As the healthcare sector continues to adapt to evolving needs, real estate mergers and acquisitions (M&A) have become pivotal in shaping the landscape of healthcare delivery. The healthcare real estate (HCRE) sector includes medical outpatient buildings (MOBs), ambulatory surgery centers (ASCs), life sciences buildings and other general healthcare real estate subsectors. According to data captured in the LevinPro HC database, there were 263 HCRE deals announced in the United States during 2024. Activity in 2024 represents a significant increase from 234 deals in 2023, and shows a clear upward trend from the 236 in 2022, 184 in 2021, 90 in 2020, 34 in 2019 and only 11 in 2018. This growth indicates a robust expansion in the U.S.-based HCRE market and underscores a sector ripe with opportunities for both investors and healthcare providers looking to leverage real estate for better service integration and patient access.

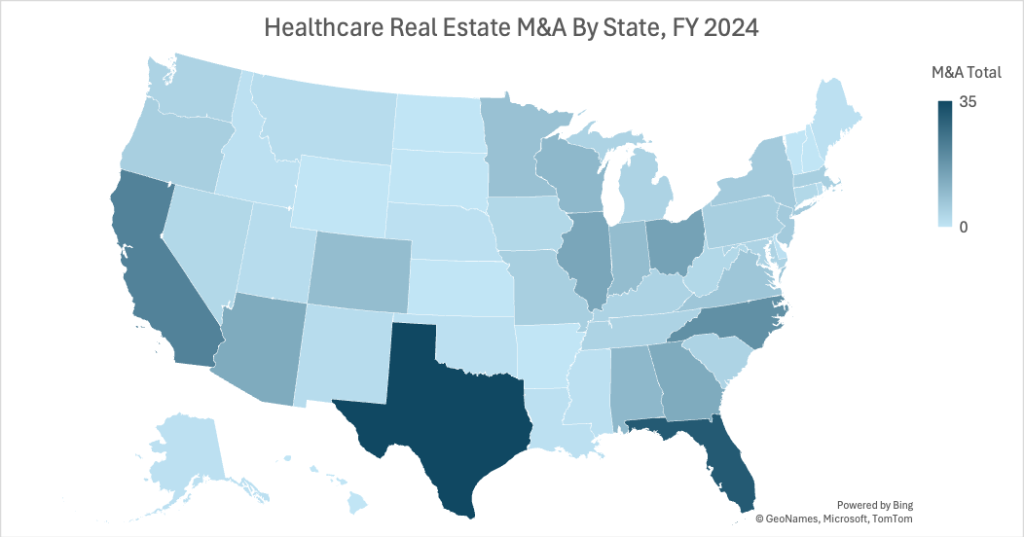

In 2024, certain states have stood out as particularly active in HCRE M&A. This analysis focuses on the most active U.S. states for these transactions, highlighting the driving forces behind this activity and the opportunities and challenges shaping the U.S. HCRE landscape.

2024 Heathcare Real Estate M&A Activity by State and Region

| Region | Deal Totals Per State |

| Northeast | Connecticut (3 deals), Maine (1), Massachusetts (5), New Hampshire (0), New Jersey (6), New York (6), Pennsylvania (5), Rhode Island (2) and Vermont (0). |

| Southwest | Arizona (13 deals), New Mexico (2), Oklahoma (1) and Texas (35) |

| West | Alaska (1 deal), California (22), Colorado (9), Hawaii (0), Idaho (1), Montana (2), Nevada (3), Oregon (5), Utah (2), Washington (4) and Wyoming (0) |

| Southeast | Alabama (10 deals), Arkansas (0), Delaware (1), Florida (31), Georgia (13), Kentucky (4), Louisiana (1), Maryland (4), Mississippi (1), North Carolina (19), South Carolina (4), Tennessee (4), Virginia (7), Washington, D.C. (0) and West Virginia (3) |

| Midwest | Illinois (14 deals), Indiana (9), Iowa (3), Kansas (0), Michigan (4), Minnesota (8), Missouri (5), Nebraska (1), North Dakota (0), Ohio (15), South Dakota (0) and Wisconsin (10) |

Source: LevinPro HC, February 2025

MOBs have been the focal point of numerous transactions, especially in states experiencing significant population growth. In 2024, they accounted for about 79% of all U.S.-based HCRE deals, totaling 207, with Texas and Florida leading the charge, each with 28 deals. These states are not just growing; they’re healthcare hubs in the making, driven by demographic booms. According to the U.S. Census Bureau, Texas added roughly 562,941 residents from 2023 to 2024, a 1.8% growth rate, while Florida saw an increase of about 467,347 people, with a 2% growth rate, both surpassing the national average of 1%. This rapid population growth has intensified the need for additional healthcare facilities, particularly in high-growth urban areas and underserved rural regions.

Private equity firms and real estate investment trusts (REITs) have played a significant role in shaping the HCRE landscape. Institutional investors continue to acquire medical office buildings and specialty care centers, focusing on markets like California and New York, where demand remains strong. In terms of M&A activity, real estate investment firms were the most active investor type with 103 deals, accounting for approximately 39% of all U.S.-based HCRE transactions. Private equity and/or their portfolio companies followed, participating in 32 deals, which made up about 12% of the market. Real estate investment trusts were involved in 23 deals, representing around 9% of transactions. Health systems were the least active among these groups, participating in 16 deals, which constituted approximately 6% of all U.S.-based HCRE transactions in 2024.

In the U.S.-based HCRE market of 2024, Montecito Medical Real Estate emerged as the most active acquirer, with 25 HCRE deal announcements. Other notable players included Four Corners Property Trust with eight acquisitions, Remedy Medical Properties with seven and a cohort of firms like Woodside Health, LLC, Stockdale Capital Partners, LLC, National Dental Healthcare REIT, Hammes Partners, Big Sky Medical and Anchor Health Properties, each announcing four deals. These companies, alongside the brokers facilitating these transactions, have been pivotal in driving the momentum within the sector.

In 2024, the healthcare real estate sector saw deals with notably high price tags. The largest transaction was Lonza Group‘s acquisition of a 427,000-square-foot manufacturing facility in Vacaville, California, for $1.2 billion, at roughly $2,810 per square foot, announced in March. Additionally, the largest U.S.-based MOB deal was completed by a joint venture between Remedy Medical Properties and Kayne Anderson, which acquired 37 medical outpatient buildings from Broadstone Net Lease Inc. for $251.7 million. That deal, which includes a portfolio spanning 700,000 square feet across 13 states, was announced in April. Of note, there were 109 U.S.-based HCRE deals with disclosed prices, and of those, nearly all of them (108 deals) surpassed the million-dollar mark.

Regulatory and policy considerations have also influenced transaction activity, particularly in states with Certificate of Need (CON) laws, which require healthcare providers to prove the necessity of new or expanded facilities before they can proceed, thereby shaping the landscape of HCRE mergers and acquisitions. In markets such as New York and Illinois, HCRE M&A has often been driven by the need for existing providers to expand within these regulatory frameworks rather than new entrants developing facilities from the ground up. This has created a competitive environment where health systems must strategically acquire properties to remain compliant and expand their reach.

Rural healthcare consolidation has been another defining trend, particularly in the Midwest and Western states. While deal volumes in Montana, Wyoming, and Nebraska are lower than in more populated regions, these transactions are crucial for maintaining access. Many rural HCRE transactions involve health systems or investors acquiring small outpatient facilities to modernize infrastructure, address provider shortages and keep essential services available in underserved areas.

While the HCRE M&A space has presented many opportunities, it has also faced challenges. Interest rate pressures have slowed some transactions, particularly for independent operators without significant capital reserves. Higher borrowing costs have made it more difficult for smaller healthcare groups to acquire new facilities, leading to a market dominated by larger health systems and investment firms with stronger financial backing. Regulatory uncertainty has also played a role, as evolving policies around healthcare facility construction and ownership structures have impacted deal flow in states with stricter oversight.

Despite facing challenges like interest rate pressures and regulatory uncertainties, which have slowed some deals, particularly for smaller operators, HCRE M&A activity in 2024 has remained strong. High-growth states in the Southeast and Southwest have led in transaction volume, while regions with stricter regulations or slower growth have seen strategic, measured acquisitions. Looking ahead, demographic shifts, investor appetite and policy changes will continue to shape this market, determining where the most significant transactions occur and how providers navigate an evolving landscape.