Waud Capital Partners Launches PharmAlliance Holdings

Waud Capital Partners, a growth-oriented middle market private equity firm based in Chicago, announced on September 14 that it launched PharmAlliance Holdings, LLC. This was done in partnership with Mark Bouck, who will serve as Chief Executive Officer of the platform. PharmAlliance Holdings is a diversified pharmaceutical and life sciences services provider focused on discovery, development and commercialization solutions. Its services span across the drug life cycle for pharmaceutical, biotechnology, life sciences and medical device companies. In conjunction with its launch, PharmAlliance invested in BioBridges, a drug development consulting business serving... Read More »

MB2 Dental Enters Wisconsin

MB2 Dental Solutions announced its acquisition of Eastridge Dental, a two-provider dental practice in Green Bay, Wisconsin. Aided by a support staff of five employees, Eastridge Dental is owned by husband and wife, Drs. William R. Meier and Carolyn W. Meier. MB2 Dental Solutions, a portfolio company of middle-market private equity firm Charlesbank Capital Partners since February 2021, partners with dentists and specialists. Founded in 2007, MB2 offers general dentistry services, orthodontics, cosmetic dentistry and oral surgery. This acquisition marks MB2’s entry into Wisconsin, per the press release. According to its website, MB2 Dental has a presence... Read More »

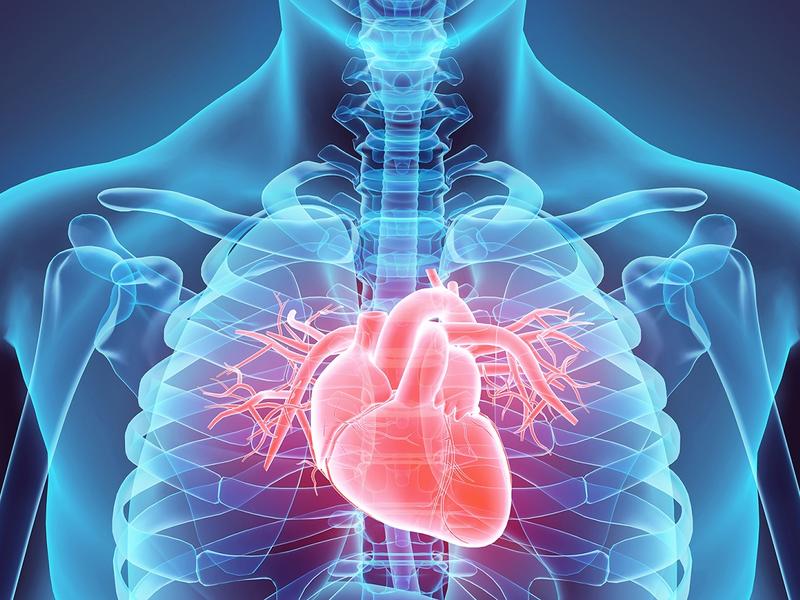

Florida-Based Daytona Heart Group Joins Cardiovascular Associates of America

Cardiovascular Associates of America (CVAUSA) announced on September 13 that Daytona Heart Group (DHG) has joined their physician alliance. According to data captured in the LevinPro HC database, this transaction represents the 382nd Physician Medical Groups acquisition of 2023, 21 of them in the cardiology specialty. This additionally marks CVAUSA’s seventh transaction of 2023. Founded in 1975, Daytona Heart Group has grown to be the largest provider of cardiology care in Volusia County. The company provides a full range of cardiovascular services and testing in multiple offices, including Daytona Beach, Edgewater, Port Orange, Deltona, Deland and Orange City, Florida.... Read More »

AQUA Dermatology Acquires Sunrise Dermatology and Skin Cancer Surgery Center

AQUA Dermatology has announced its acquisition of Sunrise Dermatology and Skin Cancer Surgery Center. The financial terms of the acquisition were not disclosed. Sunrise Dermatology and Skin Cancer Surgery Center is a Mobile, Alabama-based general dermatology and Mohs surgery practice with a focus on skin cancer diagnosis and treatment. According to its website, the practice has three physicians on staff and has a support staff of four employees. AQUA Dermatology, headquartered in Palm Beach Gardens, Florida, is among the largest and most comprehensive full-service skin care providers in the Southeast, offering medical, surgical and cosmetic dermatology. AQUA Dermatology... Read More »