The Real Estate Investment Firm (REIF) and Real Estate Investment Trust (REIT) markets remain among the most dynamic sectors. The first half of 2024 (1H 2024) exemplified this trend, continuing to demonstrate significant activity and engagement.

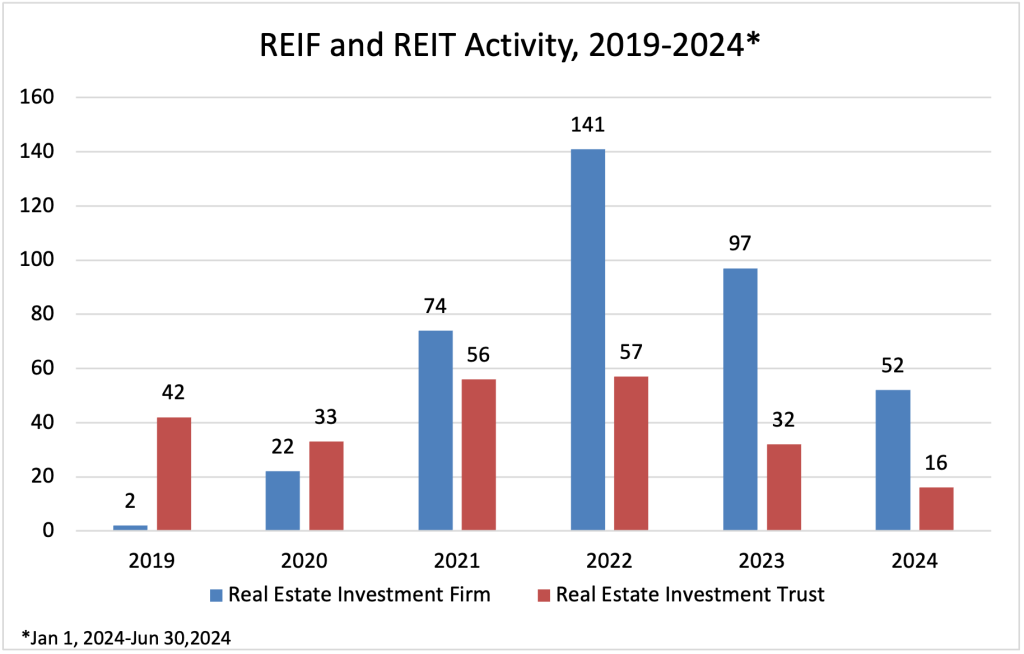

The REIF sector has shown significant acquisition activity in acquisitions in the past few years. In 2019, there were two transactions with a REIF buyer. This jumped to 22 transactions in 2020, 74 deals in 2021, and continued to escalate in 2022 when 141 transactions were announced. Yet, there was a decline in 2023 when 97 acquisitions were announced. In the first six months of 2024, 52 transactions were completed by a REIF buyer.

We spoke with Christopher Stai, Managing Director of HREA Healthcare Real Estate Advisors, to explore why there has been a decline in healthcare real estate M&A activity.

“The volume and velocity of transactions significantly slowed down when the Fed took a much more hawkish approach to inflation and started implementing rate hikes to curb inflation, the highest the rate has been in over 20 years,” Stai said.

When breaking down the types of deals that REIF buyers completed in the first half of 2024, several trends stuck out. In the first six months of 2024, there were 49 transactions related to healthcare real estate, whether the targets were medical outpatient buildings (MOB) or ambulatory surgery centers (ASC). There were 42 MOB transactions, three ASC deals, one healthcare real estate deal, one surgical center transaction and two life science building acquisitions.

Active REIF buyers include Montecito Medical Real Estate, which completed 12 deals in the first half of 2024; Remedy Medical Properties, which completed four transactions; and Big Sky Medical, a portfolio company of GFH Financial Group, which completed three deals in the first six months of the year.

The deal with the most rentable square feet, completed by a REIF in the first half of 2024, was Remedy Medical Properties and Kayne Anderson Real Estate’s acquisition of 37 MOBs from Broadstone Net Lease Inc. The portfolio totals more than 700,000 square feet and was bought for $251.7 million. The price was approximately $360 per square foot. This incredibly high square footage portfolio is an outlier as it is the only transaction of 2024 to comprise more than 500,0000 square feet. Most of the targets are less than 100,000 square feet and average approximately 47,300 square feet. This transaction also marks the highest purchase price for a REIF in 2024.

Remedy Medical Properties and Kayne Anderson Real Estate also completed the second-largest deal, in terms of purchase price, for the first half of 2024. In February, the joint venture acquired a four-facility MOB for $86 million from Flagler Healthcare Investments. The portfolio spans Phoenix, Arizona; Boynton Beach, Florida; and Elgin, Illinois and totals more than 181,000 square feet. JLL Partners acted as an advisor on the transaction.

“We were delighted to have facilitated the sale of this portfolio on behalf of Flagler Healthcare Investments,” said JLL Senior Managing Director Mindy Berman in the original press release. “The portfolio’s strong tenant mix, long remaining lease terms and strategic market locations made this an ideal investment opportunity.”

REIT buyers are also rather active. In 2019, there were 42 acquisitions. Deal volume dipped in 2020 when 33 transactions were reported by a REIT acquirer but rebounded to 56 deals in 2021 and 57 transactions in 2022. There was another decline in 2023 when 32 deals were announced. In the first six months of 2024, 16 acquisitions were reported by a REIT buyer.

Similarly to REIFs, REITs are especially active in the MOB space, purchasing 12 in the first half of 2024. The MOB with the largest square footage that was purchased is UDLR Healthcare’s acquisition of Thunderbird Medical Pavilion in Glendale, Arizona. The facility consists of 92,811 square feet and was sold for $13.5 million, totaling approximately $145 per square foot.

In addition to MOBs, REITs acquired community hospitals and inpatient rehabilitation practices in the first half of 2024. REITs have had a presence beyond MOB buyers for several years; in 2023 and 2022, REIT buyers acquired three rehabilitation facilities.

In 1H 2024, active REIT buyers include Four Corners Property Trust, which completed five transactions; Sila Realty Trust, Inc., which completed three deals; and Community Healthcare Trust Incorporated, which completed two transactions.

The largest deal by purchase price completed by a REIT in the first six months of 2024 was the acquisition of five Utah community hospitals by a newly formed joint venture between Medical Properties Trust and an undisclosed investment fund. The purchase price was $886 million. Medical Properties Trust will hold 25% of the joint venture, while the investment fund will purchase a 75% stake for $886 million.

The REIT deal with the most disclosed square footage was Sila Realty Trust’s acquisition of a five-property portfolio in Arizona and Texas totaling 158,000 square feet. The purchase price was $85.5 million, or $541 per square foot. This differs from the acquisition of Thunderbird Medical Pavilion as this is general healthcare real estate and not specifically an outpatient facility.

While activity has been strong, several factors can cause a slowdown in deal activity. These include the continued labor shortage, maturing debt, and higher inflation and interest rates.

“I think real headwinds are on the healthcare provider side with recruiting and bringing in new physicians, PAs, skilled nurse practitioners into the ranks to replace retiring physicians and nurses,” said Stai.

Even though activity from both REIFs and REITs has been cooling in the past few years, activity is not expected to dwindle completely. Stai noted that a major tailwind propelling the market forward is the rise in valuations. Although valuations and CAP rates are not where they were several years ago, they are increasing, which is expected to make transactions more appetizing.

Another tailwind that Stai touched upon was geography and the ability to bring more care to underserved areas.

He said that the geography of where real estate transactions are occurring is following population growth. States such as Florida, Arizona and Texas are experiencing a large portion of the deal volume. This is backed up by our data; since the start of 2021, there have been 37 REIF and REIT transactions in Arizona; 53 in Florida; 70 in North Carolina; and 66 in Texas.

Activity in high population growth states is partially due to changing regulations. According to Stai, in June or July 2025 CON laws on ASCs and operating rooms in North Carolina are ending which could create “M&A fluidity.”

Going forward into the rest of 2024 and 2025, Stai had this to say about how geography will continue to impact deal volume: “In the Southeast, there’s a lot of growth, so I assume that there’s going to be M&A interest. Whether it’s the Carolinas or Florida, wherever there are opportunities to scale and improve margins with a stable population, you’re going to see M&A in those geographic areas.”

Despite experiencing some fluctuations due to economic factors such as the Fed’s rate hikes, both REIF and REIT buyers continue to be active in the healthcare real estate market. We are optimistic that as valuations continue to rise, healthcare M&A deal activity will continue to be strong.

Explore 10 noteworthy REIF and REIT deals of 1H 2024 on the LevinPro HC platform:

- Remedy and Kayne Anderson Acquire 21 Novant Health Properties

- Flagler Healthcare Investments Sells 4-Building Portfolio for $86 Million

- MercyOne Outpatient Clinic Sold for $3 Million

- Big Sky Medical Acquires Blackhawk Medical Center for $46 Million from ViaWest Group

- National Dental Healthcare REIT Purchases 9-Building MOB Portfolio

- Joint Venture Buys 5 Utah Hospitals

- Flagship Healthcare Trust Acquires Mechanicsville, Virginia MOB

- Altera Fund Advisors and Virtus Real Estate Capital Buy 4-Building Portfolio

- Sanders Trust Purchases PAM Health Rehabilitation Hospital for $34.2 Million

- Montecito Medical Real Estate Acquires 3-Building Portfolio