The Long-Term Care sector is typically the busiest for healthcare mergers and acquisitions. Month after month, the seniors housing and care market posts the largest share of transactions, often between 25% and 29%. But these are not typical times. Now we’re dealing with COVID-19 and seniors housing has been hit especially hard by deaths, visitor restrictions, and more.

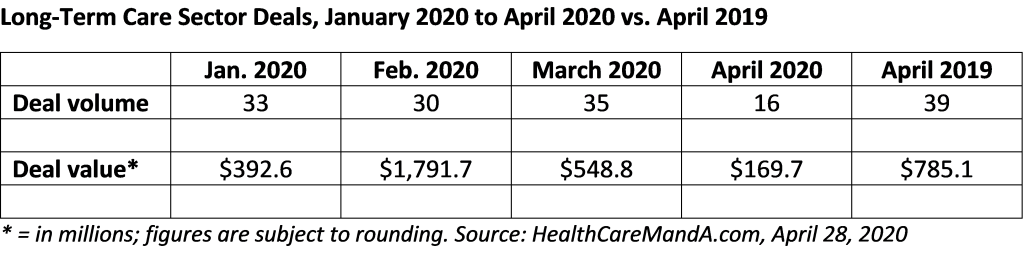

Deal flow in this sector ground to a halt in mid-April, according to our Deal Search Online database. In January 2020, 33 transactions were announced, followed by 30 in February and 35 in March. Through April 28, just 16 deals have closed, the last one on April 15. For context, 39 deals were reported in April 2019.

Monthly spending figures aren’t a reliable indicator of the health of a sector, as we’ve said many times before. But they’re interesting to look at, anyway. February 2020’s nearly $1.8 billion spending total was the result of two big deals, based on disclosed prices.

The largest was Welltower‘s (NYSE: WELL) sale of a seniors housing portfolio with communities in California, Nevada and Washington state for $740 million to an undisclosed buyer. Then there was a $555.7 million deal in which not-for-profit Preservation Freehold Corp. in Edmond, Oklahoma acquired 28 skilled nursing facilities in that state and neighboring Texas.

The biggest Long-Term Care deal by disclosed price so far in April 2020 is a $67 million sale of three skilled nursing facilities in Newark, Wilmington and Lewes, Delaware. The SNFs include 430 skilled nursing beds and 43 independent living units at one of the facilities. Overall occupancy was 90%. They were built in 1965, with a 2018 renovation, 1984 and 1988. The buyer was a newly formed joint venture based in Montreal, Quebec.

That was also the last deal announced, on April 15. It appears that everything that was already in the M&A pipeline before March has either been closed or halted. The second quarter isn’t off to a good start. We’ll just have to see what happens.