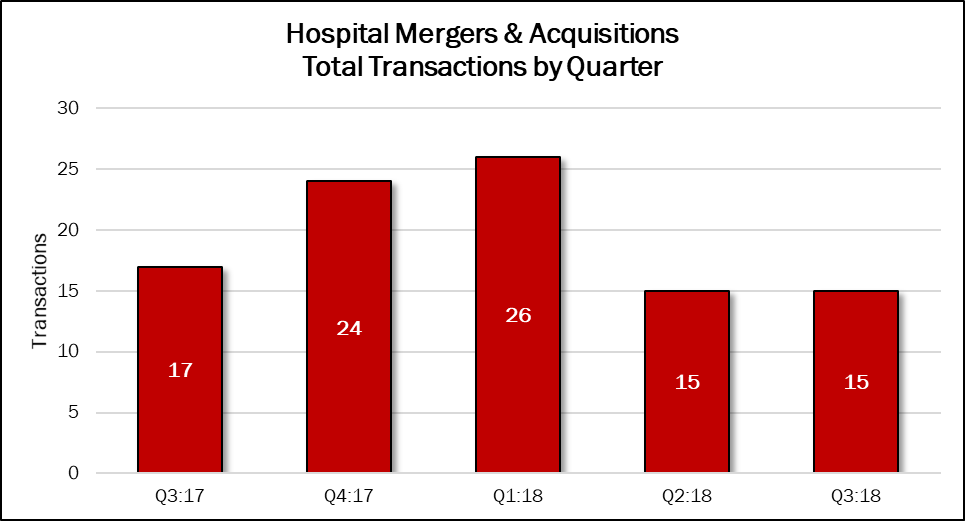

Mergers and acquisitions in the Hospital sector held steady from the second to the third quarter, with 15 definitive agreements announced in each. Deal volume dropped 12% compared with the same quarter in 2017. The 15 deals announced in the second quarter made up 19% of the 80 deals announced in the previous 12 months.

One factor behind the decline from the first quarter was the end of the announced divestitures made by some for-profit chains, particularly Community Health Systems (NYSE: CYH) and its spin-off, Quorum Health (NYSE: QHC). Together with Tenet Healthcare (NYSE: THC), these three companies spent the previous six quarters selling off underperforming assets in non-core markets. With the $5.6 billion acquisition of LifePoint Health (NASDAQ: LPNT), announced in the third quarter by RCCH HealthCare Partners, that publicly traded chain is going private, leaving the financially healthy HCA Healthcare as the only publicly traded hospital chain to still make acquisitions.

The sellers in the third quarter 2018 included six not-for-profits, three private hospital companies and four owned by publicly traded hospital chains. Two hospital companies, U.S.-based LifePoint and the India-based chain Fortis Healthcare, were acquired in their entirety. Community Health Systems sold the Sparks Health System in Arkansas, while Tenet sold three Chicago-area hospitals and divested the London, U.K.-based Aspen Healthcare chain it acquired in March 2015 for $215 million.