2017 was a busy year for healthcare mergers and acquisitions, with 1,566 transactions announced. At this early date, that total is 2% below the previous year’s total of 1,593 (a record year, by the way).

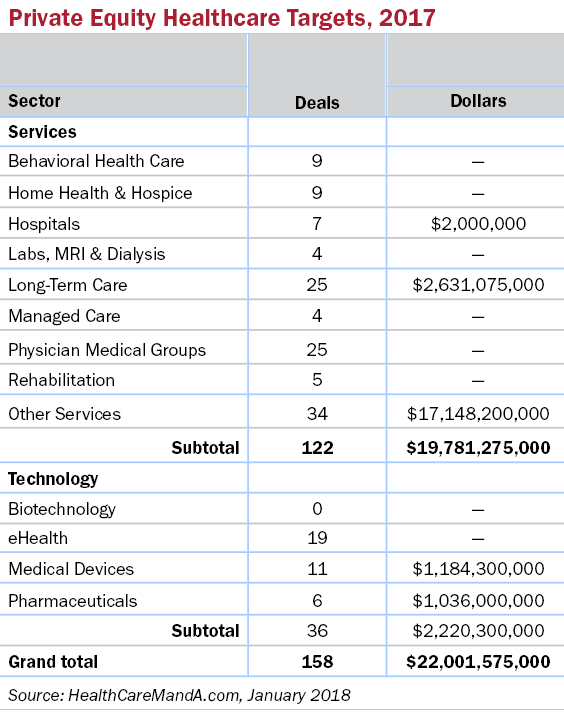

Private equity firms contributed to that total, announcing 158 transactions, or 10% of the annual total, according to data obtained from our DealSearchOnline.com database. That total is equal to the previous year’s 156 announced transactions.

Private equity firms typically don’t disclose financial terms when they announce transactions (if they announce them at all), so it’s interesting to see these firms did disclose some $22.0 billion on healthcare transactions in 2017. That total is about 7% of the $315.3 billion spent last year.

Deal volume is still the best way to measure interest, of course. In 2017, more than three-quarters (77%) of transactions targeted some type of healthcare services company. Long-Term Care and Physician Medical Groups were popular, and tied with 25 deals in each sector. However, the Other Services sector, which includes a wide range of ancillary segments, drew the most investment, with 34 deals and $17.1 billion.

Within the Other Services sector, dental practices and networks were the most popular with private equity investors (11 deals). Contract research organizations ranked second (nine deals), and medical staffing ranked third (five deals).

Contract research organizations (CROs) and their brethren, contract development and manufacturing organizations, continue to be popular targets for investors public and private in 2017. The largest deal among private equity acquirers was for a global CRO, Pharmaceutical Product Development, LLC, a portfolio company of The Carlyle Group (NASDAQ: CG). Carlyle sold its majority stake in PPD to another private equity firm, Hellman & Friedman LLC for $9.05 billion.

Pamplona Capital Management LP made its own splashy acquisition of a CRO, taking PAREXEL International Corp. (NASDAQ: PRXL) private for $5.0 billion.

New MainStream Capital made three acquisitions in the Other Services sector, with three different platform deals. Its targets were Cordental Group, a dental support services organization, for $25 million; Omni Eye Services, an optometric referral practice, and GrapeTree Medical Staffing, both for undisclosed prices.