The prominence of Management Service Organizations (MSOs) and Dental Service Organizations (DSOs) in the healthcare market cannot be overstated. These entities have become essential players, particularly noted for their high transaction volumes.

MSOs are businesses that work with predominantly physician groups to provide a range of administrative and management services to help alleviate physicians of those duties. DSOs are a specialized type of MSO that focuses exclusively on dental practices and are worth taking a deeper look at because of their high deal volume. It should be noted that the reason DSOs have such a high deal volume is because of the interest in dental practices and DSOs are a great way to expand in the dental market.

In a Group Dentistry Now podcast that aired in April 2024, Chidam Chidambaram, CEO of Specialty Appliances, discussed the benefits of a DSO.

“One of the things that a DSO can help provide a practitioner, because [DSOs] have the benefit of scale, is to think about things that normally a doctor who’s trained and focused more on the clinical side does think about,” he said.

He went on to explain that a DSO (and MSOs) can focus on things like what are the potential risks that can be mitigated, and most importantly, a DSO can provide doctors with the best value at the lowest price. Additionally, when Chidambaram mentions the “benefit of scale,” he is referring to the advantages that larger organizations can offer due to their size and extensive resources.

Holden Godat, Compensation Arrangements Director of VMG Health, discussed the appeal of private equity-backed MSOs/DSOs in a March 2023 Becker’s Healthcare podcast, especially in the wake of the COVID-19 pandemic.

“Instead of looking to health systems to stabilize income, many physicians are starting to look at private equity-backed alternatives because… physicians can stabilize their income while maintaining their autonomy.”

In addition to maintaining autonomy with a stabilized income, the benefit of MSOs and DSOs, which draw in physicians to sell their practice, is amplified access to resources, access to newer/better technology and equipment, lightened administrative duties, increased patient reach, alleviated financial burden and more. And MSO/DSO acquirers are taking advantage of this heightened interest to scoop up as many practices as they can to expand and strengthen their presence.

Statistics

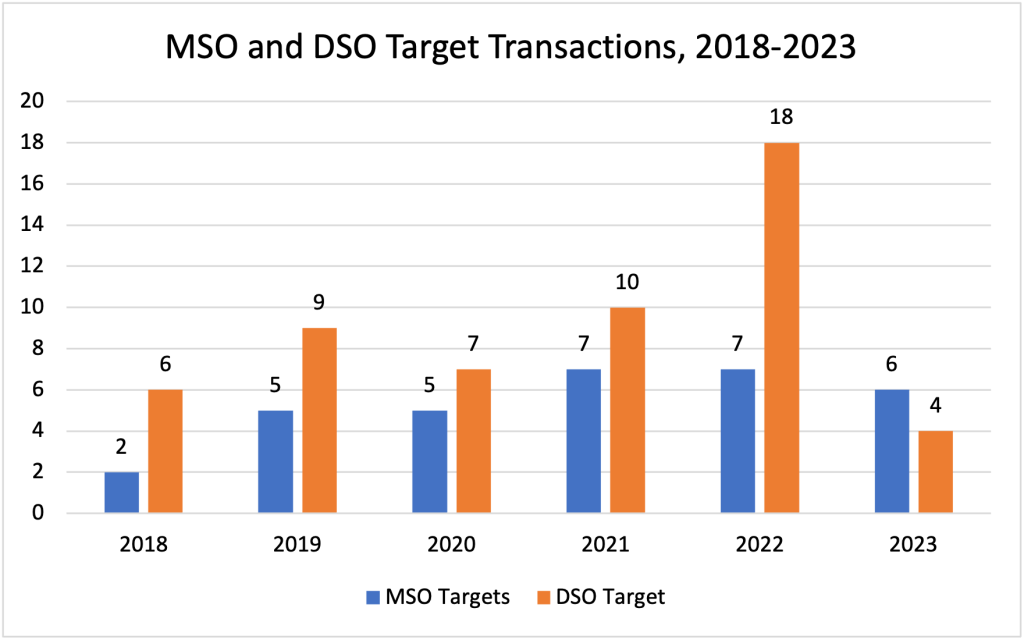

In the first half of 2024, there have been seven acquisitions targeting an MSO platform. This is on track to approximately double the number of acquisitions announced during 2023, which totaled six. In 2022 and 2021, there were seven deals announced each year. This is slightly higher than 2020 and 2019 when there were five deals each. In 2018, two MSO transactions were announced.

There were three deals with purchase prices in 2024: CUC Inc.’s purchase of Beyond Podiatry for $87 million, Bajaj Finserv Health’s acquisition of Vidal Healthcare Services for $39.1 million in January, and Cardinal Health’s purchase of Specialty Networks, LLC for $1.2 billion.

Investment activity for DSO platforms has started 2024 out on a steady note compared to prior years, with three deals announced in the first six months. In all of 2023, four transactions were reported. This is a 78% decrease from 2022, when 18 were announced and a 60% drop from 2021, when 10 were reported. Throughout 2020, seven deals were announced, which represents a slight drop from 2019 when there were nine transactions, but a slight increase from 2018 with six acquisitions.

Notable deals in 2024 include Clairvest Group Inc.’s acquisition of Bluetree Dental for $32 million. Bluetree Dental is based out of Reno, Nevada and has more than 45 office locations. In addition to the disclosed price, which is rare in the sector, this transaction stands out because of the size of the practice.

While deal volume for MSOs and DSOs is not particularly high as targets, they are significant vehicles for investments in the physician group market.

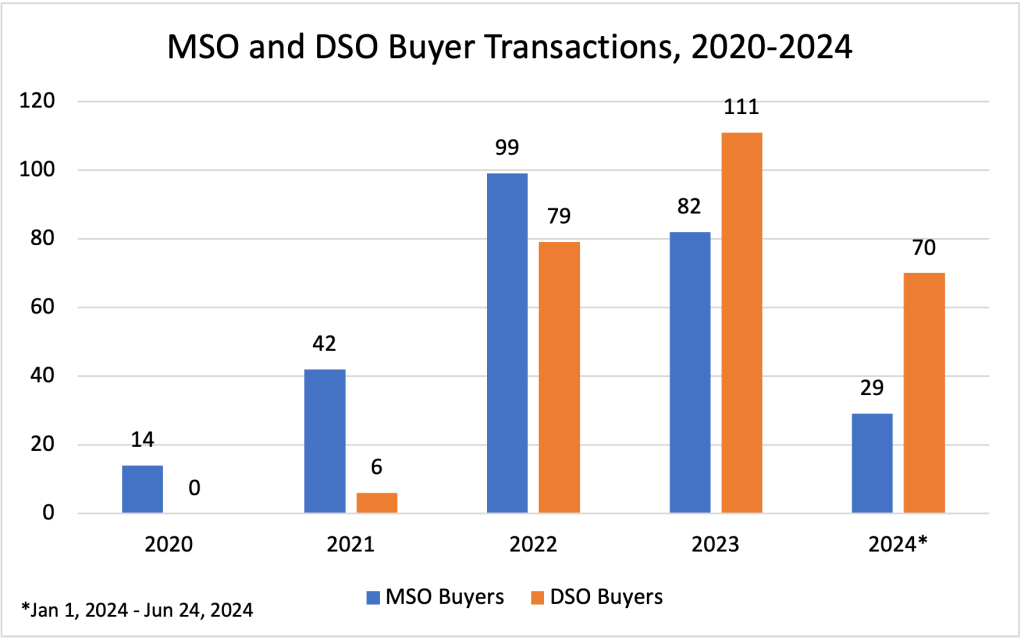

Throughout 2023, there were 82 transactions completed by MSO buyers. This is a 17% decrease from 2022, when 99 transactions were reported, but a 95% increase from 2021, when 42 acquisitions were announced. In 2020, there were 14 deals completed by MSO buyers. There were no MSO acquirers reported in 2019, but in 2018 there were five deals. In the first six months of 2024, there were 29 MSO buyer acquisitions reported.

In the DSO space, throughout 2023 there were 111 acquisitions completed by DSO buyers. This represents a 41% increase from 2022 when 79 transactions were announced. The deal volume of 2023 also marks a significant increase from 2021 when six deals were reported. In 2020 no deals were announced, while 2019 saw one acquisition and 2018 saw none, again. In the first six months of 2024, 70 transactions have been completed by DSO buyers.

Private equity-backed MSO and DSO platforms dominate the M&A space. In 2024, 23 of the 29 deals were completed by private equity-backed MSO buyers. Private equity’s presence in 2023 was still high, accounting for 69 of the deals, or 84%. In 2022, private equity-backed MSOs accounted for nearly 70% of the deals, and in 2021, they accounted for 88% (37 transactions).

In the first six months of 2024, 59 out of 70 acquisitions were completed by private equity-backed DSOs. The high percentage of private equity deals continued from 2023 when 94 (85%) were completed by private equity-backed DSOs. In 2022, there were 67 private equity DSO transactions. The surge experienced in 2022 and 2023 for both sectors could be attributed to people becoming used to a ‘new normal’ for market conditions.

One of the most active buyers in the MSO space is U.S. Oral Surgery Management, which is backed by Oak Hill Capital Partners and has completed 20 transactions since the start of 2020. Webster Equity Partners’ portfolio companies have been incredibly active, too; Cardiovascular Associates of America completed 17 deals; Retina Consultants of America completed 16 acquisitions; and One GI completed 14 transactions since the beginning of 2020.

In the DSO market, unsurprisingly, MB2 Dental Solutions, a portfolio of Charlesbank Capital Partners, is the most active buyer, with 131 acquisitions since the start of 2020. Other active acquirers include Dental Care Alliance, LLC, backed by Harvest Partners, with 21 deals; Gen4 Dental Partners, a portfolio company of Thurston Group, with 14 transactions; and Quad-C Management’s Specialized Dental Partners, with nine deals.

As the statistics show, interest in selling to MSOs and DSOs has increased substantially over the last several years because of the benefits provided by MSOs/DSOs in addition to the benefit of scale. The rate of M&A activity was, in part, influenced by inflation and high interest rates.

Perrin DesPortes, Co-Founder and Partner at Polaris Healthcare Partners, appeared on a February 2024 episode of the Group Dentistry Now Show.

DesPortes said, “I think the last probably 12 to 18 months, the rise of interest rates has been, again, a three-inch bold headline. All of us see the impact of those increasing rates in our personal lives as consumers.”

He continued on to say, “Well, private equity-backed ventures use a lot of debt leverage to get transactions done. It makes their equity investment go a lot further. If they can borrow money, especially borrowing money at low, low rates to make further acquisitions, to expand the platform…. So, when we see a rise in interest rates, it puts a lot of stress and strain at an operational level for these businesses because it directly impacts free cash flow.”

This has boosted the demand for financial backing, making MSOs and DSOs attractive options for many physicians who seek a more stable environment.

The statistics illustrate a dynamic and growing market. While acquisitions involving MSOs and DSOs as targets have seen fluctuations, the volume of acquisitions by these organizations has been substantial. Going forward, we anticipate that the market will only continue to increase as demand grows.