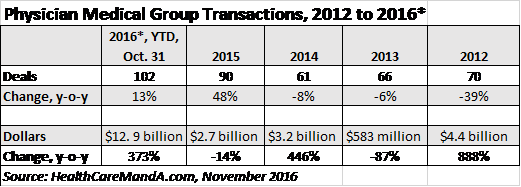

Ten months into the year, and only two healthcare sectors have posted gains compared with 2015 totals. On the technology side, it’s eHealth, where deal volume is up 10% through the end of October, to 139 transactions. On the services side, it’s Physician Medical Groups. Deal volume now stands at 102 transactions, a 13% increase over last year’s 90 deals. (See chart below.)

The Medicare Access and CHIP Reauthorization Act (MACRA) is one factor behind the increase in physician practice acquisitions. Although the Centers for Medicare and Medicaid Services eased some rules regarding data reporting periods, timing and payment options, the law still calls for smaller practices to have digital systems capable of capturing the required patient data. The sizable investments have sent some practices looking for larger partners.

Evidence of that trend is the nine acquisitions made this year by the DuPage Medical Group, two of them in October. Based in Downers Grove, Illinois, DuPage now has more than 560 physicians in multiple specialties, working in more than 70 locations in the Chicago area. Its October announcements included an OB-GYN group and six individual physicians: four hospitalists, a plastic surgeon and an orthopedic surgeon.

Another Illinois-based physician management company, Surgical Care Affiliates (NASDAQ: SCAI), has announced 11 partnerships with surgical practices this year.

Another factor is driven by value-based reimbursement and patient outcomes, which in turn have made health systems more interested in bundling their physician services with a third-party provide. That has led to consolidation among the larger players in this space.

Late last year, AmSurg Corporation (NASDAQ: AMSG), which acquired Sheridan Healthcare in May 2014 for $2.35 billion, made an unsolicited bid for Team Health Holdings (NYSE: TMH). Although the markets reacted positively to the approach, Team Health was in the process of acquiring IPC Healthcare for $1.6 billion. In November 2015, AmSurg ceased pursuit of Team Health and began talks with Envision Healthcare Holdings (NYSE: EVHC). Their $6.7 billion merger was announced in June of this year, creating a leading national provider of outsourced physician services to health systems.

In October Team Health made M&A news of its own, as private equity firm The Blackstone Group took the company private for $43.50 per share, or $6.1 billion. Although the parties agreed to a 40-day “go shop” period, its likely Team Health will end up with Blackstone, which acquired the company from a consortium of private investors led by Madison Dearborn Partners, in 2005 for $1.0 billion. (The consortium acquired Team Health from MedPartners in January 1999, for $336.9 million.) Blackstone exited the company in with an initial public offering in 2010.

Pricing pressures will continue to build up and down the healthcare spectrum, and we don’t expect to see a slowdown in this sector in 2017. If you disagree, let us know.