Hospital merger and acquisition activity softened in 2016, as more transactions came in the form of joint operating ventures, affiliations or partnerships rather than long-term financial commitments. These deals represent safer financial territory than an outright commitment to a struggling facility.

M&A transactions among larger hospitals and health systems are shifting to a more strategic focus, to gain market share, cost efficiencies and greater negotiating power. Deals involving small, standalone hospitals, however, are still driven largely by financial pressures.

Health systems are also acquiring more pre- and post-acute care facilities and services, as well as physician medical groups. These transactions extend the hospitals’ regional footprint while helping to prolong patient engagement through to skilled nursing, home health care and rehabilitation services. These transactions take time and resources that aren’t being spent on buying other hospitals, obviously.

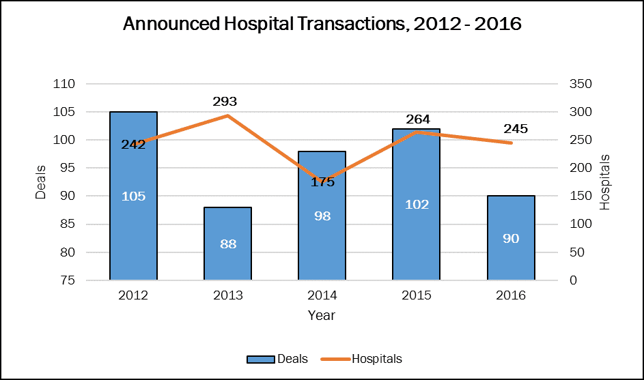

Hospital M&A fell 12% in 2016, to 90 transactions, compared with 102 transactions in 2015. The number of hospitals involved in those 90 deals stayed fairly high, at 245 facilities, just 7% below 2015. (264 hospitals).

For more on hospital merger and acquisition activity, including information on 2016’s individual deals, check out The Health Care Services Acquisition Report, 2017, 23rd edition.