You’ve seen the headlines: Global mergers and acquisitions slid in the first half of 2016, as did the combined value. The number of middle market deals completed in the second quarter fell to levels not seen since 2009. Buyers are walking away from targets that could be affected by sudden changes in tax regulations. It’s all thanks to Brexit and the U.S. presidential election.

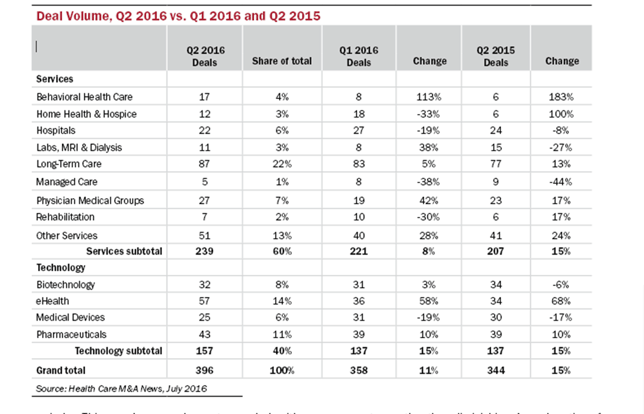

Then there’s the healthcare market. Deal volume actually increased compared with the previous quarter in 2016, and the same quarter a year ago. Deal volume for Q2:16 reached 396 announced transactions, up 11% versus Q1:16’s 358 deals, and 15% higher than last year’s 344 deals in the second quarter. For the first half of 2016, deal volume reached 755 transactions, up 5% compared with the first half of 2015 (721 deals).

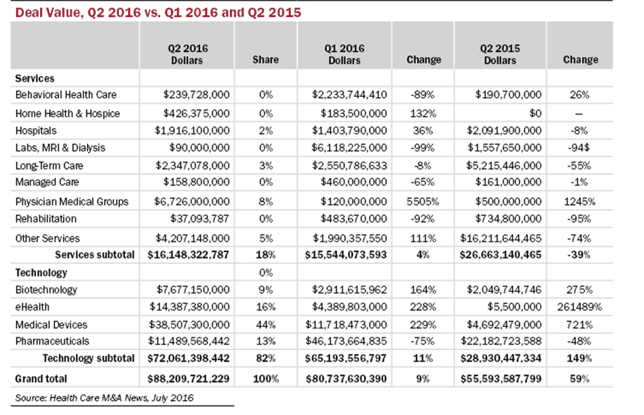

Spending on those transactions was also stronger than those previous periods. This year’s second quarter ended with approximately $88.2 billion in committed financing. That represents a 9% increase over the first quarter’s $80.7 billion, and a 59% increase compared with the second quarter of 2015. Spending in the first half of 2016 reached $168.9 billion, a 4% increase compared with the same period in 2015 ($162.4 billion).

The number of billion-dollar-plus deals was evenly distributed among these quarters. Eleven multi-billion-dollar transactions were announced in Q1 and Q2:16, and 10 in Q2:15. However, Q2:16 had two deals that topped the $10-billion mark—Abbott’s (NYSE: ABT) $30.7 billion acquisition of St. Jude Medical (NYSE: STJ) and Quintiles’ (NYSE: Q) $12.9 billion deal for IMS Health (NYSE: IMS)—compared with a single deal in that category announced in Q1:16 and Q2:15.

Consolidation among healthcare companies is gaining momentum, rather than diminishing. A good portion of that impetus comes from the Medicare Access and CHIP Replacement Act of 2015 (MACRA), which accelerated the pace of change that began with the Affordable Care Act in 2010 (ACA). The Centers for Medicare and Medicaid Services (CMS) set a deadline of January 1, 2018 for its first round of proposed regulations to take effect, which many of the most affected groups, including hospitals, physician medical groups and other providers, have rebutted as too aggressive.

CMS has been known to revise its deadlines in recent years, and that may happen again, when it publishes its final rule later this year. But the big companies aren’t waiting, particularly in the Physician Medical Group sector. In 2015 TeamHealth (NYSE: TMH) acquired IPC Healthcare for $1.6 billion, and rebuffed AmSurg’s (NASDAQ: AMSG) offer of $7.8 billion. In the second quarter of 2016, AmSurg announced its all-stock merger with Envision Health Holdings (NYSE: EVHC), to the tune of $6.7 billion. In the meantime, MEDNAX (NYSE: MD) has expanded its offerings with acquisitions such as MedData in 2014 and Virtual Radiologic Corporation in 2015. The former transaction added strong revenue cycle management capabilities, and that company has continued to grow through acquisitions. Virtual Radiologic added radiology and telemedicine services.

And that is the second trend we’re seeing in 2016, as healthcare companies in one sector acquire companies in other sectors to expand their product offerings. The Quintiles/IMS Health deal is a perfect example. The global contract research organization put up billions to buy a healthcare information technology company that has years of data on the global pharmaceutical industry.

The Medical Device sector is still feeling the effects of the ACA, and consolidation continues there. For Abbott, the addition of St. Jude Medical expands its global scale and diversifies its portfolio into cardiovascular medical devices. Rival Medtronic (NYSE: MDT) paid $1.1 billion in June to acquire HeartWare International (NASDAQ: HTWR), maker of miniaturized implantable heart pumps. On the orthopedic side, Zimmer Biomet (NYSE: ZBH), which is big in musculoskeletal products, paid $1 billion for LDR Holdings (NASDAQ: LDHR), which focuses on surgical technologies for spinal disorders.

Of the 396 deals announced in the second quarter, 51 (13%) were made by private equity firms and investor groups, compared with 38 (10%) in the first quarter and 32 (9%) in the second quarter of 2015. We’ve noted in previous issues that the private equity segment has a lot of money waiting to be put to work, but not at the prices some sellers are still looking for. Foreign travails aside, we expect a busy third quarter. It’s in the fourth quarter, post-election, that the tide may turn. □