As third quarters go in the cycle of healthcare mergers and acquisitions, big news is not expected. First quarter results may be exciting if the previous year’s fourth quarter was so hectic that a number of deals were pushed into the next year. Second quarters are usually a pause for breath as more books begin to circulate, indicating sellers’ interest in closing a deal by the end of the year.

Third quarters tend to stay quiet, or even go dormant. Holidays and vacations are blamed, but for many deal makers, it’s a time to study and gird for the fourth quarter, when regulatory and tax deadlines sometimes loom.

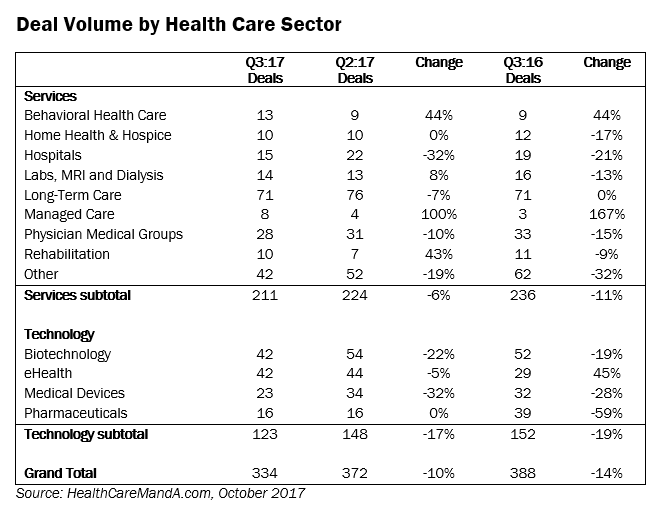

Preliminary results for Q3:17 show it is following the typical pattern. With 334 transactions recorded thus far, deal volume is down 10% versus the previous quarter, and 14% lower than the same quarter the year before.

Understand that the record for third-quarter deal volume was set recently, in 2015, when 411 transactions were announced. With that perspective, Q3:17’s 334 is slightly weaker, will probably improve as more deals come to light, and doesn’t harbinge a sudden downturn in interest in the healthcare market.

If anything, the third quarter data indicates there are more “tourist investors” putting down money in this space. Far fewer healthcare companies made multiple transactions in this period, despite the relatively high volume of transactions. As you read through this issue, you’ll note more Chinese investors are turning up in the Medical Device and Pharmaceutical sectors, and smaller U.S. private equity firms are entering services sectors such as Behavioral Health Care (largely substance abuse programs), Rehabilitation and Other Services, which includes urgent care and ambulatory surgery centers, as well as contract research organizations (CROs).

After a long walk in the desert, the Managed Care sector posted strong gains, quarter over quarter (+100%) and year over year (+167%), albeit on light volume. The protracted battle over repealing and replacing the Affordable Care Act died a third death in the Senate this September. There’s nothing final about that legislative action, of course, but it moved attention back to a more bipartisan approach in that chamber to address health insurers’ concerns over federal funding in the immediate term. Centene Corp. (NYSE: CNC) made a large bet in September that New York State would be a good place to open shop, which you can read about later in this issue.

Spending in this recent third quarter was strong, at $42.8 billion (see chart on page 4), although the current total is 12% lower than the same period in 2016 ($48.9 billion). Spending on Q3 transactions peaked in Q3:15, at $102.3 billion. And that is after we’ve subtracted the $91 billion in deals announced that quarter between Anthem (NYSE: ANTM) and Humana (NYSE: HUM), and Aetna (NYSE: AET) and Cigna (NYSE: CI), both of which were quashed by the U.S. Department of Justice earlier this year.

The largest deal to disclose a price in Q3:17 was Gilead Sciences’ (NASDAQ: GILD) $11.9 billion takeover of Kite Pharma (NASDAQ: KITE), a biotech focused on novel cancer immunotherapy products. The deal constitutes the majority of spending in the Biotechnology sector in the third quarter (total of $14.1 billion), and contributed to that sector accounting for one-third of all spending in healthcare M&A in Q3.

We’ll have much more analysis and insight in The Health Care M&A Report, Third Quarter 2017, scheduled to be published by the end of the month. Watch for it.