Investors have flocked to the “Other Services” sector this year, as its ancillary nature keeps the companies that comprise it largely outside the purview of reimbursement regulations and other stroke-of-the-pen sectors.

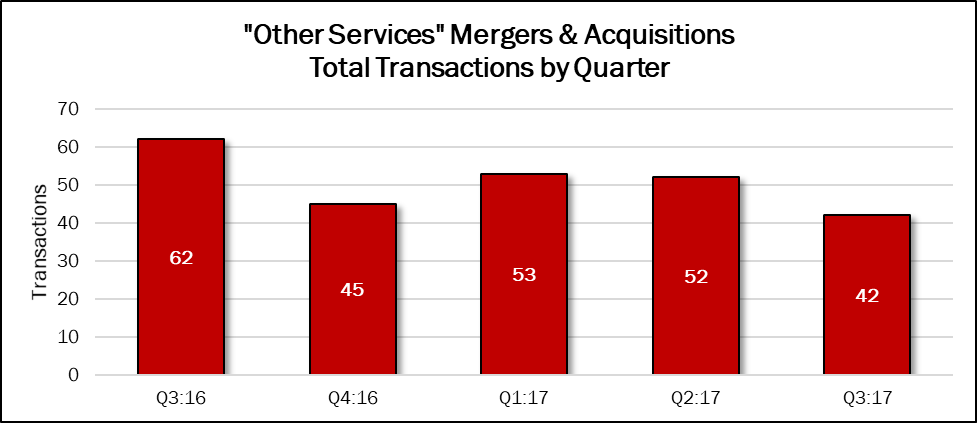

The 42 transactions announced in this sector in the third quarter represent a 19% decrease from the previous quarter, and a 32% decrease compared with the year-earlier quarter. Deal volume accounted for 22% of the 192 deals announced in the past 12 months.

The “Other Services” category covers products and services related to human health care, but in an ancillary way, such as contract research organizations, ambulatory surgery centers, institutional and specialty pharmacy companies, dental practices and management, staffing and pharmacy benefit plans. We do not include agriculture-based companies, animal nutrition or veterinary products and infant nutrition products as targets.

Source: HealthCareMandA.com, October 2017

Source: HealthCareMandA.com, October 2017

Last quarter, six deals carried prices of more than $1.0 billion, totaling $34.0 billion. This quarter, only nine of the 42 deals disclosed prices, and two of those topped the $1.0 billion mark. The combined total for the quarter was $7.8 billion, a decline of 78% increase compared with the previous quarter, but a 112% increase compared with the third quarter a year earlier. It also represents 16% of the $47.8 billion spent in the previous 12 months.

Dollars Spent on Other Services Mergers & Acquisitions, by Quarter

| Q3:16 | Q4:16 | Q1:17 | Q2:17 | Q3:17 |

| $3,712,490,000 | $1,425,997,163 | $3,085,425,000 | $35,481,573,994 | $7,852,083,088 |

The largest deal in this sector targeted The Advisory Board, the health care business of the publicly traded The Advisory Board Company, which broke into a few parts in August. Optum, a significant division of UnitedHealth Group, paid $1.3 billion for The Advisory Board. The company’s independent research, strategic healthcare advisory services, and capabilities in analytics will complement Optum’s products and services, which range from population health management to pharmacy benefit management.

LabCorp of America announced the second largest deal, paying $1.2 billion to acquire the global contract research organization Chiltern. The U.K.-based target provides clinical services and solutions in a variety of therapeutic areas with engagement models for biopharmaceutical and medical device industries in 47 countries. Chiltern will become part of LabCorp’s Covance segment, a drug discovery company it acquired in 2014 for $5.6 billion. The acquisition creates leading oncology expertise, leveraging Covance’s extensive experience in late-phase clinical studies with Chiltern’s expertise in early clinical development.

The third largest acquisition of the quarter was made by a publicly traded CRO, Catalent, Inc., which offers development services, delivery technologies and supply solutions for drugs and biologics. The company paid $950 million for Cook Pharmica LLC, a division of the Cook Group, which is a biologics-focused contract development and manufacturing organization (CDMO) with capabilities across biologics development, clinical and commercial cell culture manufacturing, formulation, finished-dose manufacturing, and packaging.