc. for approximately $78.5 billion, including $10.5 billion of assumed debt, in January 2009.

Without the Takeda/Shire deal, May 2018’s spending would only be around $7.1 billion, down 75% compared with the previous month and 77% below the total posted in May 2017.

The upshot of all of this? Buyers should be modeling in a contraction in multiples in a few years’ time, realizing this hot market is bound to cool off. The bubble doesn’t have to burst for multiples to come down, but the end may be near. According to some economists and private equity investors, the next downturn could be as close as 2020, or 2023. Be prepared. □