When it comes to mergers and acquisitions (M&A), every closed transaction tells a story—a narrative of challenges, negotiations and ultimately, success. Stephen Sargent, a Managing Director at Austin, Texas-based M&A advisory firm Agenda Health, recently shared his involvement in a noteworthy home care deal that was completed at the end of 2023. His commentary not only reveal the intricacies of the transaction itself, but also shed light on market trends and future forecasts in the Home Health & Hospice (HH&H) market.

The key players in this deal were Regency Home Care, based in Atlanta, led by founder and owner Erich Schuetz, and Feature Healthcare, also in Georgia. The seller, Schuetz, engaged with several different groups during the process. However, he meticulously evaluated each option and concluded that Feature Healthcare was the right fit for him.

This transaction deviated from the norm, as Sargent explained, “[the acquisition process] ended up taking longer than normal. The buyer that closed the deal made an offer early on, but the transaction took longer due to timing issues with the buyer and seller. It ultimately closed at the end of December.” He continued, “The seller engaged with a few different groups, but felt like this was the right fit for him.”

Regency Home Care is a locally owned, licensed in-home care agency servicing seniors in Atlanta and its surrounding communities. With high recovery rates and low rehospitalization rates, Regency Home Care’s goal is to provide the best level of care possible while promoting independence among seniors.

Feature Healthcare is a health network providing care to seniors across Georgia and the Southeast.

The advisor in the transaction, Agenda Health, has a track record of more than 15 years of successful transactions. According to data captured in the LevinPro HC database, the company has successfully completed more than 40 deals since 2019, most of which (about 90%) have been in the HH&H sector. The majority of these deals (more than 42%) have been in the home hospice and palliative care specialty. Agenda Health is one of the most active HH&H advisors tracked by LevinPro HC.

Sargent highlighted the commitment of Agenda Health throughout the acquisition, stating, “Sometimes, the process is not ideal, but it reflects our commitment to stay with the owner until we complete the deal.” This commitment echoes the firm’s dedication to guiding sellers through the deal process, navigating any challenges that arise and ensuring a seamless transaction for all involved.

The stars aligned when Feature Healthcare came forward as a buyer. Not only is it a fellow Georgia-based company, but it also has a vision of being the highest quality employer and provider of home care services throughout Georgia. This fit into the kind of company culture Schuetz was looking for his staff.

“Our hope is to match each seller with multiple, highly-qualified buyers in order to achieve the greatest number of competitive offers possible… [the seller] wanted to make sure that his staff was going to be taken care of,” emphasized Sargent. “We find that so much of these kinds of transactions… the owner cares just as much about the culture and the staff as the bottom dollar.”

Our talk with Sargent revealed some evolving dynamics within the home health industry, highlighting significant shifts that are currently shaping the preferences of buyers.

According to Sargent, “Home care is more attractive to many buyers than skilled home health right now.”

Although the preference for home care over skilled home health services often comes down to practical and personal considerations, the move towards these types of services reflects changing dynamics in how we approach patient well-being. Home care focuses on daily living assistance and companionship, while skilled home health services offer specialized medical attention. Home care ensures comfort and support, while skilled home health services deliver essential medical expertise to enhance patients’ overall well-being.

According to Sargent, there is a growing focus on private pay models within the HH&H market. He notes that there’s “a trend of buyers focusing on private pay models due to regulatory challenges.”

This shift can be linked to the increasing complexities and regulatory burdens associated with government programs like Medicare and Medicaid. Providers must adhere to regulations regarding patient care standards, documentation, billing practices and quality reporting. Additionally, changes in reimbursement policies and ever-evolving healthcare laws further contribute to the complexity of regulatory compliance in skilled home health services. Buyers are finding private pay models more appealing as they offer a pathway to reduced regulatory scrutiny and administrative challenges.

Sargent further accentuates the notable surge in buyer activity, indicating a shift in momentum. He mentions, “There’s been a huge tick up of buyers that even four or five months ago were pausing things are now coming in very aggressively on the same opportunities.”

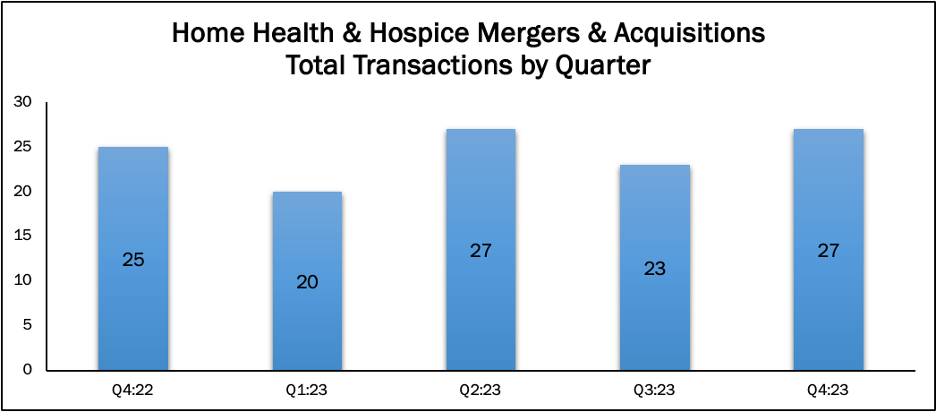

This uptick in buyers becomes evident when examining the HH&H M&A data from the most recent quarter. The HH&H sector experienced an increase in deal volume during Q4:23, with 27 deals announced, a 17% increase from 23 deals announced during the previous quarter, and an 8% increase from Q4:22. This surge suggests a renewed confidence and proactive engagement from buyers who had previously adopted a more cautious approach. The increased buyer activity points toward a dynamic and potentially robust HH&H market.

Sargent also provided a look into current market valuations in the HH&H market: “For the smaller deals, under $500,000 in Adjusted EBITDA, you’re really looking at a 3 to 4X multiple. Once you have a million or more of EBITDA, you’re pretty safely in the 5 1/2 to 6X range.”

Sargent’s valuation analysis highlights the relationship between deal size and valuation multiples in the HH&H market. Smaller deals, which often involve local or regional players seeking expansion opportunities, may lack the geographic reach, resources and diversified revenue streams of their larger counterparts. As a result, buyers apply more conservative valuation multiples to account for the risk. Larger deals benefit from economies of scale, broader market presence and potentially stronger financial performance, seeming more stable and capable of sustaining growth to buyers. These larger transactions tend to have higher valuation multiples, reflecting their perceived value and potential. As the industry continues to adapt, understanding these valuation nuances becomes essential for making informed strategic decisions and having success in the M&A market.

As the home health industry anticipates a resurgence in M&A activity for 2024, Sargent provides valuable guidance. His prediction points to a positive trajectory, marking the year as a pivotal moment for rebound and recovery in the home care sector. Despite the challenges faced by home-based care providers in recent years, there’s renewed optimism. The pandemic-induced disruptions have prompted strategic shifts, and M&A activity is poised to play a pivotal role in reshaping the home health landscape as providers seek to enhance service quality, expand their market reach and optimize their operational efficiency.

According to Sargent, “2024 is expected to be a bounce-back and recovery year for M&A in home care.” This optimism extends to both buyers and sellers, as opportunities emerge within the sector. The momentum behind Medicare Advantage is growing, and technology adoption—such as telehealth and AI-driven solutions—will drive positive patient outcomes. However, uncertainties persist. Sargent acknowledges that while 2024 may lean toward a seller’s market, it won’t match the robustness of 2021 and 2022. The looming question mark? The upcoming election scheduled for November 2024, which adds complexity to decision-making and investment strategies. Providers will have to act strategically, as flexibility and adaptability will be key as political dynamics play out.

Sargent further notes, “buyers are becoming more aggressive after a slower year, and the M&A space usually sees increased activity in an election year.”

Despite challenges such as Medicare reimbursement rate cuts, advocacy efforts persist to ensure fair rates. Organizations like the American Medical Association have been actively working to ensure fair rates for physicians. Meanwhile, the labor shortage has had an effect on patient referrals. Despite a 33% increase in referrals per patient to home health providers, there’s been a 15% decrease in acceptance, according to a report from CarePort Health. This decrease may lead to longer wait times and potentially affect the quality and timeliness of care. It could also restrict overall access to home health services, affecting provider revenues due to fewer accepted referrals, resulting in missed revenue opportunities.

Providers must continue to communicate the cost-effectiveness of home health services and embrace holistic care coordination beyond clinical services. As buyers change up their strategies, the home health M&A landscape is expected to heat up. The interplay of market forces, regulatory changes and investor sentiment will shape the industry’s trajectory, as they always do.

While 2023 had historically low activity, the strong finish in HH&H M&A volume sets the stage for a potentially more active year for buyers and sellers. We’ll just have to see what happens in the coming months.