Laboratories, MRI & Dialysis Deals Dropped in 2016

Deal volume settled down in 2016, following a very busy 2015 in the Laboratories, MRI & Dialysis sector. The 41 deals recorded represent a 21% decline compared with the 52 announced in 2015. Laboratories have had to adapt as hospitals and health systems have merged or closed in recent years. Some labs have evolved to offer coordinated diagnostics: offering tests that give on-the-spot diagnoses, handling bills and lab data from several sources and providers as an aid to accountable care organizations, and focusing on the patient experience to ensure repeat business. At the same time, deal value surged in 2016, up 166% year-over-year to $11.6 billion. Two multi-billion-dollar deals... Read More »

Strategic vs. Financial Healthcare Buyers in 2016

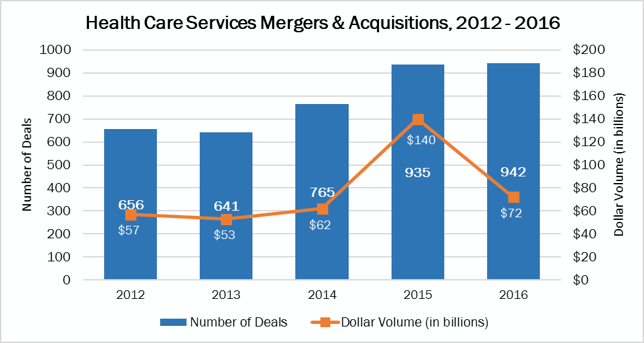

Every spring, we publish myraid statistics on the healthcare services deals announced the year before, in the form of The Health Care Services Acquisition Report. This year’s 23rd edition, which will available in late March, has this examination of what financial buyers targeted in 2016. Strategic buyers continued to dominate the health care services M&A market in 2016, as they have in the past. Their 683 deals made up 73% of the year’s deal volume. The $45.7 billion spent accounted for 63% of the combined total of $72 billion. A total of 259 deals, or 27% of the services deal volume in 2016, were carried out by financial buyers, such as private equity firms and real estate... Read More »