Boom! That was April 2018’s M&A results breaking the sound barrier. With 167 transactions, the monthly deal total (almost) blew away the record for deals in a single month. The current record is now January 2017, with 178 transactions. With time, as more deals come to light, April 2018 may be the new champion.

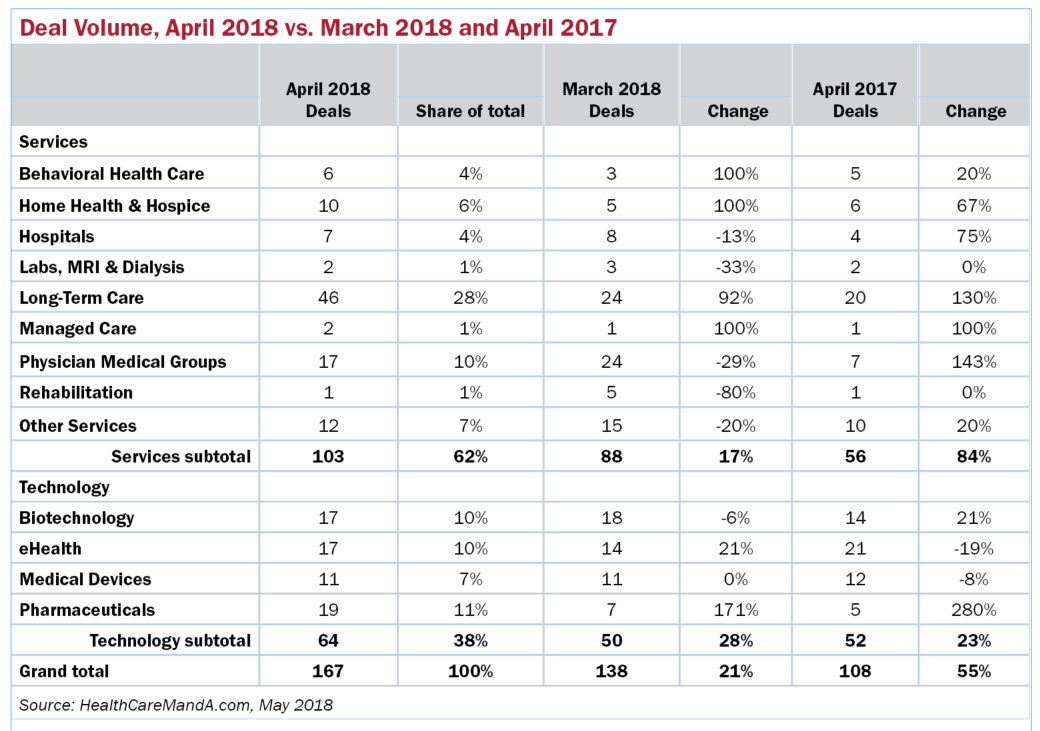

Deal volume was 21% higher than the 138 transactions reported in March 2018, and up 55% compared with April 2017’s 108 transactions.

The Long-Term Care sector was a major force behind the surge in deal volume. A record 46 deals were reported, representing a 92% increase over March’s anemic 24 deals, and a 130% gain over the 20 deals reported a year earlier. Included in that mix was the $4.0 billion acquisition of Quality Care Properties (NYSE: QCP) and its subsidiary, HCR ManorCare, by Welltower Inc. (NYSE: WELL) and ProMedica Health System.

Other sectors showing signs of life were Behavioral Health Care and Home Health & Hospice. Although their monthly totals are typically in the single digits, if not zero, both sectors doubled their deal volumes compared with the previous month.

The big deal in Behavioral Health Care was The Blackstone Group‘s (NYSE: BX) acquisition of The Center for Autism and Related Disorders (CARD). Even without a price, the deal is significant, because it brings Blackstone into the sector in a big way. Autism spectrum disorders and individuals with developmental difficulties are the latest “hot ticket” in this sector. CARD is no startup, either, with 194 centers and offices in 34 states.

The Home Health & Hospice sector had another big deal from the new Three Acquiring Amigos, Humana (NYSE: HUM), TPG Capital and Welsh, Carson, Anderson & Stowe. As an add-on to their surprise Decmeber 2017 acquisition of Kindred Healthcare (NYSE: KND), and its Kindred at Home division, the trio have agreed to buy Curo Health Services LLC, one of the largest hospice operators in the United States, for $1.4 billion from Thomas H. Lee Partners.

The Pharmaceutical sector is another bloomer. After nearly 18 months of low and slow deal making, the sector logged 19 transactions. That wouldn’t have been news back in 2014 or 2015, but today it makes for a 171 % rise over the previous month, and a 280% jump compared with April 2017.

Deal value was about average, although it’s never a good barometer of strength or weakness in the M&A market. April 2018’s current total is nearly $28.9 billion, which is 60% lower than the previous month’s $71.4 billion (thanks to the $67 billion Cigna/Express Scripts announcement), and 42% below the $49.9 billion total for April 2017.