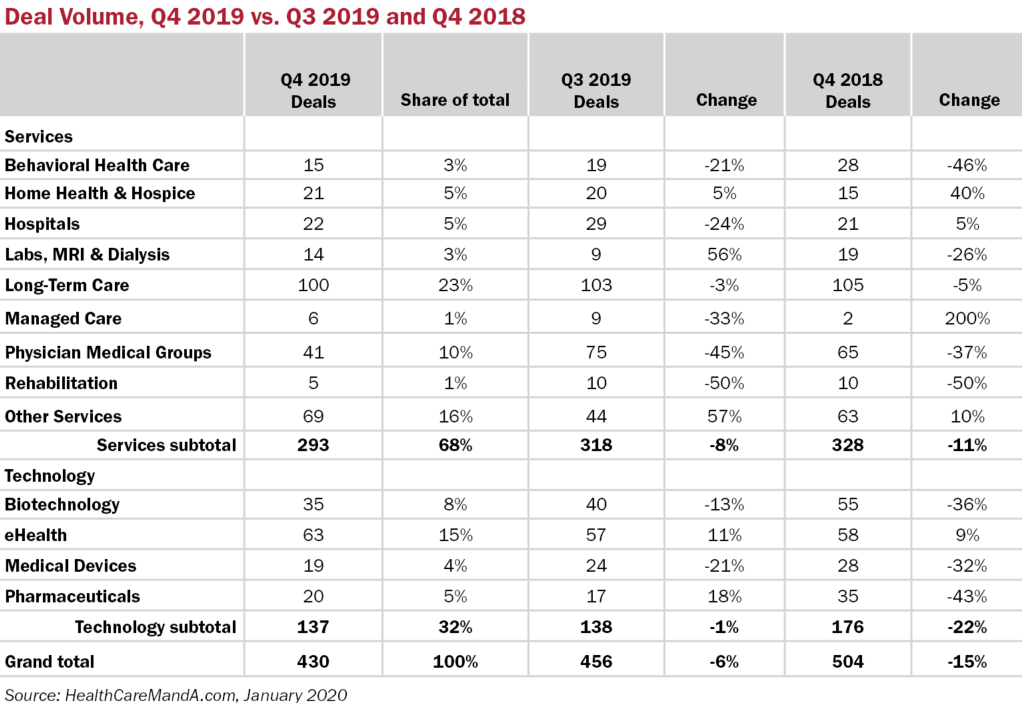

Fourth quarter 2019 results will turn out to be a strong one. Deals are still being added, but the current total for Q4:19 is 430 transactions. That’s down about 6% compared with the third quarter’s 456 deals and 15% behind the same quarter in 2018, when 504 deals were announced.

Some trends emerged in the quarter that bear out what we’re hearing from sources. Deal flow in the Behavioral Health Care sector softened in the fourth quarter, although it didn’t fall into negative territory. This sector has seen years of growth as private equity firms have piled in to build national and regional platforms around addiction treatment and autism programs and services.

Autism is still the hottest commodity in the sector (see story following), but investor interest in substance abuse programs and inpatient psychiatric facilities has waned a bit. Case in point: Webster Equity Partners spent the last four years and undisclosed millions to build BayMark Health Services into the largest opioid treatment platform in North America.

BayMark went on the auction block early in 2019, but Webster pulled the plug on a sale just this month, January 2020, and plans to try the market again in a few years. According to PE Hub reports, the firm hoped to lock in a deal at $1 billion-plus, but the private-equity-only auction disappointed. BayMark anticipated 2019 EBITDA of $75 million, but now plans to grow that beyond $100 million before going back to market.

The Home Health & Hospice sector showed strong growth, year over year, despite the imposition of the Patient-Driven Groupings Model (PDGM) on January 1 of this year. All the publicly traded companies assured investors they were fully prepared for the rule changes made by CMS, the most significant reimbursement overhaul in two decades. Many smaller agencies, mostly mom-and-pops, are expected to close or sell rather than struggle to comply with the new model. If that happens, valuations may dip and even more private equity buyers may enter the still-fragmented market.

The Long-Term Care sector is still going strong, delivering 100 or more deals every quarter in 2019. The skilled nursing side is flagging, however, having faced its own CMS-imposed rule change, the Patient-Driven Payment Model (PDPM), on October 1, 2019. Many small family-owned businesses are selling, and not always to a buyer willing to continue SNF operations. On the brighter side, interest in independent and assisted living, memory care and CCRCs is picking up the slack from the SNF side.

Among the technology sectors, eHealth is the strongest performer. Investors are piling into revenue cycle management, patient engagement tools and anything with “artificial intelligence” written on it. AI’s role in health care is wide open for debate, with hype exceeding results in many areas. We expect a few more years of upswing in this sector, no matter what the economy does.

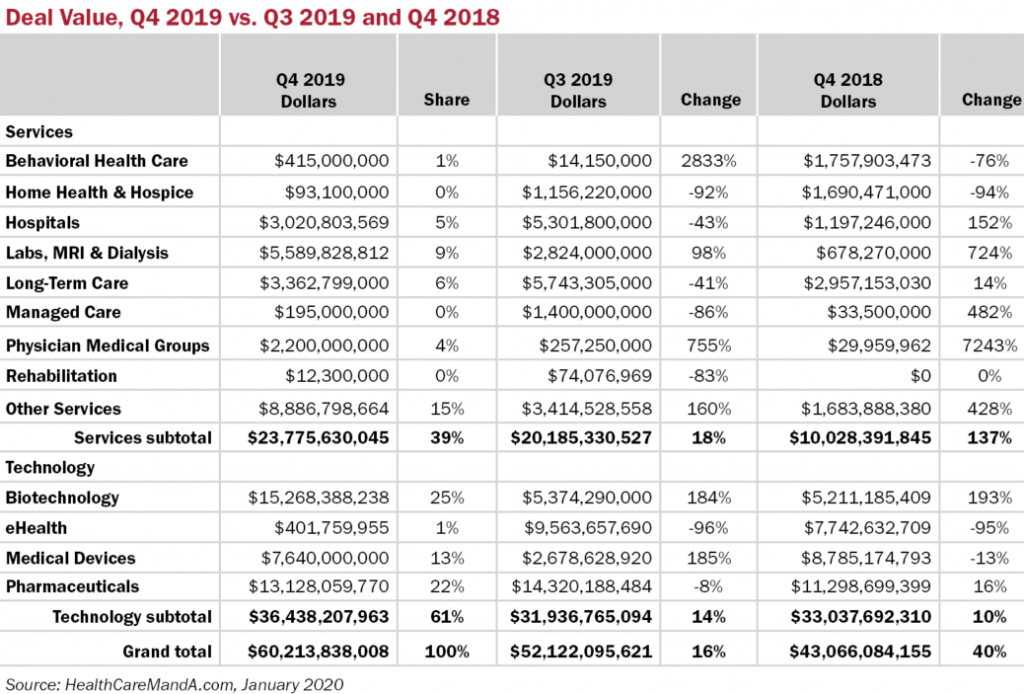

Spending in the fourth quarter was rather anemic, at $60.2 billion. The preliminary total beat the previous quarter’s $52.1 billion by 16% and was 40% higher than the same quarter a year earlier, at $43.1 billion. But with more than $401 billion for all of 2019, neither the third or fourth quarter can compare with Q1:19’s $150 billion total and Q2:19’s $139 billion. Seems like the spending action happened in the first half of the year.