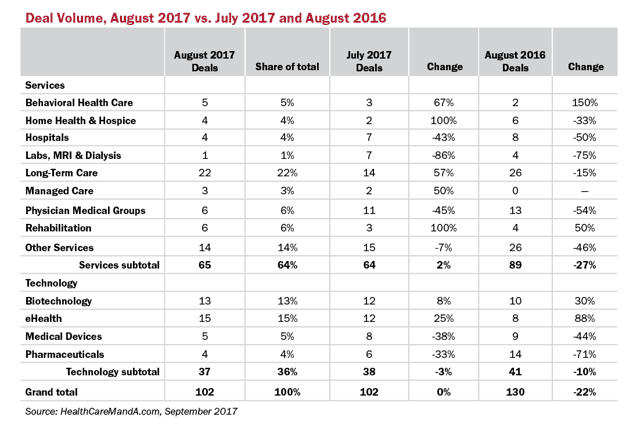

The dog days of summer weren’t really all that hot, here in the Northeast. Neither was August’s deal volume. Although it’s preliminary data, the 102 deals posted in August equalled the total in July. Compared with the same month in 2016, that represents a 22% slide in deal volume.

But don’t fret, deal-meisters. We saw several billion-dollar deals last month, which lifted August 2017’s spending to $22.3 billion. That’s 156% higher than the previous month, and just 1% below the $22.6 billion recorded a year ago.

Once again, the Biotechnology sector was the big money-maker. Deal volume was up 30%, year over year, to a modest 13 deals. The largest deal announced in August was Gilead Sciences’ (NASDAQ: GILD) $11.9 billion takeout of Kite Pharma (NASDAQ: KITE), which represents 53% of the month’s total. This deal was a long time coming, as sales of Gilead’s hepatitis C virus drugs, Solvadi and Harvoni, were slipping and the company needed to add another product pipeline. Kite filled the bill with its CAR T-cell therapy, currently under priority review by the Food and Drug Administration.

Five additional deals topped the $1.0 billion mark in August, for a variety of targets. Air Medical Group (NYSE: KKR) paid $2.4 billion for the air ambulance company American Medical Response, Inc. (NYSE: EVHC), and Fresenius Medical Care (NYSE: FMS) committed $1.9 billion to acquire medical device maker NxStage Medical, Inc. (NASDAQ: NXTM). There was even a $1.4 billion deal for a major physician medical group in Chicago, DuPage Medical Group, by Ares Management. KKR & Co.also took out PharMerica Corp. (NYSE: PMC), an institutional pharmacy services company, for $1.3 billion.

We usually don’t focus too much on the spending side, as it isn’t a reliable indicator of the strength (or weakness) of the healthcare market. This month, however, the big deals show there is still strong interest in many aspects of this market, with the exception of Pharmaceuticals, which once dominated the charts in deal volume and spending.

At this writing, the Senate health committee held the first of four hearings on steps Congress could take to stabilize premiums in the individual insurance market. In the same week, the deadline for insurers to file 2018 prices for health insurance sold through the exchanges arrived. Meanwhile, state regulators were still in decision-making mode about pricing and coverage for those plans. All this, and Hurricanes Harvey and Irma, took a toll on the for-profit hospital stocks, as well as some managed care companies.

The health insurance marketplace will be stabilized one way or another, but the for-profit hospital companies will be interesting to watch. Tenet Healthcare’s (NYSE: THC) outgoing CEO, Trevor Fetter, announced at an investor conference that the company will sell eight more hospitals in the U.S. and nine in the U.K. to reduce debt and appease activist investors. Community Health Systems (NYSE: CYH) is dealing with a Chinese billionaire whose company, Shanda Group, now owns 22.1% of its stock. CHS has shed 20 hospitals in 2017, and plans more. What grows up through M&A may get pared down.