In the Behavioral Health Care (BHC) market, the autism and intellectual and developmental disabilities (I/DD) markets have experienced several years of whirlwind M&A activity.

While there is a fair amount of crossover between autism and I/DD, there are distinct differences. Autism is a neurodevelopmental disorder that is characterized by deficits in social communication and the presence of repetitive and restrictive behaviors. Intellectual disabilities are neurodevelopmental disorders characterized by impairment in intelligence and adaptive function that appear in childhood. Developmental disabilities are physical impairments that present before adulthood.

Although some behavioral health providers work with both populations, most of the agencies and organizations captured in our database specialize in working with one group, and they are categorized on a case-by-case basis. An important trend to note is that, based on transaction data in our LevinPro HC database, most autism providers targeted by investors specialize in providing Applied Behavioral Analysis (ABA) to children. ABA is a psychological approach to caring for autism that is based on conditioning to change social and behavioral habits.

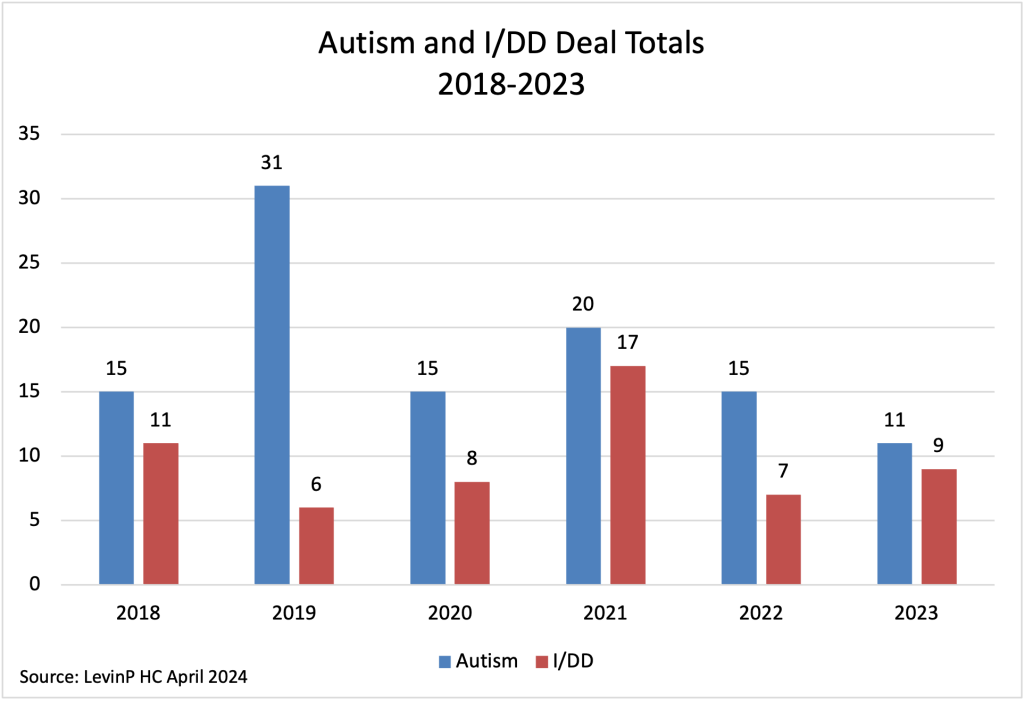

According to data captured in the LevinPro HC database, there were 15 autism transactions in 2018. In 2019, the autism M&A market hit a high with 31 transactions. This was followed up by a 55% decrease in 2020 when 14 deals were announced, and a slight rebound in 2021 with 19 transactions. But in 2022 there was another decrease in activity when 15 deals were announced, which continued into 2023 with 10 transactions. Through the first three months of 2024, there have only been two autism transactions reported. In March, private equity firm Fletch Equity purchased Autism Spectrum Interventions, based in Fullerton, California. Also in March, The Children’s Autism Center, a not-for-profit ABA center, bought Child’s Play Plus, which is based in Fort Wayne, Indiana.

The I/DD M&A market follows a similar pattern to the autism space. In 2018, 11 I/DD transactions were reported. In 2019 and 2020, activity fell to six deals and eight deals, respectively. Yet, like with many sectors, there was a surge in 2021 when 17 transactions were announced. I/DD activity decreased in 2022 to seven acquisitions and nine in 2023. During the first quarter of 2024, no I/DD deals were announced.

The decline in M&A activity in recent years can be attributed to several factors, including the COVID-19 pandemic, clinician burnout, public scrutiny over private equity (PE) investments in behavioral health care and higher interest rates in the lending market.

Despite the headwinds for PE and their platform companies, these buyers dominate both the autism and I/DD sectors. Between 2018 and 2023, an average of 83% of autism transactions were completed by PE-backed companies, with the lowest in 2023 at six out of 11 deals. A similar story can be told for I/DD. Between 2018 and 2023, an average of 75% of I/DD acquisitions were done by PE-sponsored platforms, with the lowest also occurring in 2023 with four out of nine transactions.

It is not often that autism or I/DD deals have disclosed prices, which can be attributed to the fact that so many of the transactions are completed by private organizations.

In 2022, there was one autism transaction with a price: Charlesbank Capital Partners purchased Action Behavior Centers, an ABA provider based in Austin, Texas, for $840 million. The seller was NexPhase Capital and, according to the press release, the purchase price represented a 14x multiple on revenue. This transaction also represents the largest announced purchase price in the autism sector captured in the LevinPro HC database, as of April 2024.

While purchase price is important when looking at the market, it’s not the only factor that goes into determining the importance of a deal. In October 2022, Acorn Health, a portfolio company of MBF Healthcare Partners, purchased seven ABA centers in Florida and Virginia. The deal expanded Acorn’s presence to 14 locations in Florida and 13 centers in Virginia. This meaningfully increased their ability to provide high-quality ABA services, supporting both patients and their families.

In 2021, Hunter Street Partners, an investment firm based in Wayzata, Minnesota, sold a 51-property I/DD company to an undisclosed buyer. The portfolio of residential properties caters to individuals with I/DDs. According to the press release, since the initial sale and leaseback acquisition in March 2019, the portfolio has grown from 22 properties to 51 single-family, duplex, multi-family and acute care group homes.

One of the more active buyers in the autism and I/DD fields is The Stepping Stones Group (SSG), a Five Arrows Capital Partners portfolio company. Since the start of 2018, SSG has completed 14 BHC transactions, nine of them in the autism subsector and four of them in the I/DD space. SSG serves more than 1,000 clients and 300,000 children each year and has locations across 42 states.

Another active buyer in the autism subsector is Blue Spring Pediatrics, Inc., which is backed by KKR & Co. Since 2018, when the company was formed, it has completed seven autism acquisitions. As one of the largest autism services providers based in Texas, it also has locations in California, Florida, Kentucky, Missouri, Ohio, Oklahoma, Oregon, South Carolina and Washington.

Active buyers in the I/DD field include Caregiver Inc. and Broadstep Behavioral Health, Inc.

Since 2019, Caregiver has completed seven I/DD transactions and an additional autism acquisition. It was backed by Council Capital until 2020, when WindRose Health Investors, LLC, a private equity group based in New York City, purchased it. Caregiver provides care to adults with I/DDs through multiple locations across Texas, Georgia, Tennessee, Indiana, and Ohio.

Broadstep Behavioral Health, backed by Bain Capital, completed three I/DD transactions in 2021. Additionally, it completed another BHC acquisition in the substance use disorder subsector. Broadstep operates more than 90 facilities in seven states. The company was formerly known as Phoenix Care Systems and rebranded in April 2020.

An increase in prevalence and demand for services have made the autism and I/DD space rife for investing opportunities.

The Centers for Disease Control and Prevention (CDC) released two studies in early 2023 that found that 1 out of every 36 children had autism, a notable rise from the 2021 estimates of 1 out of every 44 children and a surge from the 2006 estimates of 1 in 110 children.

Additionally, for developmental disabilities, the CDC also reports an increase in diagnoses over the past several years. The frequency of diagnosed developmental disabilities among children, between the ages of 3 and 17 years, rose from 7.4% in 2019 to nearly 8.6% in 2021. Reports on how many adults live with an I/DD were harder to come by, but it is estimated that roughly 1% of the adult American population has an I/DD, whether diagnosed or not. I/DD remains largely underdiagnosed in adults because the signs are less obvious in adults, the diagnostic criteria and assessment tools are often developed for children and there’s a large stigma associated with I/DDs, especially among adults.

While these numbers are startling, there’s a relatively simple explanation for the rise: diagnosing the disability is becoming easier as knowledge of disabilities becomes more widespread. There is no one-size-fits-all diagnosis test for autism, but there has been an increase in empirical studies and research on diagnosing autism, giving clinicians more tools and skills to assess the disorder properly.

Something to note is that many experts suggest that autism and I/DD are not actually increasing but rather people are becoming more aware as the stigma around disabilities begins to decline. This allows for people to feel more comfortable seeking care.

All of these changes have created an increase in demand for these services, especially as children age into needing adult services. The need for care is so high that it outpaces supply, creating a plethora of opportunities for providers and investors to carve out a space for themselves in the market. With more people reaching out for care, there’s inherently a need for more providers.

An incredibly important reason for investors to pay more attention to these sectors is the ability for improvements and innovation. The delivery of care is rather stagnant, meaning investors have plenty of room to be creative in the ways that they innovate the industry. This will not only raise the quality of care but also allow ambitious and creative investors to become leaders in the industry. There are several areas of improvement that industry experts have called attention to.

Technology, such as virtual reality speech aids and other augmentative and alternative communication systems, have made improvements in how people with disabilities can interact and communicate. So, it’s vital that care facilities have access to new technology. Incorporating more medical devices into care and teaming up with new technological advances is a way to make sure that patients receive high-quality care and are set up with the best tools to help them through life.

Utilizing the latest technology and innovative care methods can help retain employees because it can alleviate workloads and case management responsibilities, creating a healthier environment for clinicians and patients. Having better helps in a labor shortage because it means that employees and patients are more likely to stay at one facility, creating longevity. But it also creates a distinct brand culture which can help draw in more patients who seek out specific care, knowing it will be exactly what they’re in search of.

Emphasizing access to new technology and focusing on retaining employees are not necessarily innovative, but they would shake up the status quo of autism and I/DD facilities and the markets. As more providers and CEOs retire, there’s room for new leaders to come in and try new approaches to care, leading to innovation and profit.

Even though the deal volume in both the autism and I/DD specialties have decreased in recent years, there are still plenty of opportunities for investors to carve out a place for themselves in the market.