Occupational health, not to be confused with occupational therapy, focuses on ensuring workplace safety, employee wellness and compliance with health regulations. Occupational health provides employer-driven services, such as injury prevention, health screenings and compliance programs, and is vital for workforce productivity and risk management. In recent years, the sector has seen a dramatic shift in merger and acquisition (M&A) activity, with 2025 marking a significant slowdown in the space.

A Marked Decline in 2025 Deal Activity

According to data captured by LevinPro HC, there have been six occupational health transactions announced year-to-date (as of August 11, 2025). This marks a 40% drop from the 10 deals recorded in the same period of 2024 and a 57% decline from the 14 deals in 2023.

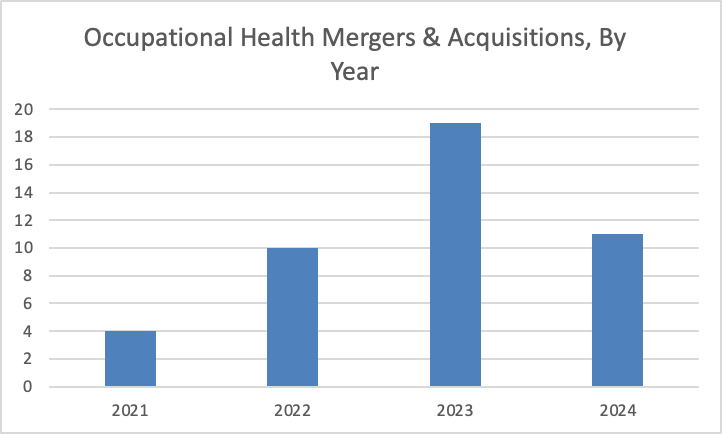

Source: LevinPro HC, January 2025

Prior to 2021, occupational health M&A was minimal, with zero to one deal announced annually. The landscape began to shift in 2021 with 4 deals, followed by a jump to 10 deals in 2022 and a peak of 19 transactions in 2023. Activity eased to 11 deals in 2024, but the steep decline in 2025 underscores a return to caution among investors and operators.

What Drove the Surge—and the Slowdown?

The spike in occupational health M&A from 2022 to 2023 was fueled by a post-COVID emphasis on workplace health. The pandemic heightened awareness of employee well-being, prompting companies to invest in occupational health services to manage workplace safety, comply with evolving regulations and address rising mental health and ergonomic concerns. Private equity firms and strategic buyers (such as Audax Private Equity, Angeles Equity Partners and Concentra) saw opportunities in consolidating a fragmented market, driving deal volumes to unprecedented levels.

However, several factors are contributing to the 2025 cooldown:

- Economic Pressures: Rising interest rates and tighter capital markets have made financing large deals more challenging. During the 2021-2023 surge, deals like Audax’s acquisition of Occupational Health Centers involved larger platforms with extensive clinic networks, commanding higher valuations. In contrast, 2025 deals (such as Concentra’s acquisition of Nova Medical Centers) are smaller, with buyers prioritizing less capital-intensive transactions or pausing M&A to integrate prior acquisitions.

- Integration Challenges: The 2021-2023 surge consolidated many providers, leaving buyers focused on integrating complex occupational health clinic networks and compliance systems, delaying new deals. For example, the July 2025 merger of Akeso Occupational Health and Agile Occupational Medicine, backed by Angeles Equity Partners, reflects efforts to streamline prior acquisitions before pursuing new ones.

- Valuation Adjustments: Post-2021-2023 consolidation, valuations for remaining occupational health targets are adjusting downward as buyers await more favorable pricing, reducing deal frequency.

- Consolidation Aftermath: The 2021-2023 M&A frenzy consolidated many high-value occupational health providers, leaving fewer attractive targets and driving valuations downward as buyers await more favorable pricing, reducing deal frequency.

Future Opportunities in a Quiet Market:

The current slowdown does not signal a lack of interest in occupational health but rather a recalibration after an extraordinary period of activity. Several trends suggest the sector remains ripe for future M&A:

- Workplace-Specific Technology: Solutions like real-time injury tracking systems, ergonomic assessment tools and compliance monitoring software are gaining traction. Buyers may target firms offering these specialized platforms to streamline workplace safety and reduce employer liability.

- Regulatory-Driven Services: The ongoing need for compliance with workplace health regulations, such as OSHA standards, drives demand for providers with expertise in navigating these frameworks.

- On-Site and Near-Site Clinics: Employers are increasingly investing in on-site health clinics to reduce downtime and costs. For example, Concentra’s April 2025 acquisition of Pivot Onsite Innovations expands its network of workplace clinics, positioning it as a prime M&A target for scalable models.

- Workplace Mental Health Integration: Occupational health providers incorporating mental health screenings and stress management programs tailored to workplace settings are well-positioned for growth, appealing to buyers focused on comprehensive employee wellness. For instance, Optima Health’s January 2025 acquisition of BHSF Occupational Health enhances its mental health support services, including workplace stress management programs.

As the occupational health M&A market cools in 2025, stakeholders should view this pause as a strategic window to prepare for the next wave of activity. Investors and operators can position themselves for success by targeting providers with niche expertise in workplace-specific technologies or regulatory compliance, which are increasingly critical to employers. As businesses increasingly view occupational health as a cornerstone of workforce resilience, proactive players can shape the sector’s next growth phase.