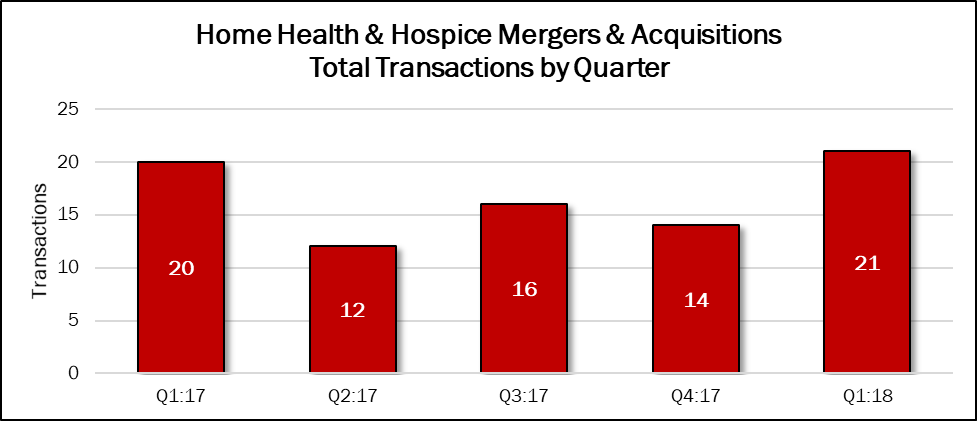

After three straight quarters of relatively low home health and hospice merger and acquisition activity, the first quarter of 2018 saw 21 publicly announced transactions. This was a 50% increase from the fourth quarter of 2017 (14 transactions), but just a 5% increase from the year-ago quarter (20 transactions), according to new data from HealthCareMandA.com.

Only three of the 21 transactions in this year’s first quarter disclosed a price, and the total was a small $46.1 million. This was similar to last year’s first quarter total of $20.9 million, but not comparable to last year’s fourth quarter when nearly $4.1 billion was announced encompassing just two acquisitions.

During the first quarter, only one company announced two transactions. Ohio-based Stonehenge Partners purchased two hospice companies in Ohio: Capital City Hospice in Columbus and Queen City Hospice in Cincinnati. About 62% of the quarter’s transactions were done by private companies, and only four were announced by publicly traded companies.

Addus HomeCare Corporation (NASDAQ: ADUS) announced the largest acquisition by price, the $40 million purchase of Ambercare Company, which had $57 million of revenues.

“Most transactions in the home health and hospice space are small, and typically do not come with disclosed prices,” stated Lisa Phillips, editor of The Health Care M&A Report, which publishes the data. “The number of transactions in the first quarter was the highest since the fourth quarter of 2016 (24 acquisitions), and it may be a sign that investment interest has returned after some regulatory headwinds diminished in the fourth quarter.”