by | Mar 2, 2017 3:56 pm | Behavioral Health Care, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Long-Term Care, Managed Care, Other Services, Physician Medical Groups, Private Equity, Rehabilitation

Every spring, we publish myraid statistics on the healthcare services deals announced the year before, in the form of The Health Care Services Acquisition Report. This year’s 23rd edition, which will available in late March, has this examination of what financial buyers targeted in 2016. Strategic buyers continued to dominate the health care services M&A market in 2016, as they have in the past. Their 683 deals made up 73% of the year’s deal volume. The $45.7 billion spent accounted for 63% of the combined total of $72 billion. A total of 259 deals, or 27% of the services deal volume in 2016, were carried out by financial buyers, such as private equity firms and real estate... Read More »

by | Jan 20, 2017 8:45 pm | Behavioral Health Care, Private Equity

The Behavioral Health sector isn’t charging into the New Year. Only two deals have been announced in the first three weeks of January, but one of those is unusual for the sector. On January 11, 2017, Global Partner Acquisition Corp. (NASDAQ: GPAC), a blank-check company formed for the purpose of effecting a business combination, merged with Alabama-based Sequel Youth and Family Services, a portfolio company of Levine Leichtman Capital Partners. Sequel Youth and Family Services now operates 44 residential and community-based programs in 19 states that offer diversified behavioral health services for children, adolescents and adults with behavioral, emotional or physical challenges. In March... Read More »

by | Jan 13, 2017 4:37 pm | Behavioral Health Care, Biotechnology, eHealth, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Medical Devices, Pharmaceuticals, Physician Medical Groups, Private Equity, Rehabilitation

The final month of the fourth quarter is typically a busy one for deal makers in all industries. Last year, some health care deal makers apparently got a rest. Deal volume in December 2016 was an anemic 119 transactions, compared with 131 deals in November and 148 in December 2015. The Services sectors accounted for 55% of the deals in December, which is on the low side. Consider that, in November, Services accounted for 69% of the month’s transactions, and even 70% of the total in December 2015. Spending on those deals reached $15.4 billion, a relatively modest amount until it is compared with November’s $8.7 billion total (+78%) and December 2015’s $12.3 billion total (+26%). Suddenly,... Read More »

by | Jan 6, 2017 8:20 pm | Behavioral Health Care, Biotechnology, eHealth, Home Health & Hospice, Hospitals, Laboratories, MRI & Dialysis, Long-Term Care, Managed Care, Medical Devices, Other Services, Pharmaceuticals, Physician Medical Groups, Rehabilitation

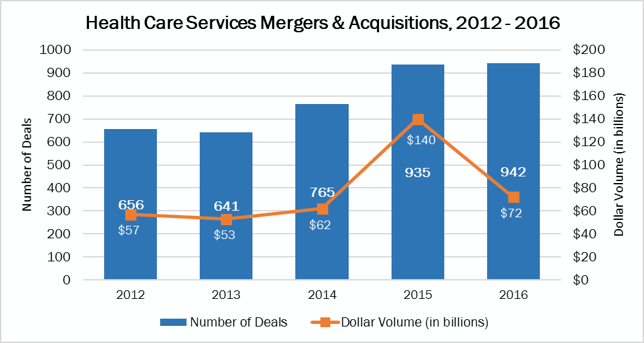

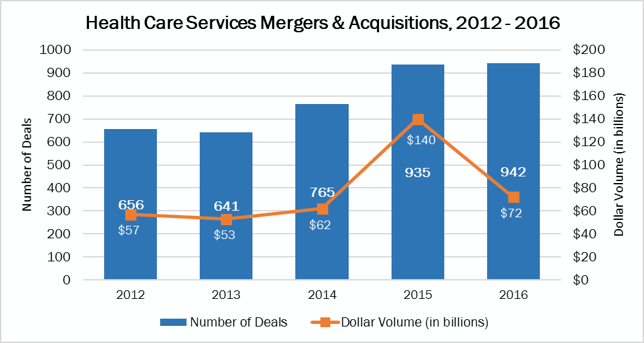

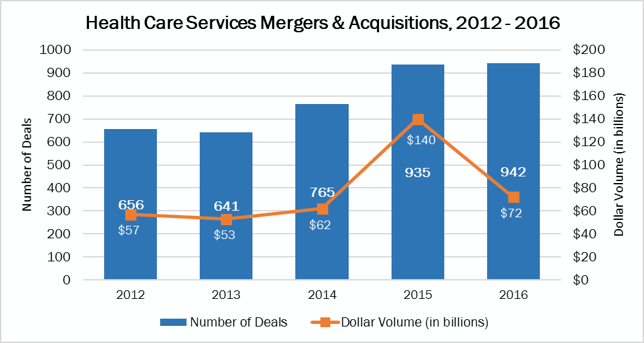

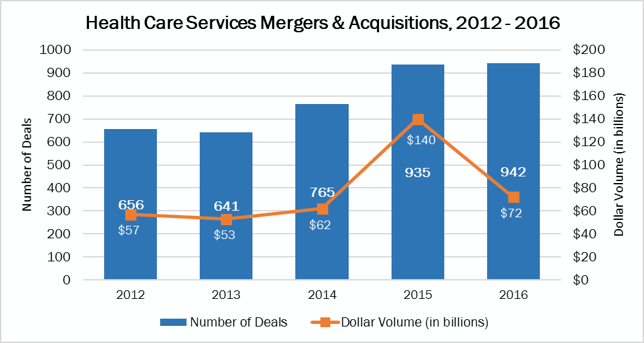

As health care mergers and acquisitions go, 2016 lived up to the predictions that M&A activity would stay strong. Preliminary data for year-end totals shows 1,536 announced transactions across 13 healthcare sectors. The total represents a 1% increase in deal volume compared with 2015. (See chart below.) Spending on those deals was significantly lower than the previous year, at least for now. The combined total spending in 2016 now stands at $255.7 billion, down 36% compared with 2015’s $400.3 billion. Nearly $100 billion of that total now hangs in the balance, as two of 2015’s largest deals (Anthem/Cigna and Aetna/Humana) await decisions from a federal judge regarding... Read More »

by | Dec 15, 2016 9:22 pm | Behavioral Health Care, Private Equity

Behavioral health care has been a hot sector for investors in recent years. After slumping to just eight announced transactions in 2010, deal volume soared steadily to 40 transactions in 2015. As of this writing, the sector has recorded 40 transactions in 2016, with two weeks left in the year. Even if no new deals surface before January 1, we expect the deal momentum to keep building through 2017, thanks to the tailwinds provided by the passage this month of the 21st Century Cures Act. The bipartisan bill, signed by President Obama, authorizes $1 billion in state grants over the next two years to address opioid abuse and other addictions. Most of that money goes to treatment facilities,... Read More »

by | Dec 9, 2016 6:16 pm | Behavioral Health Care, Biotechnology, eHealth, Other Services, Physician Medical Groups, Private Equity

Private equity’s success relies upon forward-looking expectations about which firms are best positioned to capitalize on market conditions. The healthcare market poses unique challenges. Although healthcare targets may have the profit opportunities that appeal to PE firms, the volatile legislative and reimbursement environment can turn a “smart bet” into an albatross. A recent report from McKinsey & Company on private equity and healthcare showed that healthcare investments returned the highest global total returns to shareholders (15% between 2010 and 2015). The consumer staples category came closest to that return, with 13% in the same time period. Within the healthcare market,... Read More »